The path of the dollar in one image, from growth to “Maybe dedollarization”

The US dollar has dominated global trade and capital flows for many decades.

Now, as Visual Capitalist's Bruno Venditti explains , many nations are looking for alternatives to the greenback to reduce their dependence on the United States.

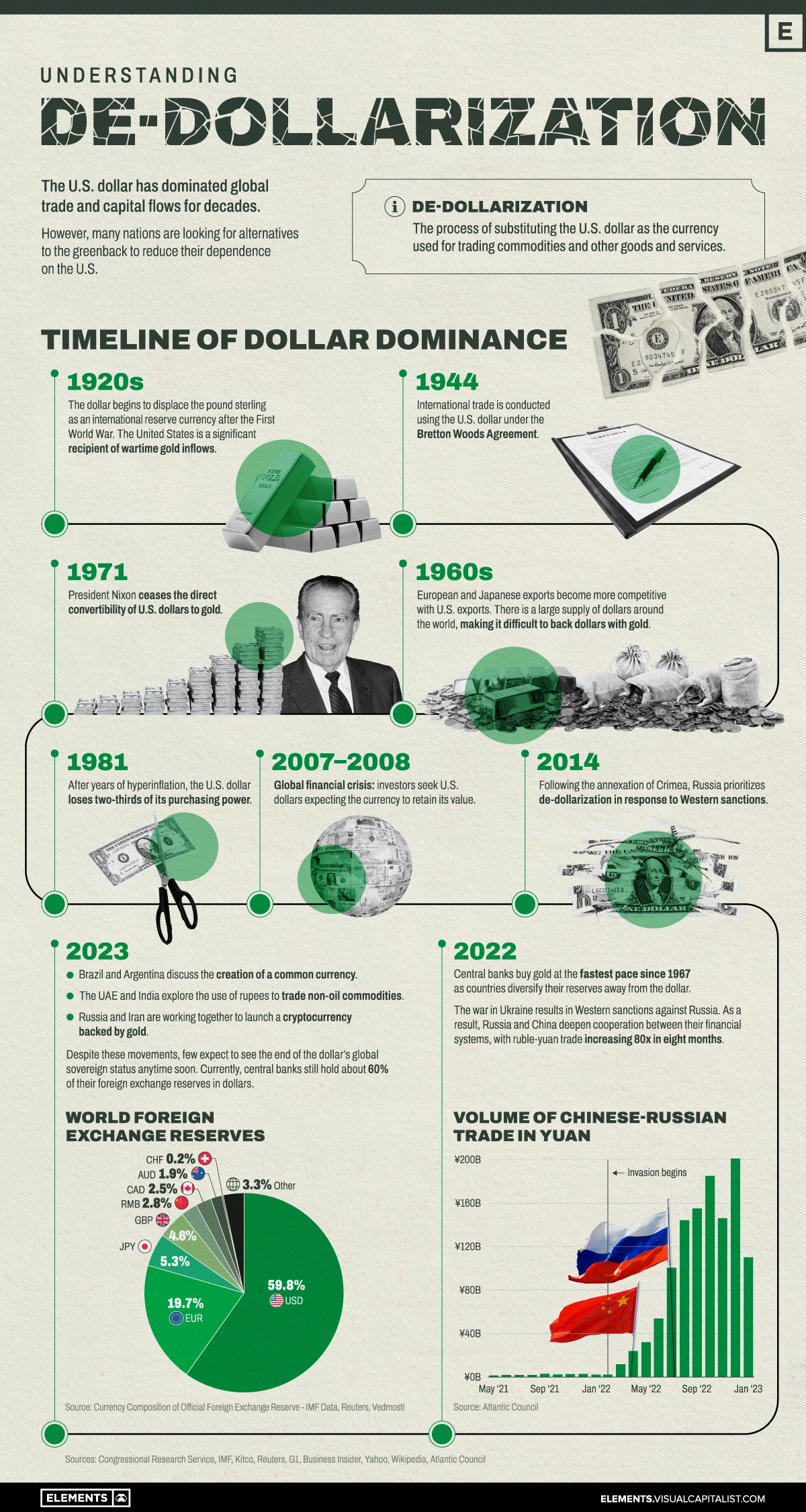

This chart illustrates the rise of the US dollar as the dominant international reserve currency and recent efforts by various nations to de-dollarize and reduce their dependence on the US financial system. Here's the story of dollar dominance and how that trend is reversing, perhaps:

The United States became, almost overnight, the leading financial power after the First World War. The country only entered the war in 1917 and emerged much stronger than its European counterparts. As a result, the dollar began to replace the pound as the international reserve currency, and the United States also became a major recipient of wartime gold inflows.

The dollar then acquired a more important role in 1944, when 44 countries signed the Bretton Woods Agreement, creating a collective international exchange rate regime pegged to the US dollar, which in turn was pegged to the price of gold.

In the late 1960s, European and Japanese exports became more competitive with US exports. The large availability of dollars around the world made it difficult to redeem them in gold. In 1971, President Nixon ended the direct convertibility of US dollars into gold. This ended both the gold standard and the limit on the amount of currency that could be printed. Although it has remained the international reserve currency, the US dollar has lost more and more purchasing power since then.

The steps of Russia and China towards de-dollarization

Concerned by America's dominance of the global financial system and the country's ability to "weapon" it, other countries have experimented with alternatives to reduce the dollar's hegemony.

As the United States and other Western nations have imposed economic sanctions on Russia in response to its invasion of Ukraine, Moscow and the Chinese government have teamed up to reduce dependence on the dollar and establish cooperation between their financial systems.

Since the 2022 invasion, trade between the ruble and the yuan has increased eighty-fold. Russia and Iran are teaming up to launch a gold-backed cryptocurrency, according to Russian news agency Vedmosti. Furthermore, central banks (especially Russia's and China's) have been buying gold at the fastest pace since 1967, as countries are looking to diversify their reserves away from the dollar.

How other countries are reducing their dependence on the dollar

De-dollarization is also a theme in other parts of the world:

- In recent months, Brazil and Argentina have been discussing the creation of a common currency for the two largest economies in South America.

- At a conference in Singapore in January, several former Southeast Asian officials spoke about ongoing de-dollarization efforts.

- According to Reuters, the UAE and India are in talks to use rupees to trade non-oil commodities away from the dollar.

- For the first time in 48 years, Saudi Arabia has declared that the oil-rich nation is open to trade in currencies other than the dollar.

Despite these moves, few expect to see the end of the dollar's global sovereign status anytime soon. Currently, central banks still hold about 60% of their foreign exchange reserves in dollars.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article THE journey of the dollar in one image, from growth to "Maybe dedollarization" comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-cammino-del-dollaro-in-una-immagine-dalla-crescita-alla-forse-dedollarizzazione/ on Sun, 23 Apr 2023 06:00:25 +0000.