The “Dutch Disease” of the economy: why finding a great natural resource is not always lucky, and how to avoid it

In common discourse it is often stated “If only I could find an oil well” or a gold mine, imagining that these natural resources could be a great fortune. Yet what appears as wealth can be a sort of curse and cause what economists call "Dutch disease". What is it?

Dutch disease is a concept that describes an economic phenomenon in which the rapid development of one sector of the economy (particularly natural resources) causes a decline in other sectors. It is also often characterized, if not caused, by a substantial appreciation of the national currency. Dutch disease is a paradoxical situation in which good news for one sector of the economy translates into a negative impact on the overall economy of the country.

Origin of the term

The term “ Dutch disease” was first introduced in The Economist magazine in 1977 to analyze the economic situation of the Netherlands (hence the name) after the discovery of large deposits of natural gas in 1959. Although the Dutch economy has increased its revenue thanks to the export of natural gas, the significant appreciation of the national currency, due to the large influx of capital into the sector, has caused an increase in the unemployment rate in the country and a decline in the manufacturing industry.

The Dutch disease phenomenon commonly occurs in countries whose economies rely heavily on the export of natural resources. The paradox contradicts the concept of comparative advantage. According to the comparative advantage model, each country should specialize in the industry in which it has a comparative advantage over other countries.

However, it does not work well with countries that mainly export natural resources . For example, volatile commodity prices cannot support a country's economy for long periods of time. Furthermore, excessive dependence on the export of natural resources leads to the underdevelopment of other sectors of the economy, such as industry and agriculture. The country in question becomes incredibly fragile and subject to fluctuations in the markets of the main exported product.

A classic case of Dutch disease: Venezuela

Dutch Disease should be called “Venezuelan Disease” because Venezuela is a classic case of it. The country's first oil discovery took place in 1914. The Great War led to the first development in the exploitation of its resources. Therefore, the oil boom that began in the 1920s absorbed financial and human resources from other sectors, such as agriculture or industry. For example, agriculture accounted for two-thirds of GDP in 1920 and 10% in 1950.

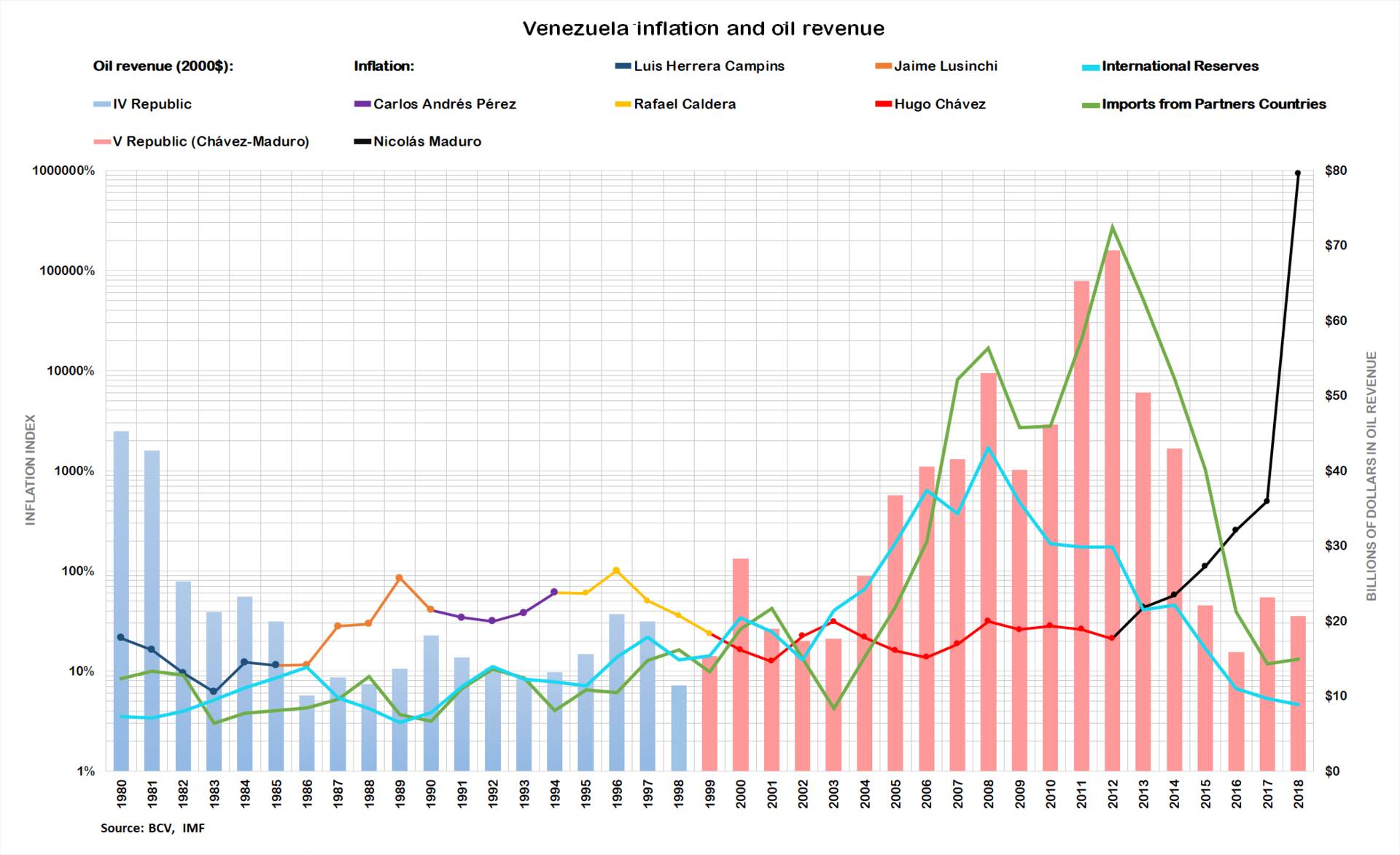

This meant that the economic history of the country was closely linked to the trend of oil. Over time, Venezuela has become increasingly dependent on oil exports. The collapse of oil prices in the 1980s had a devastating effect on the Venezuelan economy. The government, lacking sufficient tax revenue, began printing money uncontrollably, causing runaway hyperinflation.

The same thing happened after the revenue explosion in 2004, due to the spike in oil prices:

For Venezuela, oil has been, and is, a curse that prevents the development of a balanced economy and widespread well-being, with the creation of a stable middle class that does not only depend on state subsidies, but on its own productive activities. Furthermore, large fluctuations in black gold prices have caused social instability and thus caused the current situation.

How Dutch disease develops

The negative influence of Dutch disease on the economy can be explained by some characteristics attributable to natural resource-related sectors. For example, mining industries typically require heavy capital investment, but are not labor-intensive. Therefore, multinational companies and foreign countries that have capital are often interested in investing in these businesses.

Foreign investments can lead to greater demand for the country's national currency , which will begin to appreciate. The appreciation of the national currency will make the country's exports in other sectors more expensive, while imports will become cheaper.

As a result, domestic manufacturers will face lower demand for products abroad and increased competition from foreign manufacturers. Thus, the lagging sectors of the economy will face further problems. This is the curse of the illusion of strong currency, which is a positive thing only if linked to a balanced development of the economy, otherwise it is a real curse.

So the Dutch evil is caused:

- by an excess of financial and human resources dedicated to the future sector;

- from the consequent revaluation of the currency linked to the export of the dominant raw material;

- to the loss of economic competitiveness of other industrial, agricultural and service activities, which leads to desertification;

- therefore to the dependence of the national economy on a good whose value is determined by international markets, which ultimately become the masters of the nation's economy.

How to avoid Dutch Disease?

The two main strategies that can help resolve Dutch disease are listed below:

1, Deceleration of the appreciation of the national currency. Hard currency is bad, in this case,

Deceleration of currency appreciation is an easier and more viable strategy to prevent the negative effects of Dutch disease. It can sometimes be achieved by smoothing the expenditure of revenue obtained from the export of natural resources.

One of the most common ways to do this is to create a sovereign wealth fund by isolating its returns and deferring them over the long term . Many developed and developing countries, including Australia, Canada, Norway and Russia, manage large sovereign wealth funds.

Sovereign funds aim to stabilize capital inflows into the economy, to prevent it from overheating and causing significant currency appreciation. Excess revenue can be spent on education or infrastructure which will help diversify the economy.

2. Diversification of the economy

Diversification of the economy is a strategy that can almost eliminate the negative impact of the Dutch disease on the economy. Economic diversification can be achieved by subsidizing lagging sectors of the economy or establishing tariffs to support domestic producers. Sovereign funds are very useful in this function of stimulating diversification.

3. Increase in internal productivity

Investments in infrastructure and capital can increase the competitiveness of national economic activities and thus avoid the loss of competitiveness of the national economy. This is the street, for example. originated from Norway.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The “Dutch Disease” of the economy, or why finding a great natural resource is not always luck, and how to avoid it comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-malattia-olandese-delleconomia-ovvero-perche-trovare-una-grande-risorsa-naturale-non-e-sempre-una-fortuna-e-come-evitarlo/ on Sat, 30 Mar 2024 15:42:06 +0000.