Here is the continuity in economic policy between Draghi and Meloni

Past, present and prospects of economic policy in Italy. The analysis of the study center Ref

In recent months, the international economic scenario has been characterized by a phase of improvement in conditions on the supply side. The tensions triggered by the pandemic before, and by the war in Ukraine after, have started to ease.

Even the signs of an imminent slowdown in inflation have gradually become more evident.

INFLATION PASSED IN 2023?

If these trends are confirmed, 2023 could be the year of overcoming the most intense inflationary shock for forty years now.

Against this, the year starts weighed down by a slowdown in demand in all major economies. In part, this is a physiological trend, after the rally in the consumption of services, following the reopenings in the sectors penalized by the distancing measures. The central banks contributed in part, accelerating the process of normalizing monetary policies. In some countries, adverse effects are already being observed in sectors most sensitive to interest rates, such as real estate.

The world economy should therefore slow down in the coming months. However, the risks of a recession have diminished because price tensions have abated, and therefore also the probabilities of a very restrictive monetary policy. Financial markets are reacting positively to signs of easing inflationary pressures.

Many unknowns remain, such as the problems of the new wave of Covid-19 in China and the evolution of the war in Ukraine.

GOOD NEWS FOR ITALY

For Italy, the reduction in long-term rates and the fall in energy prices are the good news at the beginning of 2023. They will help manage the phase of reduction of the public deficit, in view of the return of European public finance constraints from 2024 .

Three years after the start of the pandemic, and a year and a half after the start of the European energy crisis, 2023 should be the year of the return of the two formidable shocks that made the international economic picture of this beginning of the decade completely extraordinary . Assuming a return to the anomalies in behavior that have characterized the last three years, we would find ourselves experiencing the effects of a countershock on the supply side such as to allow a reduction in inflation and a strengthening of the economy during the year .

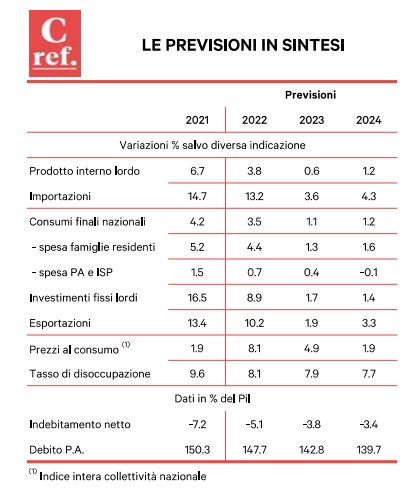

This scenario allows the euro area to avoid a recession in 2023. For Italy, GDP growth is expected to slow down, to 0.6 percent this year, but after a period of sustained recovery. In addition to the effects of the weaker international economy on exports, we will observe a weakening of domestic demand: in particular, the boosts to consumption linked to the reopenings in sectors subject to distancing measures are wearing off, and the construction activity should interrupt the phase of growth, stabilizing on the high levels achieved above all thanks to the tax incentives for restructuring.

THE ELEMENTS OF UNCERTAINTY

However, the path described is confronted with various elements of uncertainty. On the one hand, the same hypothesis of normalization on the side of the pandemic is not obvious, as the new wave underway in China has also confirmed. On the other hand, the European energy picture is still very dependent on a limited number of primary energy sources and supplier countries, revealing the need for an increase in diversification in the short term.

Assuming a fall in energy prices and a restoration of operating conditions of the value chains, the 2023 scenario would be characterized by a reversal in the impetus to the economy linked to import prices. The terms of trade are expected to improve rapidly, leading to a recovery in the trade balance. The prices of international manufactured goods should also slow down markedly in the coming months. The transfer of this change in the international scenario to European consumer prices will be rapid for the energy price component. On the other hand, slowdowns have already been seen, supported by the energy policies implemented by European governments, especially in Spain and France.

Net of energy, the deceleration of inflation will instead be more gradual; the transfer of the slowdown in costs to final prices will also depend on the tone of demand. On this aspect, a slowdown in consumption is expected, once the push linked to reopening has subsided. Also important is the fact that economic policies have become more prudent, and will begin to weigh on the growth in demand. At risk are the real estate markets, more sensitive to changes in interest rates, which are already starting to retreat in several countries outside Europe.

MONETARY POLICIES AND ENERGY POLICIES

An open question is that of monetary policies. Overcoming pandemic and war-related shocks should also lead to policy normalization. Monetary policies over the last year have chased inflation that exceeded forecasts: one wonders what central banks should do now that the price scenario seems to be improving. It is likely that there will still be some upside, with the Fed funds rate reaching 5 per cent, and the ECB repo rate at 3.5 per cent.

However, there is no shortage of positions from those who believe that more aggressive policies will be necessary, suggesting continuing to raise rates until the signs of a slowdown are also evident in the "core" inflation indicators. This strategy can prove risky; the ECB could adopt a restrictive policy even if the premises are seen for a slowdown in inflation next year. In this case, an excess of monetary restriction would result which would lead to an unjustified worsening of the real economy.

Italy also experienced very pronounced price tensions. After several years of lower inflation, at the end of 2022 Italy returned to registering a price trend higher than the European average; the reason lies in the policies to combat high energy prices which, as mentioned, in some countries have aimed directly at curbing the dynamics of prices; while we have acted to a more limited extent on the taxation of energy products, however allocating significant resources through other channels, such as tax credits in favor of companies in the energy intensive sectors and transfers to households.

Net of the effects of energy policies, Italian inflation is still lower than the European average. Even the wage trend until last year did not show signs of significant acceleration. Starting this year we should observe a more lively dynamic, but many contracts are awaiting renewal, especially in services. The picture therefore remains consistent with a decline in the price race.

RATES AND THE GOVERNMENT'S ECONOMIC POLICY

If the European inflation scenario tends to normalize, interest rates will not rise much either. Italy will therefore be the country that will benefit the most from an easing of the bond markets, given the high amount of our public debt.

The fiscal policy of the new Government has therefore appropriately decided to support the path of reduction of the deficit by indicating objectives which, bringing the balance back to close to 3 per cent of GDP after 2023. The resources allocated this year against the high energy cost with the Law of budget repeat the measures of the previous government until March; other resources will probably be needed, but if the fall in energy prices is confirmed, the commitments from the public budget could be limited. From this point of view, fiscal policy has not in fact revealed a discontinuity in the transition from the Draghi government to the Meloni government. We're seeing some positive effects on recent US performance

spreads.

In conclusion, 2023, a year that seemed to be marked by the consequences of the shocks that have hit the global economy in the last three years, could see a slowdown scenario without however materializing a real recession. A lot will depend on whether or not these shocks subside: the data for the beginning of the year point in the right direction… keep your fingers crossed.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/politica-economica-continuita-draghi-meloni/ on Sun, 29 Jan 2023 06:35:03 +0000.