The Swiss central bank has sold many of its securities on the US stock exchange. Lightens the active

The Swiss National Bank acted in a unique way among money-printing central banks: it created its own money, but then did not buy bonds or shares in its own currency, but instead used Swiss francs to buy foreign currency, mostly euros and dollars , and with that foreign currency it bought stocks and bonds denominated in those foreign currencies. Indeed, in those years it was not QE in Switzerland, but QE in other countries, ostensibly to prevent the Swiss franc from over-appreciating against other currencies, mainly the euro and the dollar.

But this move created 132 billion Swiss francs in losses in 2022, the SNB said earlier this year, the biggest annual loss in its history, amid falling stock and bond prices and strong exchange rate fluctuations. Then the Swiss SNB, as Wolfstreet noted, started selling the bonds on the US market.

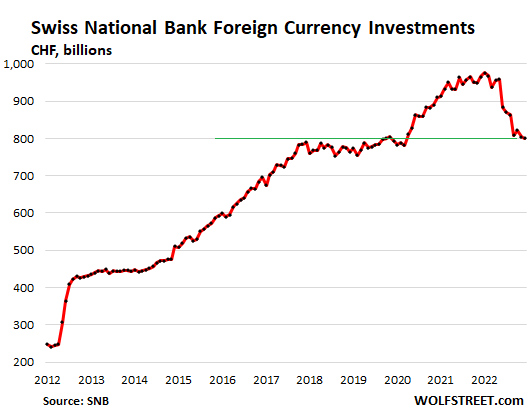

The total amount of “Foreign currency investments” on the SNB's balance sheet, including US equities, at the end of December 2022 dropped by 176 billion francs, or 18%, from its February 2022 peak, to 801 billion francs. francs, the lowest value since October 2019 and slightly higher than in December 2017:

At its peak in February 2022, foreign currency investment totaled 977 billion Swiss francs ($1.06 trillion at today's exchange rates), or about 130% of Switzerland's GDP!

The decline in the value of foreign currency investments has occurred in conjunction with the collapse in asset prices and sharp swings in exchange rates. The SNB values its foreign currency investments on the market. Its foreign currency bonds are not designed to be “held to maturity,” but are held for sale under its currency manipulation scheme, and the shares still need to be marked to market.

But not to worry: the SNB, like any central bank that creates its own money, can't run out of funds and “go bankrupt” or whatever, no matter how much money it loses.

Here is a table showing the decline in the ownership of American equities at the end of 2022 compared to the previous two quarters.

| Top 50 | as at 31 December 2022 | changes compared to | ||

| Dollar values | number of shares | Q3 2022 | Q2, 2022 | |

| APPLE | 8.486 | 65,315,868 | -4,826,740 | -5,475,740 |

| MICROSOFT | 6,906 | 28,795,370 | -1,996,285 | -2.098.985 |

| ALPHABET | 4,150 | 46,912,500 | -3,601,740 | -3,824,040 |

| AMAZON | 3.130 | 37,264,400 | -2,419,640 | -2,467,040 |

| UNITED HEALTH | 2.016 | 3,801,661 | -264.065 | -279.765 |

| JOHNSON & JOHNSON | 1.888 | 10,685,700 | -718.116 | -719,716 |

| EXXON MOBIL | 1,868 | 16,938,376 | -1.317.815 | -1.426.315 |

| Nvidia | 1.479 | 10,120,000 | -731,824 | -724,624 |

| PROCTER AND GAMBLE | 1,469 | 9,694,590 | -703.383 | -703.583 |

| VISA | 1.381 | 6,645,100 | -487.119 | -548.919 |

| CHEVRON | 1,357 | 7,557,690 | -531.642 | -890.542 |

| TESLA | 1.333 | 10,824,975 | -623.902 | -607.302 |

| HOME DEPOT | 1.314 | 4,160,700 | -293.266 | -369.066 |

| MASTERCARD | 1.219 | 3,506,700 | -256.757 | -279.157 |

| ELI LILLY | 1.201 | 3,282,490 | -217.558 | -228.958 |

| PFIZER | 1.169 | 22,810,112 | -1,506,129 | -1,583,329 |

| SHORTS | 1.161 | 7,186,010 | -472.365 | -486.665 |

| MERCK & CO | 1.142 | 10,295,951 | -663.281 | -668.981 |

| META PLATFORMS | 1.115 | 9,269,300 | -670.310 | -747.310 |

| COCA COLA | 1.062 | 16,697,600 | -1,149,994 | -1,168,694 |

| PEPSICO | 1.013 | 5,609,000 | -383.804 | -392.204 |

| BROADCOM | 918 | 1,641,234 | -108.808 | -135.608 |

| THERMO FISHER SCIENTIFIC | 877 | 1,592,400 | -104.127 | -104.527 |

| WALMART | 869 | 6,127,500 | -434.083 | -490,483 |

| COSTCO extension | 822 | 1,800,300 | -119.699 | -123.299 |

| CISCO SYS | 802 | 16,830,000 | -1,115,820 | -1,190,120 |

| MCDONALDS | 788 | 2,990,200 | -214.757 | -235.357 |

| ABBOTT LABS | 781 | 7,117,380 | -470.885 | -532.485 |

| DANAHER CORPORATION | 745 | 2,808,708 | -184.562 | -139.262 |

| ACCENTURE | 686 | 2,570,900 | -174.038 | -170.638 |

| VERIZON COMMUNICATIONS | 673 | 17,068,798 | -1,131,403 | -1,140,703 |

| NEXTERA ENERGY | 668 | 7,985,400 | -528.282 | -528.782 |

| LINDE | 661 | 2,025,501 | -153.067 | -197.867 |

| DISNEY WALT | 644 | 7,409,425 | -484.546 | -488.246 |

| ADOBE SYSTEMS | 640 | 1,902,100 | -145.589 | -144.089 |

| PHILIP MORRIS | 638 | 6,300,300 | -417.622 | -422.622 |

| COMCAST | 626 | 17,898,200 | -1,476,229 | -1,725,429 |

| BRISTOL-MYERS SQUIBB | 624 | 8,678,300 | -548.557 | -776.957 |

| TEXAS INSTRS | 614 | 3,713,600 | -282.683 | -292.583 |

| CONOCOPHILLIPS | 611 | 5,173,915 | -431.614 | -463.214 |

| RAYTHEON TECHNOLOGIES | 606 | 6,000,881 | -444,533 | -472.633 |

| NIKE | 601 | 5,135,800 | -362,393 | -400.593 |

| HONEYWELL | 587 | 2,738,100 | -211.955 | -236.855 |

| AMGEN | 571 | 2,174,033 | -140.993 | -242.293 |

| SALESFORCE | 539 | 4,064,277 | -243.054 | -208.554 |

| AT&T extension | 533 | 28,961,984 | -2,063,278 | -2,022,978 |

| NETFLIX | 533 | 1,807,400 | -117.904 | -118.504 |

| ORACLE | 531 | 6,498,500 | -439.388 | -451.888 |

| UNION PAC | 526 | 2,538,000 | -185.316 | -224.816 |

| UNITED PARCEL SERVICE | 517 | 2,974,400 | -208.418 | -203.318 |

| Total | 65.089 | 521,901,629 | -36,779,338 | -39.575.638 |

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The Swiss central bank has sold many of its securities on the US stock exchange. Lighten the asset comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-banca-centrale-svizzera-ha-venduto-molti-dei-propri-titoli-sulla-borsa-usa-alleggerisce-lattivo/ on Sun, 12 Feb 2023 11:32:44 +0000.