The Russian Central Bank cuts interest rates again. After all, the Ruble is very strong, thanks to sanctions (and economic ignorance)

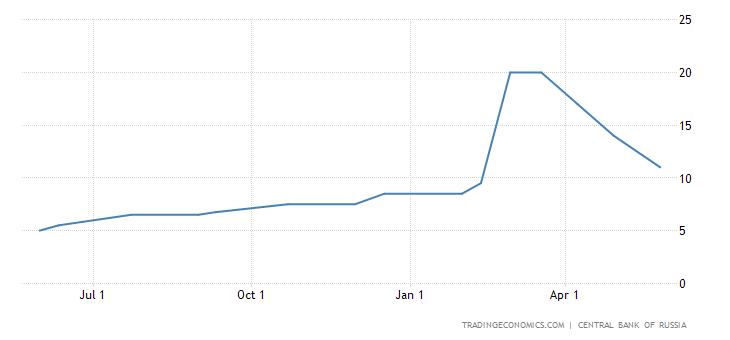

The Central Bank of Russia cut its benchmark interest rate by 300 basis points, 3%, to 11%, during an extraordinary monetary policy meeting held on May 26, after a cumulative cut of 600 basis points in April. The latest weekly data points to a significant slowdown in current price growth rates. Inflationary pressure eases thanks to the dynamics of the ruble exchange rate and the significant decline in inflation expectations of households and businesses. Annual inflation reached 17.8% in April, but slowed to 17.5% according to May 20 estimates, falling faster than the Bank of Russia's April forecast. According to the forecasts of the Bank of Russia, given the stance of monetary policy, annual inflation will fall to 5.0-7.0% in 2023 and will return to 4% in 2024. source: Central Bank of Russia.

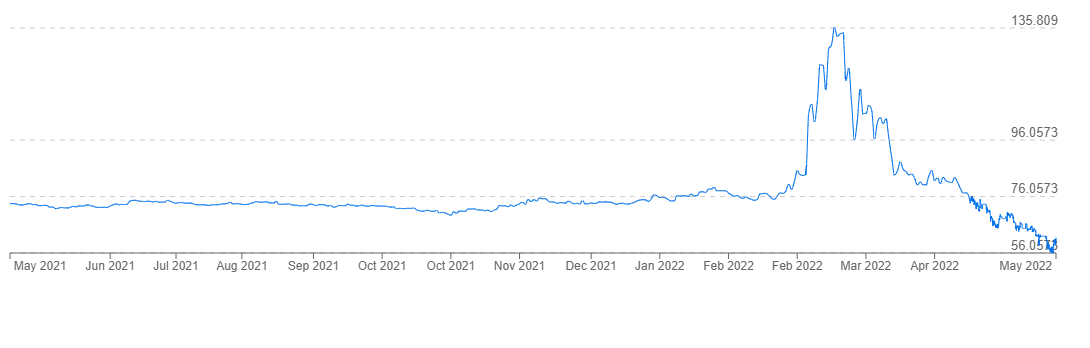

So we are moving towards a normalization of inflation, at least in the medium term, while the Ruble has revalued to levels even higher than those of May 2021. Here is a graph that shows everything

Moreover, thanks to the imposition of the foreign currency payment system – Rubles, Russia sees purchase flows of Rubles on the market not counterbalanced by sales, due to the almost total interruption of exports from the EU and the US to Russia.

In the fake financialized economy that reigns in the void of Brussels and Washington, the war and the announcement of sanctions had to lead to the flight from the Russian currency and its collapse. In the real world of international trade, if I buy raw materials from Russia and pay them in rubles, I will have to buy them up on international markets, making them revalue. If, on the other hand, I block exports, no one will have to buy Dollars or Euros in Russia, counterbalancing the previous push. So the Ruble has revalued and will continue to do so until an opposite push occurs. Paradoxically, even the forced “Default” of the dollar debt will only strengthen it. if Russia had been allowed to buy the US currency there would have been an opposite push in the market, now this corrective push is canceled as well. At this point, the risk for the Ruble is of an excessive revaluation which would displace Russian industrial production in relation to third parties, making the domestic market more dependent on external imports…. from China, Brazil and India.

To explain the behavior of the Western elites in this situation we must refer directly to the laws of stupidity of Carlo Cipolla.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The Russian Central Bank cuts interest rates again. After all, the Ruble is very strong, thanks to the sanctions (and economic ignorance) it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-banca-centrale-russa-taglia-ancora-i-tassi-di-interesse-del-resto-il-rublo-e-fortissimo-grazie-alle-sanzioni-ed-allignoranza-economica/ on Thu, 26 May 2022 10:26:45 +0000.