The Fed plans to expand guarantees for banks, and what Yellen plans to do = The First Republic case

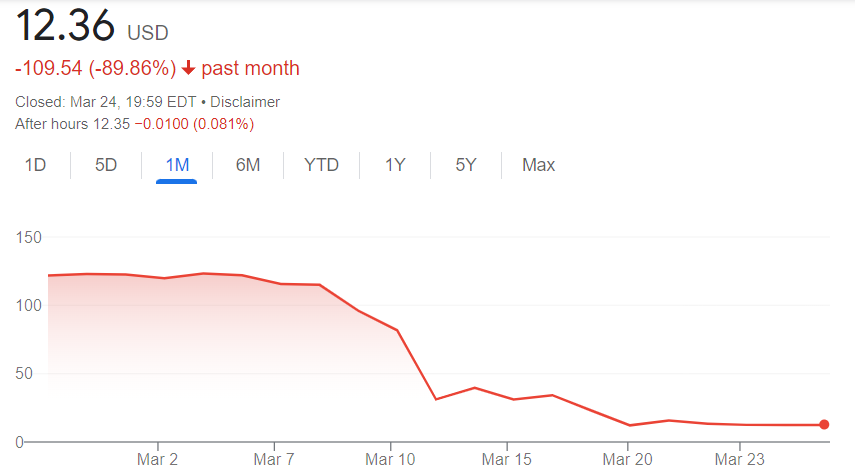

One day after a long meeting on the growing banking crisis by the Financial Stability Oversight Council, which already years ago promised that there would never again be financial crises, on the last day of a week that began with the collapse of Credit Suisse and culminated with historic losses by US regional banks, amid speculation that First Republic Bank could collapse at any moment and take countless other names with it, even as the FSOC assured Americans that “while some institutions are been subjected to stress, the US banking system remains strong and resilient. Meanwhile, however, First Republic has lost 89% in value in one month (therefore unthinkable that it can be refinanced on the market)

And the entire US banking sector has lost a healthy 20% in one month, including the big systemic banks which, in fact, have even strengthened their position

Bloomberg reports that in an effort to bail out the most troubled of regional banks, authorities are considering expanding the recently introduced emergency loan facility for banks, the Bank Term Funding Program (BTFP), in order to expand the emergency for the banks to be able to give better coverage to medium-small and regional banks, just like First Republic.

The problem, however, is that Janet Yellen does not have clear ideas, or she simply does not want to save the regional banks, or not all of them, and if she does so, she does it reluctantly. Consider the contradictory confusion between statements on Wednesday and Thursday last week, when he first denied an FDIC insurance extension and then had to correct himself. So the Treasury and the FED have not yet decided on further interventions in favor of the First Republic.

Bizarrely, even without such a step, regulators view First Republic as stable enough to operate without immediate intervention, while the company and its advisers try to strike a deal to shore up its balance sheet, which is bizarre and leads to a sort of role reversal in which the controller is calm and the bank is anxious about its future, also because, as we have underlined, it would be impossible for it to obtain capital from the market. For now, the bank has been on its feet mostly with the $30 billion of liquidity provided by systemic banks on a voluntary basis in the form of deposits, proving that Yellen is ultimately less interested in the stability of the banking sector than the First Republic's own competitors. !!

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article THE FED plans to expand guarantees for banks, and what Yellen plans to do = The First Republic case comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-fed-pensa-di-allargare-le-garanzie-per-le-banche-e-la-yellen-che-cosa-pensa-di-fare-il-caso-first-republic/ on Sun, 26 Mar 2023 14:01:12 +0000.