China’s central bank continues to hoard gold

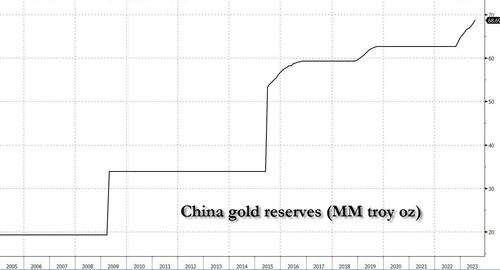

Not only is China voraciously buying up all the physical gold it can get its hands on – something it has done virtually non-stop since 2009, mostly covertly with occasional bouts of public disclosure intended to achieve specific policy goals – more importantly , is letting the world know that it is buying all the physical gold it can get its hands on.

China's central bank revealed on Monday that it increased its gold reserves for the ninth consecutive month in July as central bank purchases – largely from China – continue to support the price of the precious metal, offset by ETF sales. China is one of the top 10 gold-bearing central banks in the world.

Bullion held by the People's Bank of China rose by 740,000 troy ounces, or about 23 tonnes, taking the country's total stockpile to a record 2,137 tonnes, with about 188 tonnes added in a round of purchases that began in November. What China's real purchases are, however, remains a mystery and will only be revealed when Beijing is ready with whatever it has in mind for its currency.

As previously reported, China led the central bank's gold purchase in 2023 as it continues to diversify its reserves by diversifying against the weaponized US dollar. This has helped keep prices high despite rising interest rates around the world, which typically weakens demand for non-interest bearing bullion. One can only imagine what will happen once rates start to fall and when the exponential increase in US debt forces the Fed to resume monetizing it.

Official purchases are key to the price outlook this year, according to the World Gold Council. Industry body expects central banks to continue to increase their holdings, albeit at a slower pace than last year as demand surged as they hunt for alternatives to the dollar after the US sanctions reserves of Russia following its invasion of Ukraine.

Meanwhile, the PBOC also reported that China's total foreign exchange reserves rose $11.3 billion to $3.204 billion in July, up 3.2% on the year and up 0.4% on the year. the previous month, and higher than the consensus estimate of $3.193 billion.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The Chinese Central Bank continues to hoard gold comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-banca-centrale-cinese-continua-ad-accaparrarsi-oro/ on Thu, 10 Aug 2023 14:30:45 +0000.