Which US banks have the least insured deposits, risking account holders losing their money?

There are at least $7 trillion in uninsured bank deposits in America today.

This dollar value is about three times Apple's market capitalization or 30% of US GDP. Uninsured deposits are those that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was raised from $100,000 after the global financial crisis. They account for about 40% of all bank deposits.

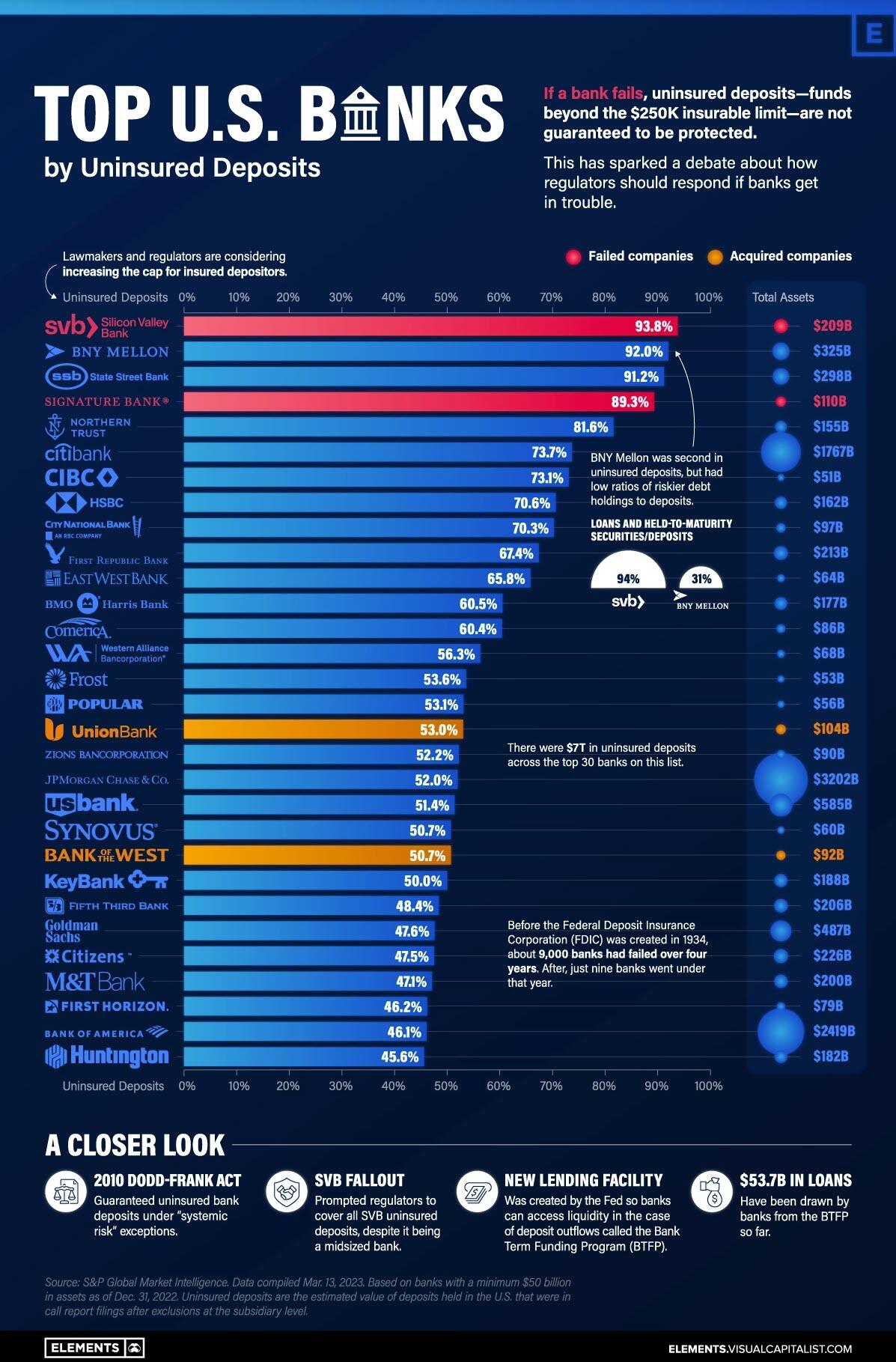

In the wake of the Silicon Valley Bank (SVB) failure, Visual Capitalist's Dorothy Neufeld and Sabrina Lam analyze the 30 US banks with the highest percentage of uninsured deposits, using data from S&P Global.

Below, we show how their level of uninsured deposits compares to other banks. Dataset includes US banks with at least $50 billion of assets at the end of 2022, so small local banks are not included

Bank of New York (BNY) Mellon and State Street Bank are the active banks with the highest levels of uninsured deposits. They are the two largest custodian banks in the United States, followed by JP Morgan. Custodian banks constitute critical infrastructure of the financial system, as they hold assets for investment managers and transfer assets, among other tasks.

Both BNY Mellon and State Street are considered "systemically important" banks, so their failure would be disastrous. The difference between these banks and the SVB is that their loans and held-to-maturity securities, as a percentage of total deposits, are much lower. While these loans made up more than 94% of SVB's deposits, they made up 31% of BNY Mellon's and 40% of State Street Bank's deposits, respectively. The fact that securities must be held to maturity is linked to the fact that, if sold early, they would lead to heavy losses. This is therefore a significant additional risk. For example, the value of long-term US Treasuries has declined by about 30% in 2022 so these securities must be held to maturity if you do not want to pay heavy losses.

Overall, 11 banks on this list have loans and held-to-maturity assets that exceed 90% of the total value of their deposits. therefore these are high-risk institutions

To avoid broader consequences, regulators have implemented emergency measures. To this end they protected all deposits of SVB and Signature Bank a few days after the bankruptcy announcement. The Fed also set up an emergency loan facility for banks. The Bank Term Funding Program (BTFP) was created to provide additional funding to banks should depositors withdraw their money. It was also created to save banks from interest rate risk.

More than $50 billion in loans have been withdrawn from the BTFP so far, up from $11.9 billion in the first week. (This caused the Fed's balance sheet to climb once again, after the slow decline seen with the introduction of quantitative tightening in 2022.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Which US banks have the least insured deposits, risking account holders losing their money? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/quali-banche-usa-hanno-i-depositi-meno-assicurati-rischiando-di-far-perdere-i-soldi-ai-correntisti/ on Mon, 10 Apr 2023 10:49:02 +0000.