The ECB pays 1% to lend the money. Which then remain in the banks

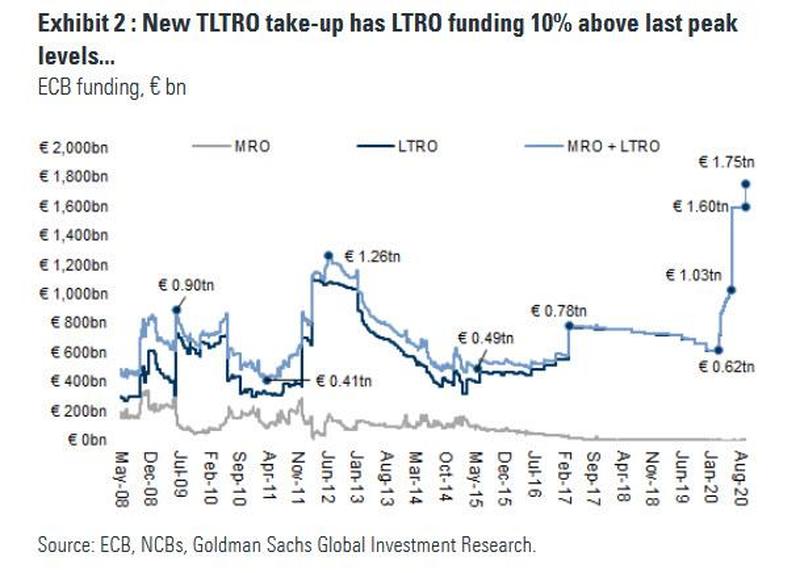

Did you know that the ECB pays 0.5% to 1% to banks to borrow money? Recently the ECB announced that the latest TLTRO auctions, targeted long term refinancing operations, have received a total amount of € 1750 billion.

So the ECB pays interest to make the banks then lend the money. The problem is that in the last allocation of funds, the banks asked for only 174.5 billion euros. All this despite the banks receiving the money and 1% for loans in the first year and 0.5% for the second and third years. Except that if they do not intend to make loans, it is useless to ask for money which then goes back into overnight deposits at the ECB where banks pay 0.5%.

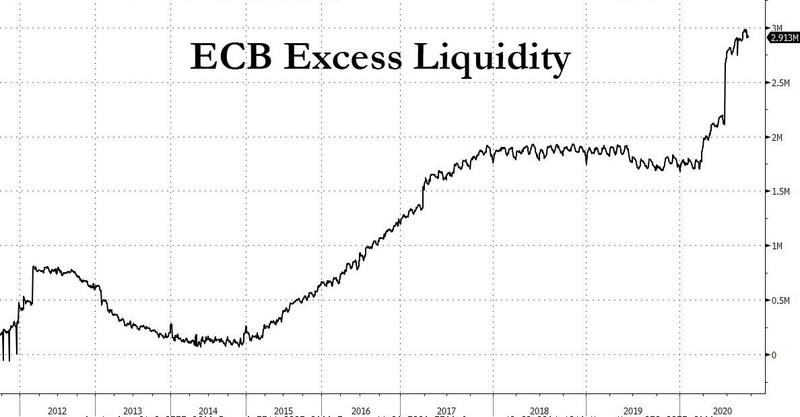

So BE can bring the horse banks to water, but it cannot force them to drink, that is, to take money and make loans. The result of this type of work is an enormous amount of excess liquidity in the euro area:

According to Danske bank at the beginning of 2021, the ECB will inject another 600 billion of liquidity, bringing total liquidity to about 3 trillion.

The effect of all this negative value liquidity has the effect of simply bursting asset bubbles, ie investment bubbles, one after another. According to Bloomberg, the ECB could undermine its influence on short-term market rates. The three-month Euribor – the rate at which banks can theoretically borrow from each other – fell to an all-time low of minus 0.508% this week .

When it dropped below the ECB's key rate last week, it was a phenomenon that had only happened once, in August 2019, just before the central bank cut the deposit rate.

A record € 3 trillion in excess liquidity, however, is probably not enough for the European bank and more stimulus is on the way. The ECB expects the economy to contract 8% this year and the inflation rate has dropped below zero for the first time in four years. Rising coronavirus infections could worsen the outlook.

Economists expect the € 1.35 trillion pandemic bond purchase program to be expanded again this year. Meanwhile, markets aren't pricing in another 10 basis point rate cut until October 2021.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The ECB pays 1% to lend the money. Which then remain in the banks comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-be-paga-1-per-prestare-i-soldi-che-poi-rimangono-nelle-banche/ on Fri, 25 Sep 2020 06:00:50 +0000.