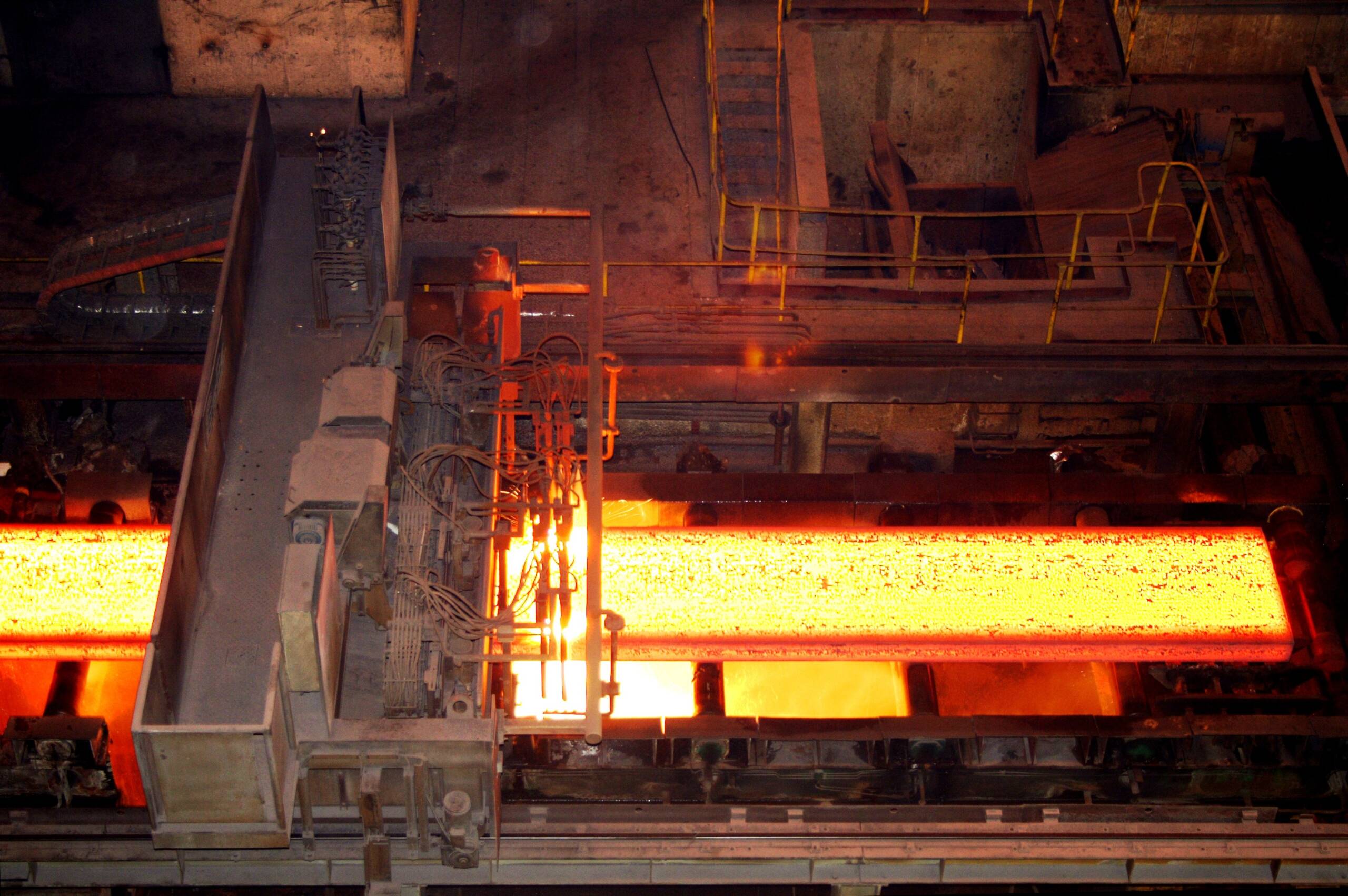

Steel and steel mills: great changes are expected in Eastern Europe

Big changes appear to be coming to the Polish steel industry. Local steel news outlets recently reported that several companies have expressed interest in leasing Polish sheet metal producer Huta Cz?stochowa , acquired by Liberty Steel in 2021, after a local court declared the plant bankrupt in July .

Among the potential suitors for the plant is the Ukrainian group Metinvest , which specializes in metals and mining. “We can confirm that we have been invited to consider leasing the steel plant, with the possibility of acquiring it later,” ?ycie Cz?stochowy newspaper said on August 15, quoting Metinvest commercial director Dmitriy Nikolayenko. “We currently have no information on the conditions in which the previous owner left the site. We need to conduct a thorough assessment, including a comprehensive due diligence study, which will determine the start-up date of the steel plant,” Nikolayenko added.

Metinvest officials were unavailable for comment, despite numerous attempts. Other parties interested in leasing Huta Czestochowa include Katowice-based coal producer Weglokoks , which has stakes in other Polish rolling mills. An official from that company only told MetalMiner that the company is analyzing the possibility and declined to comment further.

Metinvest may expand production capacity outside Ukraine Information published on the group's website shows that Metinvest's activities outside Ukraine include Italian sheet metal producers F erriera Valsider and Metinvest Trametal. The latter is located in the Friuli Venezia Giulia region and has a capacity of 600,000 metric tons per year of rolling sheets of 4-180 mm and a maximum width of 3200 mm.

The Ferriera Valsider, in Veneto, can roll up to 400,000 tonnes per year of heavy plates with thicknesses from 8-200 mm and widths up to 3,000 mm and 600,000 tonnes per year of HRC with thicknesses from 1.8-25 mm and maximum width of 1,555 mm.

Huta Czestochowa is located 80 kilometers north of Katowice, the capital of the Silesian Voivodeship, and can produce around 1.2 million tonnes per year of plates with thicknesses from 5-20 mm on two rolling mills, so it is larger than Italian plants put together. Information on Liberty Steel's website indicates that the plant's products are intended for wind towers and non-pressurized tanks.

Huta Czestochowa's production also targets the yellow goods, construction, vehicle and water transport sectors. Furthermore, the plant is capable of producing welded pipes with diameters between 1,000 and 3,000 mm. The plant has a troubled financial history. On July 25, the Czestochowa District Court declared Huta Cz?stochowa bankrupt. According to Polish media and steel industry publications, the decision was made because the plant had not operated for six months and had not received new orders. A GFG Alliance source told MetalMiner that the plant was operating at rock-bottom levels at the start of the year, but worsening market conditions in Europe had created cash flow problems.

Sheet metal produced in Northern Europe currently costs around 605 euros ($675) per tonne EXW, down from 700 euros ($780) at the start of the month. This is partly due to lower seasonal demand in the European summer and lower input prices.

Huta Czestochowa. it failed several times

The current failure is not the first for Huta Czestochowa. In fact, the same court that announced the current bankruptcy also placed the plant in bankruptcy in September 2019, after its board of directors filed for bankruptcy in June.

Liberty hopes to maintain its positions in the steel industry Sunningwell International Polska reportedly expressed interest in taking over the plant's lease in 2019, after Polish courts previously placed the plant in bankruptcy. The company backed out of the planned sale in 2020, after which Liberty Steel acquired it for the reported sum of z? 190 million euros (43.3 million dollars).

Liberty Steel initially took over the Czestochowa lease in December of that year and then fully acquired the plant in May 2021. Liberty's parent company, GFG Alliance, said on August 15 that it has appealed the bankruptcy proceedings and to regain possession

“Liberty is appealing because it believes that the company has demonstrated that it has strong support from its main creditor, that it has a letter of intent from a credible financial institution for a working capital loan of 100 million euros [ $111 million] and are already in the process of restructuring and restarting,” the company said in an announcement.

“Liberty's appeal also highlights a number of court procedural issues that have a significant impact on the validity of the proceedings,” the company said.

So a failed steel mill, which previously was of interest to almost no one, now interests everyone. Could it be because, however, a growth in demand for steel from Poland is expected, to the detriment of that from other areas, such as Russia and Ukraine?

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Steel and steel mills: big changes are expected in Eastern Europe comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/acciaio-e-acciaierie-si-attendono-grandi-mutamenti-nellest-europa/ on Fri, 30 Aug 2024 06:00:07 +0000.