China: wave of negative economic data. We need more stimulus or more change

Wave of economic data from China, and it's not particularly good.

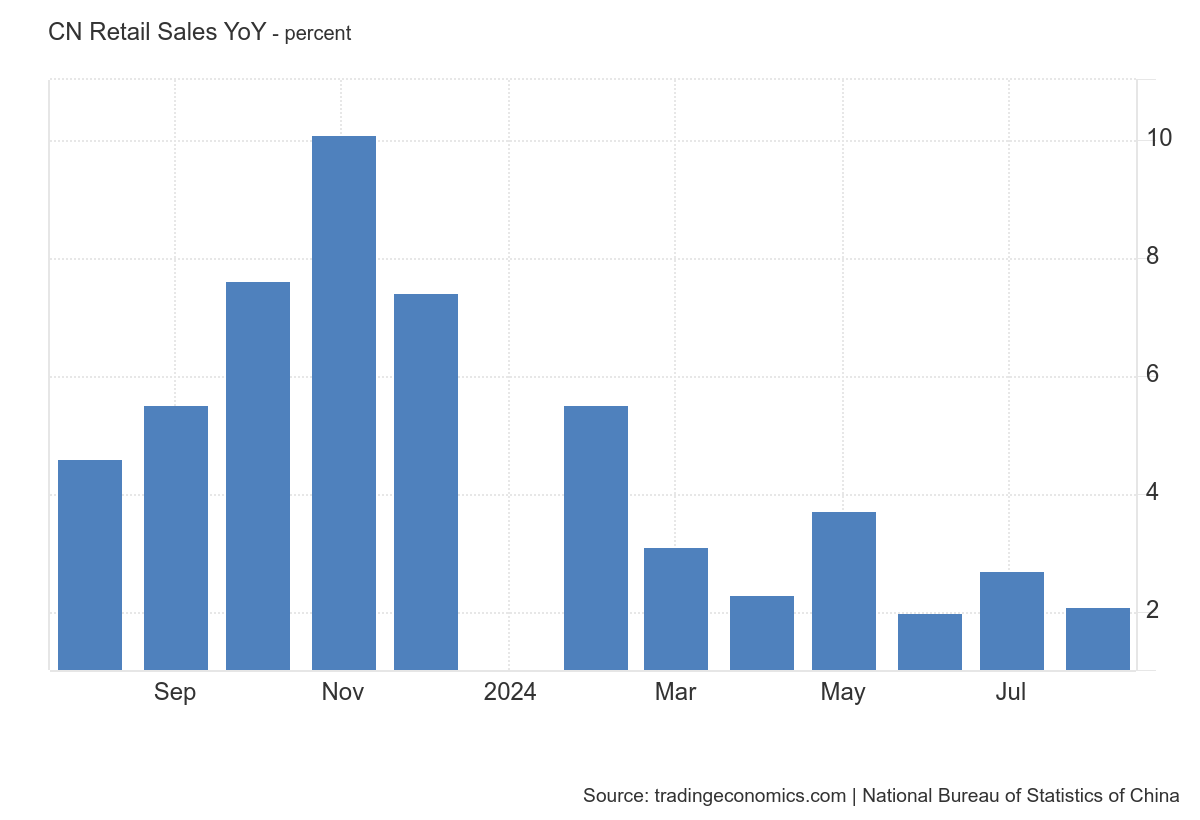

Let's start with retail sales : Retail sales expanded 2.1% year-on-year in August 2024, moderating from the previous month's 2.7% growth and missing the market consensus of 2.5%.

The latest result reflects the unusual climatic events of this summer, characterized by scorching heat and heavy rain. Sales growth slowed for personal care (1.3% versus 2.1% in July), due to weak spending on cosmetics (-6.1% versus -6.1%), l clothing, shoes, hats and textile products (-1.6% versus -5.2%), gold, silver and jewelery (-12.0% versus -10.4%), furniture ( -3.7% vs -1.1%), petroleum products (-0.4% vs 1.6%), office supplies (-1.9% vs -2.4%), cars (-7, 3% vs -4.9%) and building materials (-6.7% vs -2.1%). All personal consumption goods, as we note.

On the other hand, revenue increased for grains, oil, food (10.1% vs 9.9%) and communications equipment (14.8% vs 12.7%), while home appliance sales rebounded (3.4% vs -2.4%). On a monthly basis, retail trade remained nearly flat after rising 0.35% in July. From January to August, retail sales increased 3.9%.

Here is the relevant graph:

These are not brilliant data that show how difficult it is to increase consumption, but this is not just one of Beijing's problems.

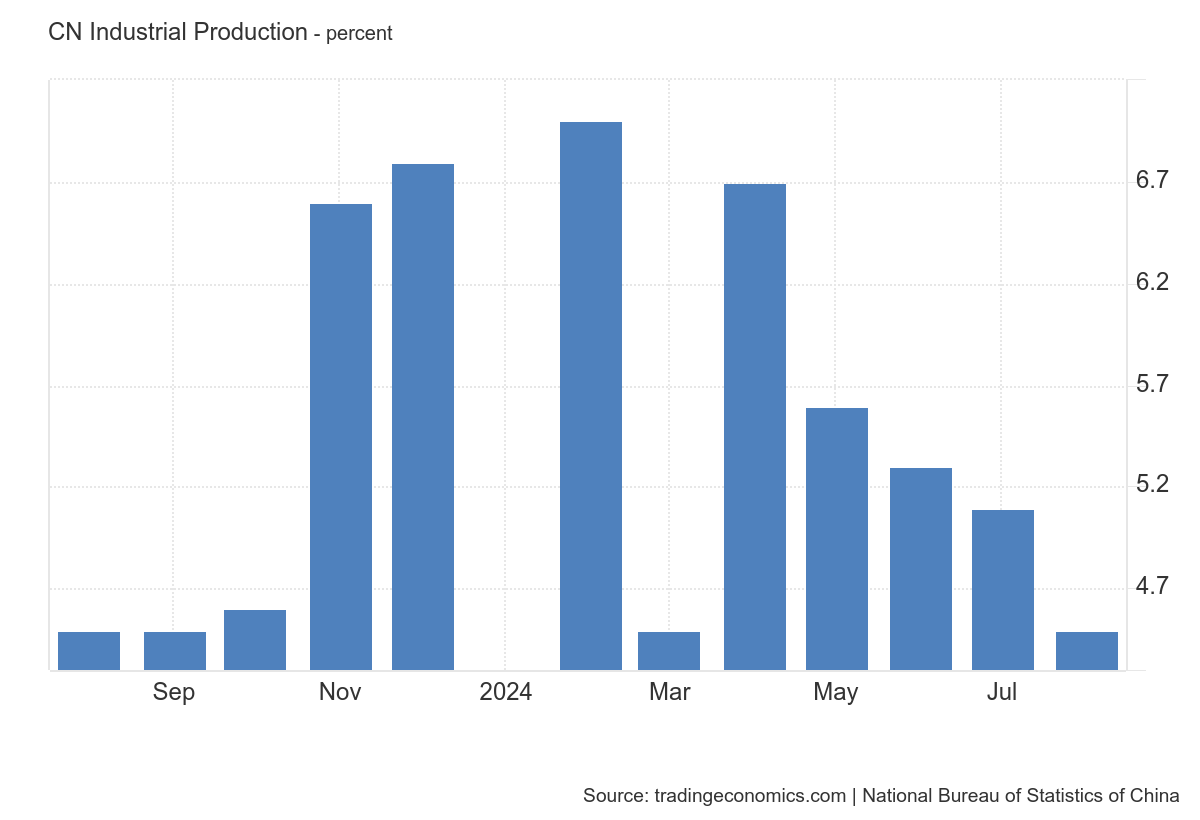

China's industrial production is also down from the previous month: China's industrial production increased 4.5% annually in August 2024, below market forecasts of 4.8% and slowing from the increase of 5 .1% in July.

It was the smallest expansion in industrial production since March, marking the fourth consecutive month of slowdown, due to disruptions caused by this summer's extreme weather.

Production growth decreased especially in the manufacturing sector (4.3% compared to 5.3% in July) and in the mining sector (3.7% compared to 4.6%). Within the manufacturing sector, 32 of the 41 major sectors grew, notably railways, shipping, aviation (12.0%), computers, communications (11.3%), heat production (6.9%), smelting of non-ferrous metals (6.6%), chemicals (5.9%), automobiles (4.5%), textiles (4.4%), oil and gas (4.0%), coal, mining and washing (3.3%) and production of special equipment (2.9%).

Production, however, decreased for products from the processing of non-metallic minerals (-5.5%) and for the smelting and rolling of ferrous metals (-2.1%).

On a monthly basis, industrial production recorded an increase of 0.32%, the lowest in the last 3 months . In the first eight months of the year, industrial production increased by 5.8%. Here is the actual graph:

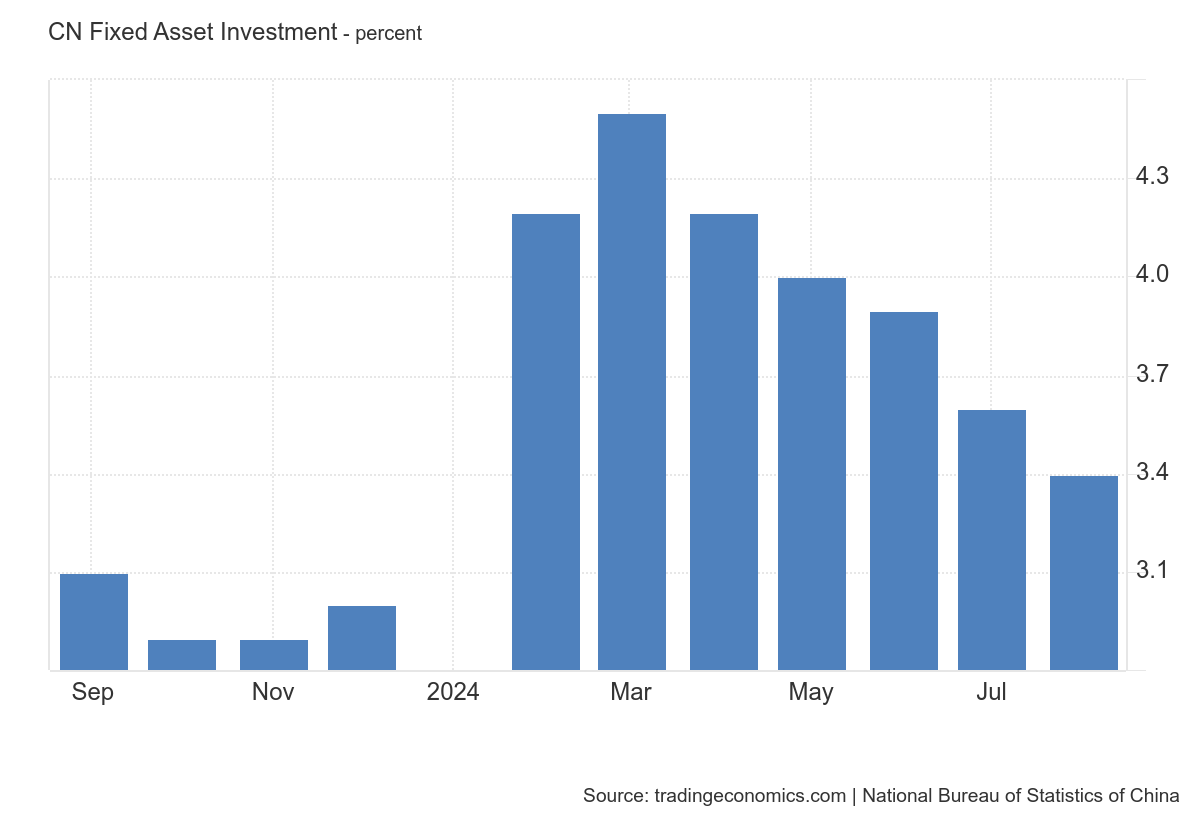

Fixed investments also saw slow growth , decreasing compared to the previous month and with the lowest value compared to recent months and also below market forecasts. Here is the relevant graph:

Another important indicator is loans from the banking system : China's new bank loans rebounded in August from a 15-year low in the previous month and broad credit expansion resumed thanks to the issuance of government bonds, but Analysts believe the real economy's demand for loans remains weak and the authority needs to step up policy stimulus to support the economic recovery.

Chinese banks extended 900 billion yuan of new yuan loans in August, according to calculations based on data released by the PBOC on Friday, a rebound from 260 billion yuan the previous month, which was the lowest level of the last 15 years.

However, new bank loans in August fell by 460 billion yuan compared to the same period last year.

Demand for loans from the non-financial corporate sector and the domestic sector weakened further, and invoice financing accounted for more than 60% of total new loans last month. So the real economy is not receiving a stimulus

China is therefore seeing development below the government's expectations. consumption is lacking and public stimulus has not yet been sufficient. At this point it would be necessary to provide a serious stimulus to consumption and investment, something of which the Chinese authorities do not yet seem sufficiently convinced.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China: wave of negative economic data. We need more stimulus or more change comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-ondata-di-dati-economici-non-positivi-ci-vuole-piu-stimolo-o-piu-cambiamento/ on Mon, 16 Sep 2024 12:36:27 +0000.