Spain beats France: BNP Paribas is no longer the bank with the highest capitalization in the Euro Area

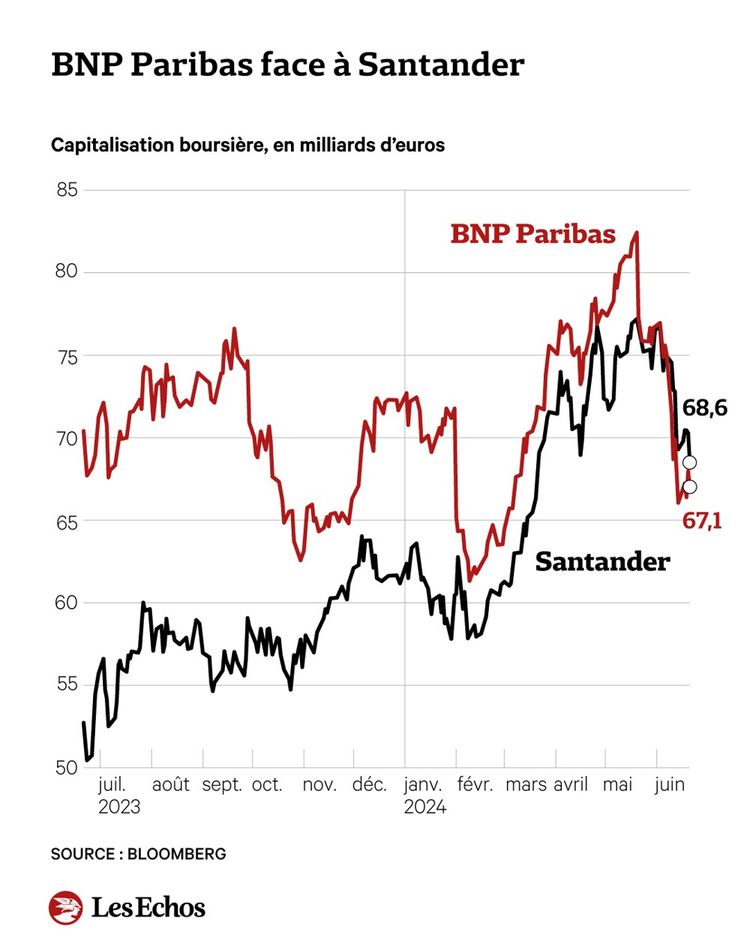

BNP Paribas no longer has the largest market capitalization of any eurozone bank. Following the massive correction in French banking stocks after Emmanuel Macron announced the dissolution of the National Assembly on the evening of June 9, the group led by Jean-Laurent Bonnafé saw its valuation fall to 67.1 billion euros, surpassed by the Spanish leader Santander, which is worth 68.6 billion euros.

Investors fear that the legislative elections on June 30 and July 7 could lead to a political alternation, with a majority for the Rassemblement National (RN) or the Nouveau Front Populaire, whose economic programs could weigh on public finances. As a result, this could affect the financing costs of French banks in the markets, which implicitly depend on the rating of French sovereign debt.

Here is a comparative graph on the value of the two banks:

Since the announcement of the dissolution of the French parliament, BNP Paribas has lost 10.6%, Société Générale 15% and Crédit Agricole 11%. “We believe the collapse of French banking stocks was driven more by macroeconomic considerations, such as the rising cost of capital, triggered by political uncertainty,” say Morgan Stanley analysts, who fear the decline will continue until the results of the legislative elections on 7 July. BNP Paribas declined to comment.

But Santander's rise to the top of the eurozone banking capitalization ranking is also due to the merits of the group, which recorded profits of 11 billion euros last year. The Spanish giant took full advantage of the central bank's rate increases, which it was able to pass on to existing loans in Europe and the UK – unlike French banks, whose real estate loans are made at fixed rates.

Furthermore, the bank tax introduced by the Spanish government had minimal impact on the bank. In Madrid's financial circles, this new title of European champion is seen as the fruit of Santander's combined efforts to improve efficiency in the management of its activities worldwide, and of its major offensive in terms of innovation.

So blaming only the dissolution of the chambers would be ungenerous towards the Spaniards who, in the end, have a less cumbersome and more innovative banking system than the French, who are also slaves to their own environmentalist prejudices and give up investing in the oil and gas sector , even if this is profitable.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Spain beats France: BNP Paribas is no longer the bank with the highest capitalization in the Euro Area comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/spagna-batte-francia-bnp-paribas-non-e-piu-la-banca-con-maggiore-capitalizzazione-in-euro-area/ on Mon, 24 Jun 2024 09:00:26 +0000.