China: inflation rises slightly due to stimulus

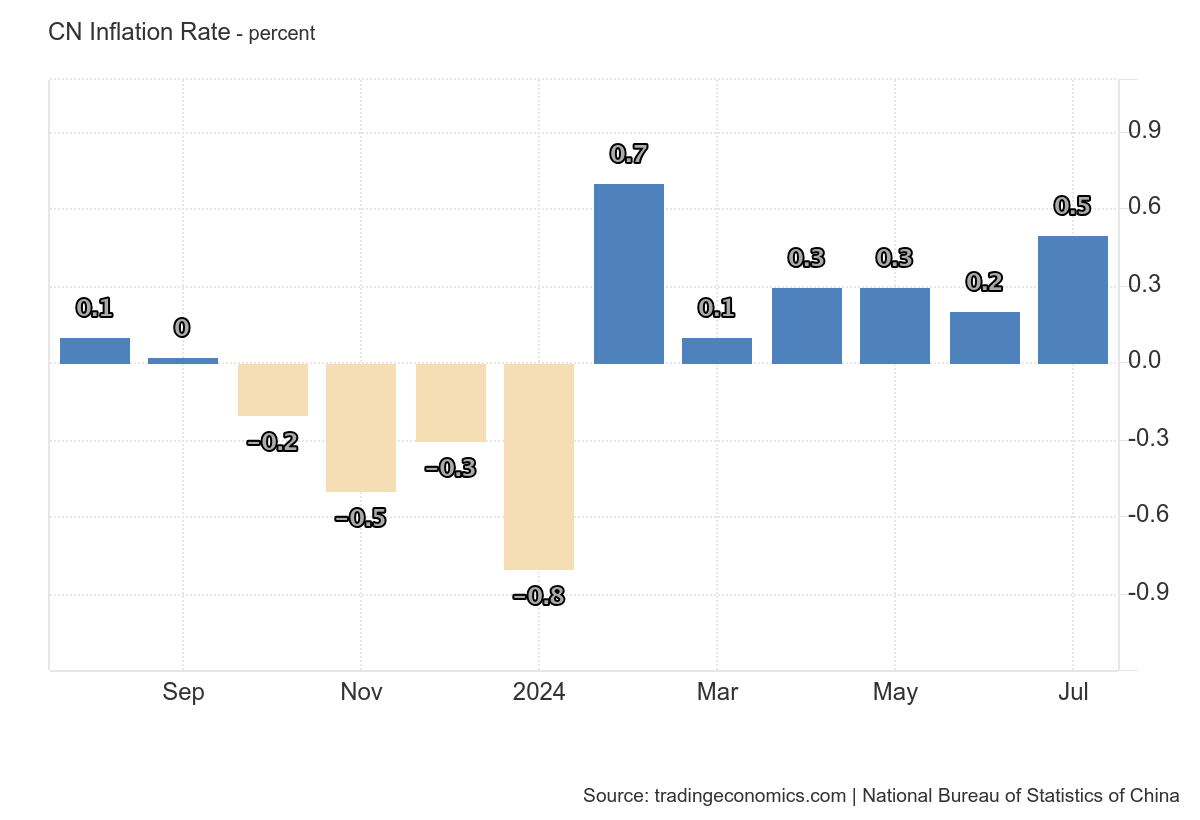

By dint of spending stimuli, the Chinese government managed to raise inflation a little, exactly as desired. China's annual inflation rate rose to 0.5% in July 2024 from 0.2% in June, beating market forecasts of 0.3% and marking the highest figure since February.

It was also the sixth consecutive month of consumer inflation, indicating continued improvement in domestic demand, thanks to increased stimulus from Beijing.

Food prices attempted to reverse the declines of the previous twelve months (flat reading compared to -2.1% in June) due to environmental situations.

Meanwhile, the prices of non-food goods continued to increase (0.7% vs 0.8%), marked by sustained increases in the cost of clothing (1.5% vs 1.5%), housing ( 0.1% vs 0.2%), health (1.4% vs 1.5%) and education (1.7% vs 1.7%).

However, transport costs fell further (-0.6% vs -0.3%), as the impact of service price increases and higher train tickets in some Chinese cities earlier in the year took hold. is rapidly attenuated.

Core consumer prices, net of food and energy costs, increased by 0.4% y/y, the lowest in 6 months, and this indicates a still moderate wage dynamic. On a monthly basis, the CPI rose 0.5%, the first gain since April and above the consensus of 0.3%.

Here is the inflation graph:

Contrary to what has been done in the EU, where inflation has always been erroneously seen as an enemy to be fought, the CCP is worried about inflation that is too low for too long, because this means a stagnant economy, which which China cannot afford.

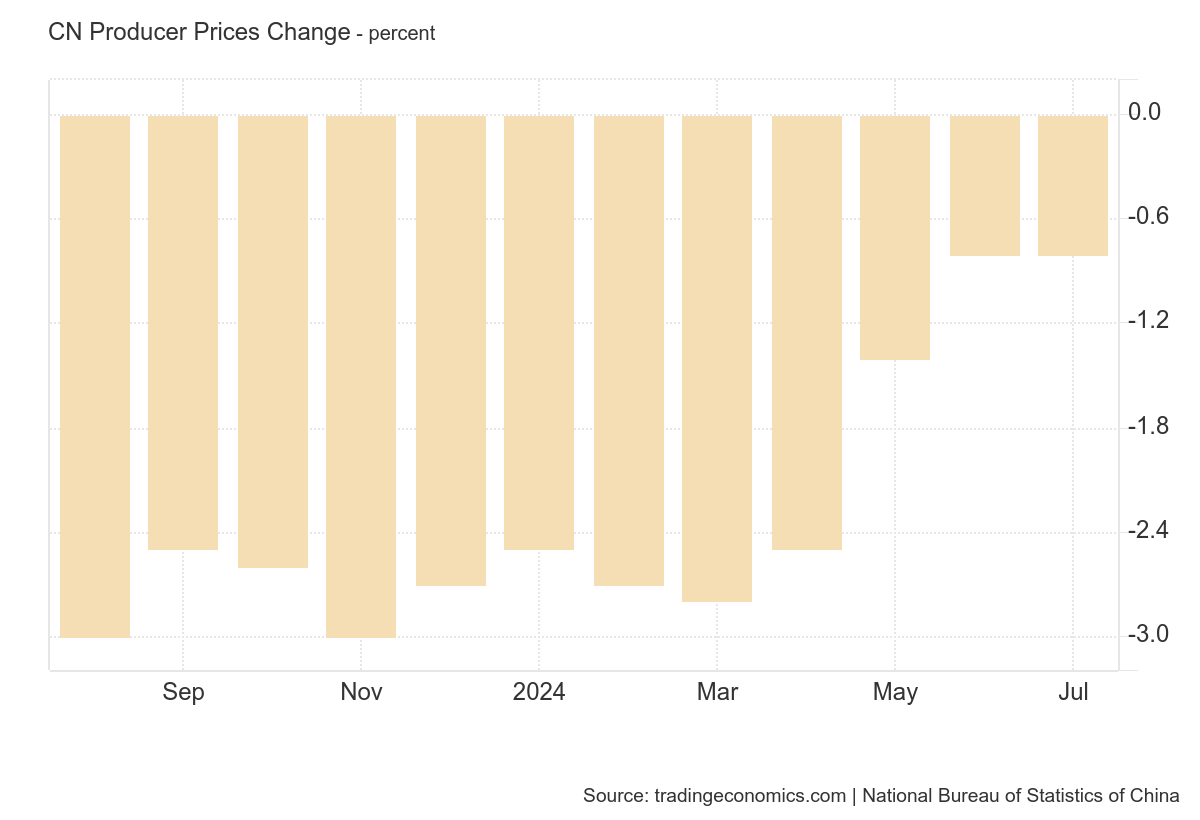

Producer prices falling, but less than expected

China's producer prices fell 0.8% y/y in July 2024, the same pace as the previous month but below market forecasts of a 0.9% decline.

While marking the 22nd consecutive month of producer deflation, the latest result remained the lowest figure in almost 1 1/2 years, aided by multiple support measures from the Government to change stubbornly weak consumption.

The costs of the means of production continued to reduce (-0.7% vs. -0.8% in June), mainly burdened by processing (-2.1% vs. -2.0%), while prices decreased increased further both for the mining sector (3.5% vs. 2.7%) and for raw materials (1.8% vs. 1.6%).

At the same time, the prices of consumer goods remained weak (-1.0% vs -0.8% ), driven by food (-0.7% vs -0.2%), everyday goods (-0 .3% vs -0.1%), durable goods (-2.0% vs -2.1%) and clothing prices (-0.5% vs flat reading). On a monthly basis, producer prices fell by 0.2%, the same pace as in June and this means that consumer demand has not yet grown enough

Considering the first seven months of 2024, factory prices decreased by 2.0%. Here is the relevant graph

The government still needs to stimulate consumption

The trend in inflation indicates that the powerful stimuli on consumption are having a certain success, but not yet at a sufficient level to be able to reawaken production prices, the continuous decline of which indicates a problem of progressive reduction of production margins .

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China: inflation rises slightly due to stimulus comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-a-furia-di-stimoli-si-rialza-un-poco-linflazione/ on Fri, 09 Aug 2024 08:00:31 +0000.