How’s the post office doing on parcels, finance, insurance and energy

Poste Italiane's 2022 numbers and trends in the main business sectors of the group led by Matteo Del Fante

Poste Italiane continues its growth trajectory in 2022 and is optimistic for 2023.

The group headed by Matteo Del Fante last year achieved revenues that reached 11.9 billion (+6%). EBIT was $2.3 billion, a record high, an increase of 24.1% to $2.3 billion, more than double the 2017 level of $1.1 billion.

As regards net profit, this is 1.51 billion, down 4.3% on an annual basis compared to 2021 but equal to double the level of 2017 which stood at 0.7 billion.

The board of directors that approved the accounts proposes a dividend revised upwards in 2022 to 0.65 euro (+10%) supported by the strong financial performance and greater visibility on 2023. For 2023, the company forecasts an operating result equal to 2.5 billion, starting from a 2022 'baseline' EBIT of 2.36 billion, with the contribution of all business sectors which more than compensates for the negative effects generated by inflation on costs and business start-up costs of Poste Energy. Net profit is expected at 1.7 billion. The dividend target for 2023 is revised upwards to €0.71 (+9%), thanks to greater visibility of capital and the generation of cash flows by all business sectors.

BELOW, THE PERFORMANCE OF THE MAIN BUSINESS SECTORS OF POSTE ITALIANE

(EXTRACT FROM THE POSTE PRESS RELEASE)

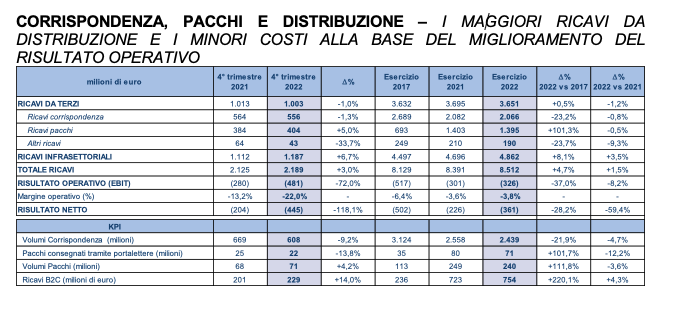

THE MAIL, PARCELS AND DISTRIBUTION SEGMENT IS RESILIENT

In 2022, revenues from the Mail, Parcels and Distribution segment amounted to €3.7 billion, down by 1.2% year-on-year (-1.0% year-on-year to €1.0 billion in the fourth quarter 2022), showing solid resilience compared to €3.6 billion in 2017.

Mail revenues in 2022 were down 0.8% yoy to €2.1bn (-1.3% yoy to €556m in Q4 2022), with volumes growing on higher-priced products such as integrated services (+126% year over year), which offset the decline in lower margin products such as unregistered mail (-10.2% year over year). FY 2022 mail revenues decreased by 23.2% from 2017 level to €2.7 billion due to historical decline in mail volumes.

Mail volumes for the period amounted to €2.4 billion, down 4.7% year-on-year (-9.2% year-on-year to €608 million in the fourth quarter of 2022), with average tariffs growing in year (+3.9%) and up by 8.2% in the last quarter of the year, mitigating the impact of lower volumes.

Parcel revenues were broadly stable in 2022 (-0.5% year-over-year) at €1.4 billion, with a positive performance in the fourth quarter (+5.0% year-over-year at €404 million), supported from the increase in volumes. Parcel revenues doubled from 2017, offsetting the decline in mail revenues.

Volumes for the period in the B2C segment amounted to 180 million, up by 0.5% year-on-year (+11.5% year-on-year to 55 million in the fourth quarter of 2022), with parcel rates up by 3 .1% (+0.8% yoy in the fourth quarter of 2022). B2B segment volumes decreased 13.3% year-over-year to 36 million units (-14.9% year-over-year to 10 million units in Q4 2022), while C2X volumes decreased by 16.4% year-over-year to 5.0 million units (-6.0% year-over-year, down 1.5 million units in the fourth quarter of 2022).

In 2022, Postmen delivered 71 million parcels, down 12.2% year-on-year.

The operating profit (EBIT) of the sector decreased in 2022 to -€326 million from -€301 million (equal to -€481 million from -€280 million in the fourth quarter of 2022) due to the impact of one-off components.

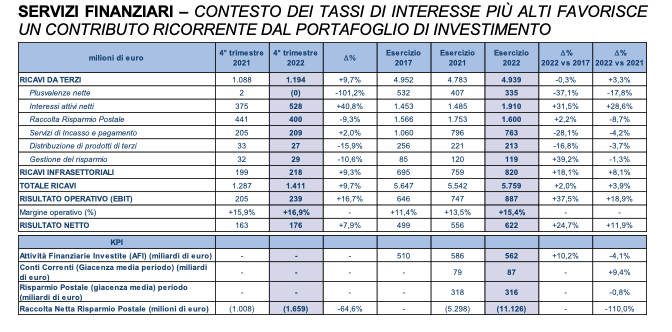

FINANCIAL SERVICES

In 2022, the revenues of the Financial Services segment amounted to €4.9 billion, +3.3% year-on-year compared to the previous year's level of €4.8 billion (+9.7% year-on-year at € 1.2 billion in the fourth quarter of 2022) with a solid interest margin and growth of 28.6% YoY (+40.8% YoY in the fourth quarter of 2022), which more than offset the lower income from postal savings product distribution commissions.

2022 gross revenues (including intra-segment revenues) increased by 3.9% year-over-year to €5.8 billion (+9.7% year-over-year to €1.4 billion in the fourth quarter of 2022), a following a positive commercial dynamic.

Net interest income (NII) up from €1.5 billion in 2021 to €1.9 billion in 2022, up 28.6% year-on-year (+40.8% year-on-year to €528 million in fourth quarter of 2022), mainly due to interest rate dynamics.

Postal savings distribution fees decreased in 2022 by 8.7% YoY to the floor level of €1.6bn (-9.3% YoY to €400m in the fourth quarter of 2022) , as a result of higher net outflows. Fees from distribution of personal loans and mortgage loans for the year amounted to €213 million, down 3.7% year-on-year (-15.9% year-on-year to €27 million in the fourth quarter of 2022) , mainly influenced by the higher financing cost of the partners.

In 2022 revenues from collection and payment services decreased by 4.2% year-on-year to €763 million (+2.0% year-on-year to €209 million in the fourth quarter of 2022), mainly due to lower volumes of traditional payment slips mitigated by repricing actions.

Asset management fees were resilient in 2022, amounting to €119 million (-1.3% year-on-year) compared to €120 million in the previous year (-10.6% year-on-year to €29 million in the fourth quarter of 2022), thanks to positive net inflows and recurring fees.

Invested Financial Assets (AFI) reached €562 billion at the end of the year (down by €24 billion compared to December 2021), impacted by a negative effect of the market value of assets of €23.6 billion. Savings and investment products recorded positive net flows of €7.1 billion.

Net technical reserves decreased by €19.2 billion, against a negative effect on market values, offset by net inflows of €7.6 billion, while deposits recorded net inflows of €0.8 billion supported by all product categories, confirming a clear preference for liquidity on the part of customers.

Operating profit (EBIT) for 2022 is up by 18.9% year-on-year to €887 million (+16.7% year-on-year to €239 million in the fourth quarter of 2022).

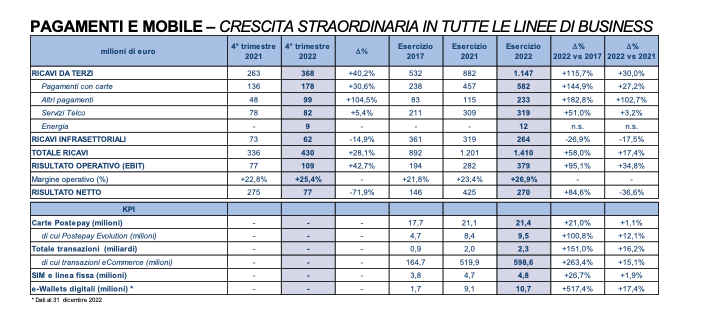

THE ITALIAN POSTAL PAYMENTS AND MOBILE SECTOR IS GROWING

Payments and Mobile segment revenues continued to grow year-on-year by a solid 30% to €1.1 billion in 2022 (+40.2% year-on-year to €368 million in Q4 2022 ), with LIS generating incremental revenues of €93 million over the year (€69 million in the fourth quarter of 2022), confirming the role played by PostePay as a leader in the rapidly growing and evolving digital payments market in Italy. Card payments rose from €457 million in 2021 to €582 million in 2022, an increase of 27.2% year-on-year (+30.6% year-on-year to €178 million in the fourth quarter of 2022).

The shift towards Evolution cards continued, which feature higher recurring margins, with the total stock now standing at 9.5 million cards (+12.1% year-on-year in 2022).

Other payments recorded constant growth of 102.7% year-on-year to €233 million in 2022 (+104.5% year-on-year to €99 million in the fourth quarter of 2022), mainly thanks to managed payment transactions directly from PostePay as Payment Service Provider.

Revenues from Telco services increased in 2022 by 3.2% year-on-year to €319 million (+5.4% year-on-year to €82 million in the fourth quarter of 2022), benefiting from a strong customer base of 4.8 million users (+1.9% year-on-year from 4.7 million in 2021) and a low abandonment rate. E-commerce transactions continued on their growth path in 2022, reaching 598.6 million from 519.9 million (+15.1% year-on-year). The new energy offer, launched in June 2022 for Poste Italiane employees and retirees and now publicly available on the market, contributed €12.1 million in 2022.

Poste Italiane confirms its leadership as a provider of digital identities: PosteID (Poste Italiane's national digital identity solution) was adopted by 23.8 million customers in 2022 (+12.7% on an annual basis). The 2022 operating result increased by 34.8%, year-on-year, to €379 million (+42.7% year-on-year to €109 million in the fourth quarter of 2022).

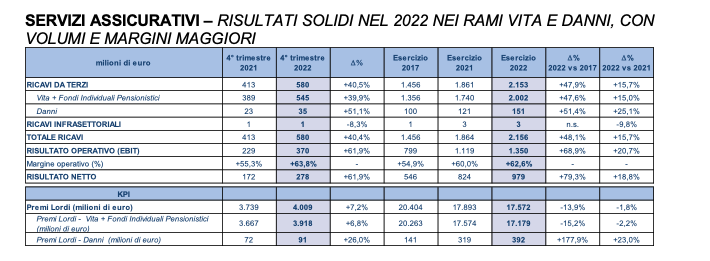

INSURANCE SERVICES

In 2022 the revenues of the insurance sector increased by 15.7%, year on year, to € 2.2 billion (+40.5% year on year, equal to € 580 million in the fourth quarter of 2022). Life business increased by 15.0%, on an annual basis, to € 2.0 billion, thanks to favorable market conditions on the inflation-linked product portfolio.

Non-Life insurance revenues increased by 25.1% year-on-year to €151 million (+51.1% year-on-year, equal to €35 million in the fourth quarter of 2022), thanks to the growing contribution of of the modular and welfare offer. Total gross premiums from the Life business decreased by 2.2% year-on-year to €17.2 billion (+6.8% year-on-year, equal to €3.9 billion in the fourth quarter of 2022).

Non-Life gross premiums increased by 23.0% year-on-year to €392 million (+26.0% year-on-year, equal to €91 million in the fourth quarter of 2022). Operating result (EBIT) for 2022 increased by 20.7%, year-on-year, to €1.4 billion (+61.9% year-on-year, equal to €370 million in the fourth quarter of 2022).

At the end of December 2022, the Solvency II Ratio of the Poste Vita Insurance Group stood at 253%, up from 207% in September 2022, with a contribution of 30 pp from mass surrender risk insurance.

POSTAL GUIDANCE 2023 SECTOR BY SECTOR

Finally, in 2023 revenues from Mail, parcels and distribution are estimated to be stable at €3.6 billion compared to €3.65 billion in 2022, of which: revenues from parcels and logistics equal to €1.4 billion against €1.40 billion in 2022, incorporating positive business trends. Mail revenues are expected at €2 billion compared to €2.07 billion in 2022, with the decline in volumes mitigated by repricing actions.

As for financial services, the gross revenues of the segment are expected to reach 5.9 billion compared to 5.76 billion in 2022. The operating result is expected to be 0.8 billion compared to a 2022 ebit of 0.89 billion.

The new energy offer, launched in June 2022 for Poste Italiane employees and retirees and now publicly available on the market, contributed €12.1 million in 2022. As regards total revenues from the Payments and Mobile segments, they are expected to grow by 1.7 billion compared to 1.32 billion in 2022, of which: card payments at 0.7 billion compared to 0.58 billion in 2022; Telco revenues at €0.3 billion versus €0.32 billion in 2022. Other payments are expected at €0.4 billion versus €0.23 billion in 2022 while Energy business revenues are estimated at €0.2 billion versus €0. 01 billion in 2022.

For insurance services it is expected that they will settle at 1.6 billion, according to the accounting standard IFRS17, of which: Life net revenues at 1.5 billion; Net P&C revenues at 0.1 billion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-va-poste-italiane-2022-settore-per-settore/ on Thu, 30 Mar 2023 10:24:06 +0000.