Vietnam and Thailand: escape towards gold

Anxious consumers in Vietnam and Thailand are rushing to buy gold – a sign of growing alarm in Asia, analysts say, over currency devaluations against the US dollar, inflation and geopolitical uncertainty.

Visible queues of buyers waiting to snap up chunks of the yellow metal have persisted outside banks in Southeast Asian countries for months, in scenes that underline a growing sense of economic and geopolitical instability across the region.

“What they are trying to do is protect themselves from the depreciation of the local currency,” said Michael Langford, a Singapore-based commodities and financial markets expert. In reality, inflation in Thailand is under control and the Baht has not depreciated much, but the feeling is that the numbers do not reveal all the inflation.

“If you don't have a lot of money in your life and all the goods you buy and sell are ultimately priced in US dollars, and the local currency goes down, you don't feel good. Inflation works against it and on top of that there is currency depreciation. You get hit twice."

The gold rush in Southeast Asia has pushed prices higher over the past six to 12 months , said Langford, who is executive director of business consultancy Airguide International. Indeed, gold prices are at a very high level:

Even in China, declining confidence in real estate and stock markets has seen investors chase gold as a safe haven.

Anxiety over economic turmoil, geopolitical insecurity and currency devaluations are fueling the flight to gold, a traditional safe haven investment.

Currency devaluation especially affects small investors, eroding their savings and inflating costs.

And it's not just these everyday investors who are looking for a safe haven: central banks are also buying gold at a "dizzying pace", according to the World Gold Council.

More than 80% of central banks expect their reserve managers to increase their gold holdings over the next 12 months, a survey published by the Council on June 18 revealed – piling on the precious metal as a bulwark against rising risks geopolitical and growing macroeconomic uncertainties.

“Extraordinary market pressure, unprecedented economic uncertainty and political upheaval around the world have kept gold top of mind for central banks,” said Shaokai Fan, head of the Council for Central Banks and the Asia-Pacific.

“What's notable is that despite record demand from the official sector over the past two years, coupled with rising gold prices, many reserve managers continue to maintain their enthusiasm for gold.”

Historically, Vietnam and Thailand have been among Southeast Asia's largest gold buyers, while China and India have dominated the broader regional market. Gold buyers flocked to Vietnam's state banks in June after the central bank agreed to sell more gold to meet public demand and drive down prices, according to local reports.

Banks quickly depleted their supplies, forcing them to limit purchases to 1 tael (37 grams) per buyer. The queues continued for weeks, until banks implemented an online registration system for purchasing gold, which filled up within minutes each day. Sold out.

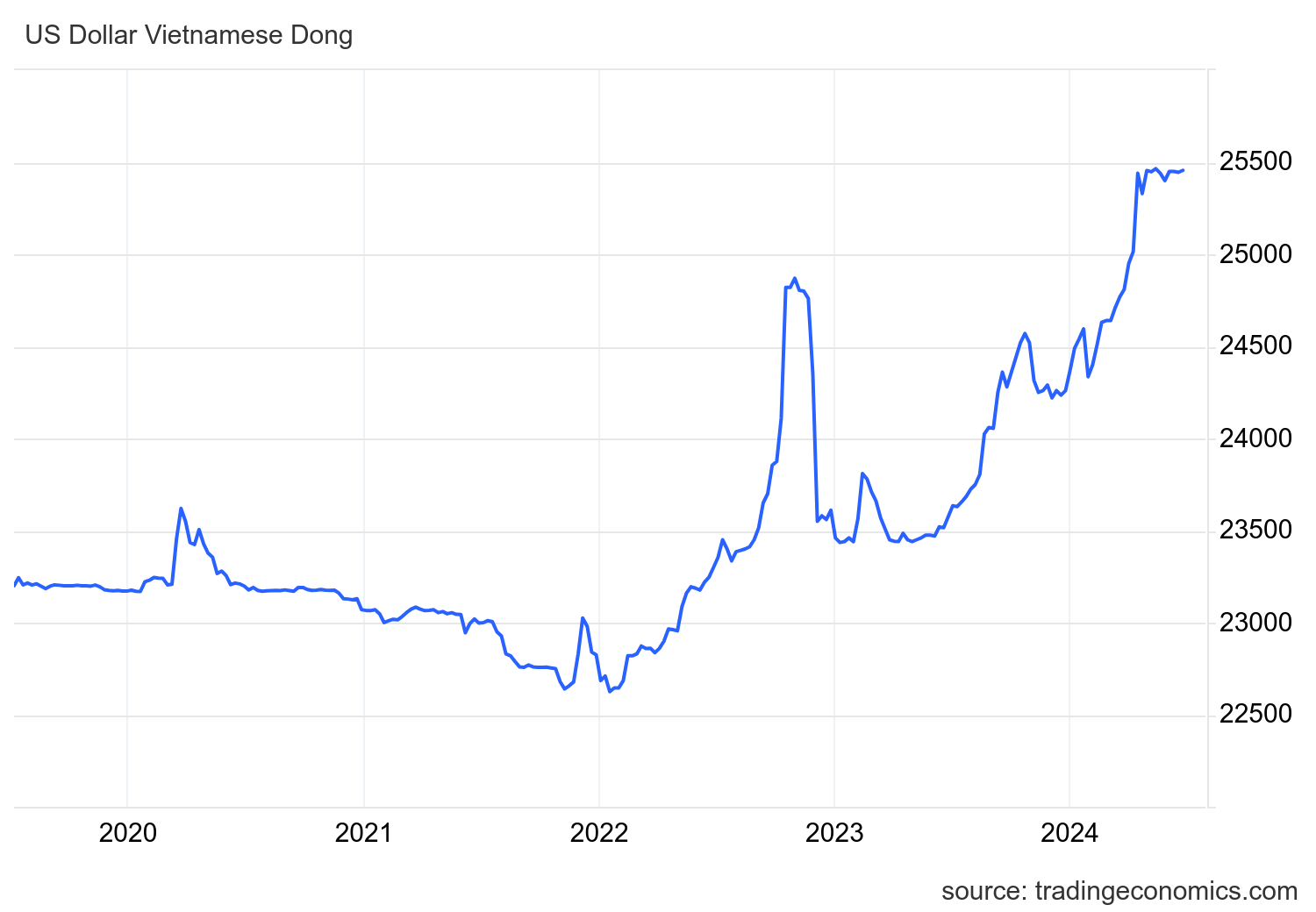

The Dong has devalued by well over 10% since 2022, while gold has appreciated, and this has resulted in a gold rush by the Vietnamese, always lovers of precious metals. Not only that, but the SCB bank scandal, which caused 6% of the country's GDP to disappear with false investments, certainly did not help create confidence in the currency and banks.

Therefore, gold is increasingly widespread in South East Asia, and this, over time, will increase its value.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Vietnam and Thailand: flight towards gold comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/vietnam-e-tailandia-fuga-verso-loro/ on Mon, 01 Jul 2024 11:04:21 +0000.