Italy: mediocre economic data and inflation should make us think

We wrote about Germany this morning, but we couldn't miss the Italian data which, if apparently a little better, should give us pause for thought.

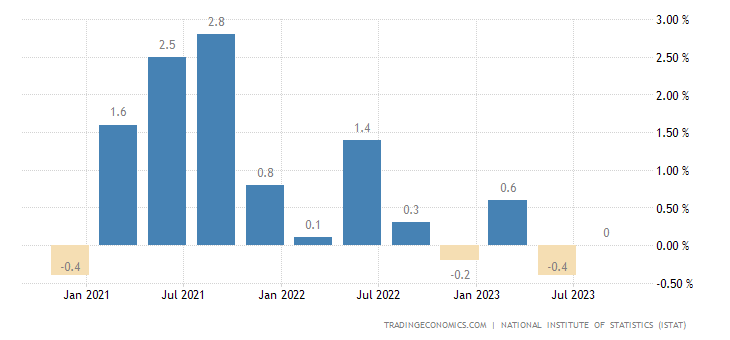

First of all the GDP data: Italian GDP remained unchanged from the previous quarter in the three months to September 2023, maintaining the 0.4% contraction of the second quarter and below market expectations of an expansion of 0. 1%, according to a preliminary estimate.

Production fell in the agricultural, forestry and fishing sectors, following a decline in industrial production and a stall in services. The result is in line with growing concerns about the growth of the Italian economy, which has succumbed to rising European Central Bank funding costs after a few quarters of resistance.

The Bank of Italy lowered its growth projections for 2023 and 2024 in its latest bulletin, citing intensifying geopolitical tensions, the weakening of the Chinese economy and the tightening of credit conditions in Italy and Eurozone.

Here is the graph at a quarter-over-quarter level

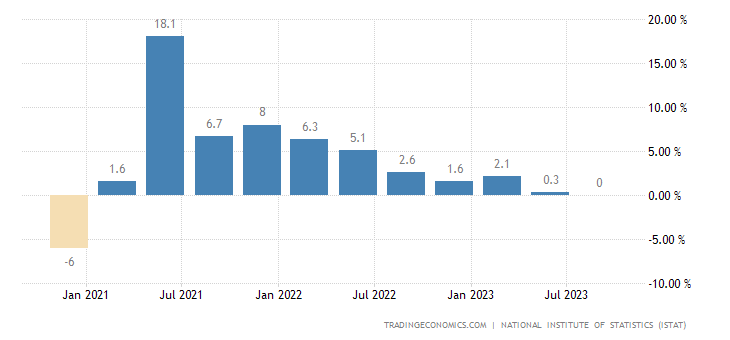

And that on year

coincidentally they are both at zero, better than Germany, but worse than much of the rest of the world. High rates and still high energy prices have had their effect.

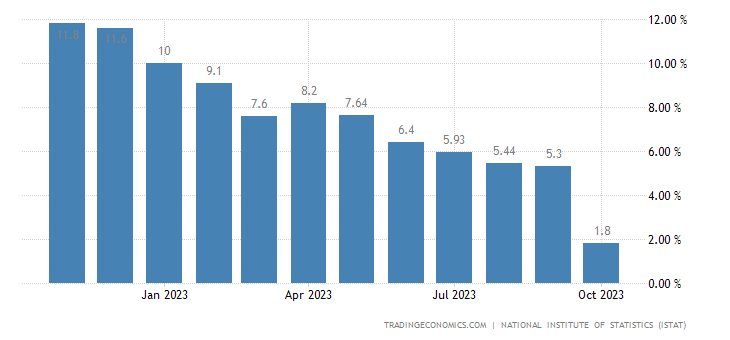

Also showing that we are facing a strong economic slowdown is inflation, which even becomes negative month on month and goes below 2% on an annual basis, with only 1.8%. On an annual basis, the inflation rate in Italy fell to 1.8% in October 2023 from 5.3% in the previous month, below market expectations of 2.3% and showing the lowest reading since June 2021.

The main cause is a sharp drop in energy costs, both unregulated (-17.7% vs 7.6%) and regulated (-32.7% vs -27.9%). Additionally, consumer prices slowed for unprocessed foods (5% vs 7.7% in September) and for processed foods, including alcohol (7.4% vs 8.9%).

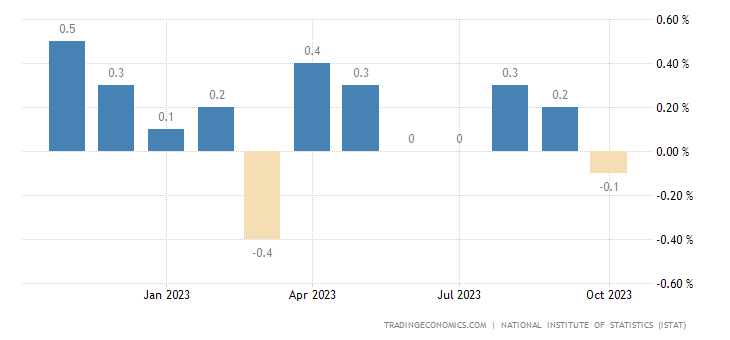

On the other hand, they increased more rapidly for housing-related services (4% vs 3.7%) and for transport-related services (4% vs 3.8%), which, remember, follow inflation subsequently the ISTAT inflation survey. As regards underlying inflation, net of energy and fresh food products, it fell further to 4.2% from 4.6% in the previous period. On a monthly basis, the CPI fell by 0.1%, indicating that the wage dynamic, which followed the external shock, is slowing down.

Here is the relevant graph

And here is the month-on-month inflation

The fact that inflation has fallen in this way has a number of causes and consequences:

- energy demand is so low that, despite international tensions, even growing ones, prices have collapsed because, simply, there is a lack of demand. Environmental factors help, but the problem is that the Italian and European production system is going into hibernation;

- now we have that the real yields of all Italian debts and government bonds become POSITIVE, and not a little positive, given that a ten-year BTP now yields 2.9% in real terms. A lot, and we're not talking about private debt whose real yields are now skyrocketing.

Positive real returns are a strong disincentive towards spending, because they weigh on debt for investment and consumption, while there is a push to save in order to have a passive positive real return. A very bad situation for the economy, because in turn it creates a push towards recession.

Will we have a self-sustaining crisis? We will only know by following the behavior of the ECB and seeing what will happen in the coming months. There would be the conditions not only for not raising rates further, but even for reducing them.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Italy: mediocre economic data and inflation should make us think comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/italia-dati-economici-mediocri-e-linflazione-dovrebbe-far-pensare/ on Tue, 31 Oct 2023 16:33:37 +0000.