Canada is thinking of replacing China in rare earths and this could be an opportunity

China's recent attempt to secure a reserve of rare earth minerals ended in failure when a competitor stepped in to snatch the deal. Vital Metals , an Australia-based mining company, announced Monday that minerals harvested from its Saskatchewan-based Nechalacho Project will remain within Canadian borders and will not end up in China.

“We have been presented with a case of great interest to Canada,” said Geordie Mark, CEO of Vital, adding: “This agreement highlights the strategic value and importance of the Nechalacho rare earths project and the priority of the chain of value of rare earths in Canada”.

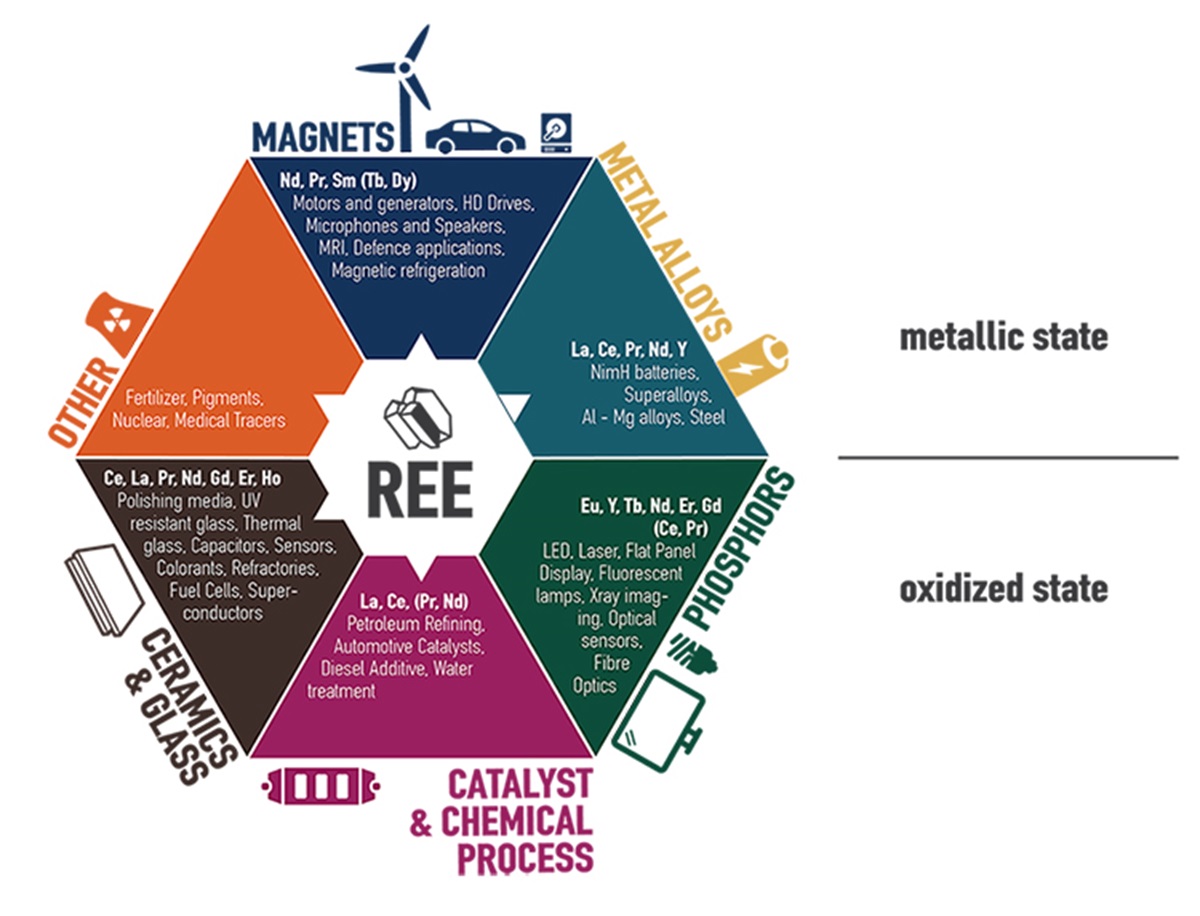

According to Vital, the Nechalacho site in northern Canada could contain more than 200 million tonnes of rare earth elements (REEs), which are used in green energy production and weapons manufacturing. Currently, China dominates the industry despite its relatively small natural supplies, capturing 75% of the global market with only 35% of global REE reserves.

“China has been able to establish such dominance over the rare earths industry only in part thanks to lax environmental regulations,” said Jaya Nayar of Harvard Independent Review. “Low-cost, high-pollution methods have allowed China to outperform competitors and create a stronghold in the international rare earth market.”

That's because rare earths can actually produce green energy, but only after generating 2,000 times their weight in catastrophically toxic waste. Many Western nations refuse to accept this trade-off within their borders, imposing heavy regulations on domestic REE producers that keep exporters like China competitive despite high asking prices.

What drives Canada to allow REE extraction and reap the profits, despite the environmental risks?

The answer lies in the Canadian List of Critical Minerals, which includes rare earths and 33 other elemental elements/groups deemed strategically and economically significant. A recent expansion of the list added high-purity iron, phosphorus and silicon, which, like rare earths and 20 other elements on the list, are key components of the green energy transition.

This update, in addition to last-minute action to protect REE (rare earth) supplies, gives an idea of the role that “green” policy will play and heralds growing pressure on component supply chains. If other countries follow Canada's lead, prices of metals linked to this critical list – including cobalt, platinum group metals, REEs, silicon and copper – could see a significant boost. It's a gamble Canada is making early, securing access to rare earths and cutting China out of the deal.

Vital's intervention was supported by Prime Minister Justin Trudeau who stated that there will be no reconciliation between China and Canada with this political and economic situation . On the mining stage, Canada is positioning itself as a direct competitor of China, flaunting its enormous mineral reserves as an alternative source for wary European countries that fear relying on Chinese producers. China's dominance will not be shaken by the lack of a single deal with the Australian firm, although the move certainly sends a message intended to exacerbate already tense relations between China and the West.

As if its challenge wasn't clear enough, Canada recently joined the United States, Japan and the Philippines to conduct military exercises in the South China Sea. Tensions between the four countries are rising and the economy is the main battleground. With rare earths as a strategic focus and green energy policies on the West's table, nations could pressure each other by sanctioning or straining metals supply chains – a move that strategists on both sides parties will definitely take into consideration.

With two of the largest holders of rare earth reserves in the world competing for supplies, the pressure on consuming countries to choose a side is increasing, and this new symptom of conflict in the metals market will lead to two contradictory pressures: from on the one hand, competition should push for a reduction in prices, but, on the other, there will no longer be economies of scale in the extraction of these materials and this would lead to an increase in prices.

But price increases may not only affect rare earths. Silver, while not considered “critical,” is a component of electric vehicles and other “green” technologies that governments (and private investors) are likely to purchase in anticipation of more limited supply, and indeed, lately, had a certain upward push:

Stress on metal supply chains is part of gold's lifeblood, which suggests rising prices for the metal as well.

Good news for investors looking to target the heartland: Rare earth prices bottomed out last year, indicating they are on the rebound and ready for a low-price purchase.

“I've seen forward-looking studies that … don't take into account demand from defense sectors, which will push [global annual land revenue well above $1 trillion by 2050,” said Melissa Sanderson, a consultant at American Rare Earths. “This is a good, strong market that appears to have healthy legs.”

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Canada considers replacing China in rare earths and this could be an opportunity comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-canada-pensa-di-sostituire-la-cina-nelle-terre-rare-e-questa-potrebbe-essere-unopportunita/ on Mon, 24 Jun 2024 07:00:27 +0000.