The USA is growing less than expected and, above all,

The USA has recorded apparently satisfactory growth, but achieved at a price that cannot be sustained for long.

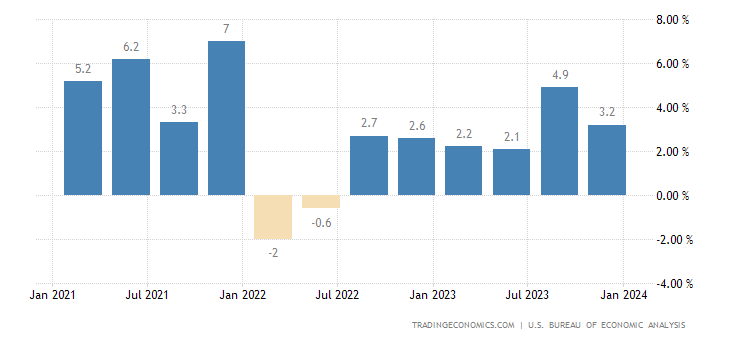

The US economy (GDP) expanded 3.2% year-over-year in the 4th quarter of 2023, slightly below early estimates of 3.3% after a 4.9% rate in the 3rd quarter .

The downward revision is due to private inventories subtracting 0.27 percentage points from growth, compared to the addition of 0.07 percentage points recorded in the advance estimate. On the other hand, consumer spending was revised upwards (3% versus 2.8% in the preliminary estimate), led by services (2.8% versus 2.4%) while goods increased less (3 .2% versus 3.8%).

Furthermore, government spending increased much more (4.2% vs 3.3%) and both exports (6.4% vs 6.3%) and imports (2.7% vs 1.9%) increased more than expected.

Looking further, non-residential investments were also revised upwards (2.4% vs 1.9%), thanks to intellectual property products (3.3% vs 2.1%) and investments in structures (7, 5% vs 3.2%) while investments in equipment were revised downwards (-1.7% vs 1%). Residential investments continued to grow more than expected (2.9% vs 1.1%). Looking at all of 2023, the U.S. economy grew 2.5%, compared to 1.9% in 2022.

Here is the relevant graph:

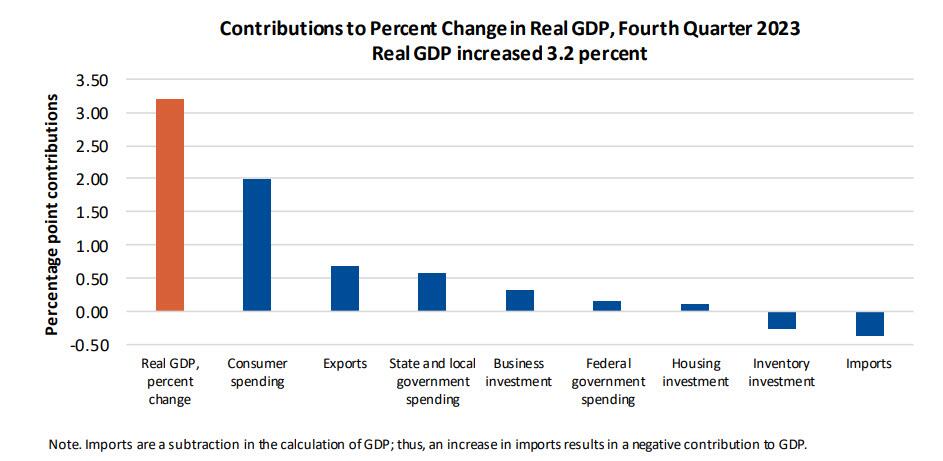

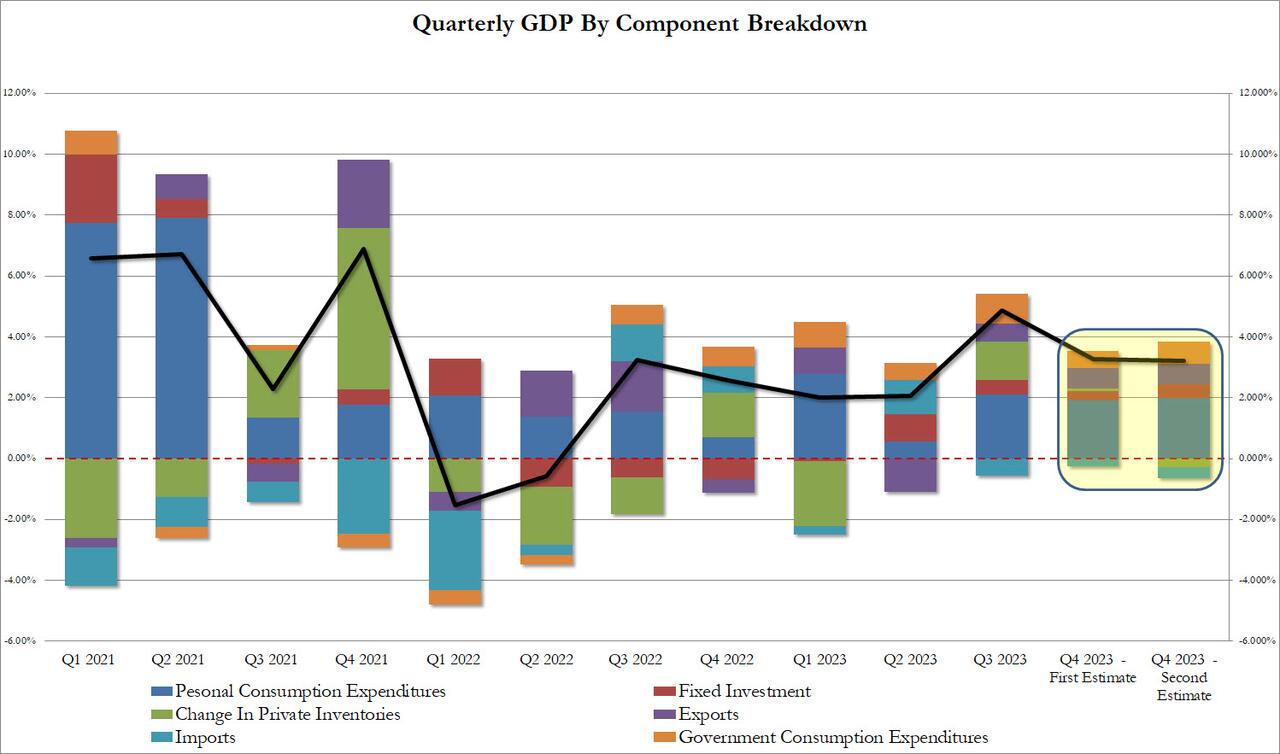

The problem is how growth is generated

The problem is not growth, but how it was generated. If we analyze the individual components graphically we see that consumer spending has a large weight, but we also see a weight of state and federal spending. The trade balance also has a net positive role

In this graph we see this fact much better:

A quick look at the increase in nominal GDP, which went from $27.61 trillion in the 3rd quarter to $27.94 trillion in the 4th quarter, shows that the US economy increased by about 334.5 billion dollars in absolute terms of nominal dollars.

But where does this growth come from? From debt, obviously, and in large quantities . To find out how much the debt amounts to, we consult the US Treasury's D ebt to the penny website, where we discover that the debt as of September 30, 2023 was $33,167,334,044,723.16 and the debt as of December 31, 2023 was of 34,001,493,655,565.48 dollars.

In other words, debt increased by $834.2 billion in the third quarter to grow the U.S. economy by $334.5 billion, or exactly $2.50 of debt for every $1 of “growth” in the GDP. A very, very low multiplier, considering that the largest contribution came from private consumption.

It is true that nominal debt has also increased due to interest, but it seems clear that if the value of nominal debt grows more than nominal GDP we will have an increase in the debt/GDP ratio which cannot continue forever, especially with these interest rates.

So the solution is either a cut in public spending, which, evidently, does not generate sufficient GDP growth or inflation. tertium non datur. And both solutions are painful in the election period.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The USA is growing less than expected and, above all, comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/gli-usa-crescono-meno-delle-attese-e-soprattutto/ on Thu, 29 Feb 2024 08:00:53 +0000.