Here’s how the defense bigs make money

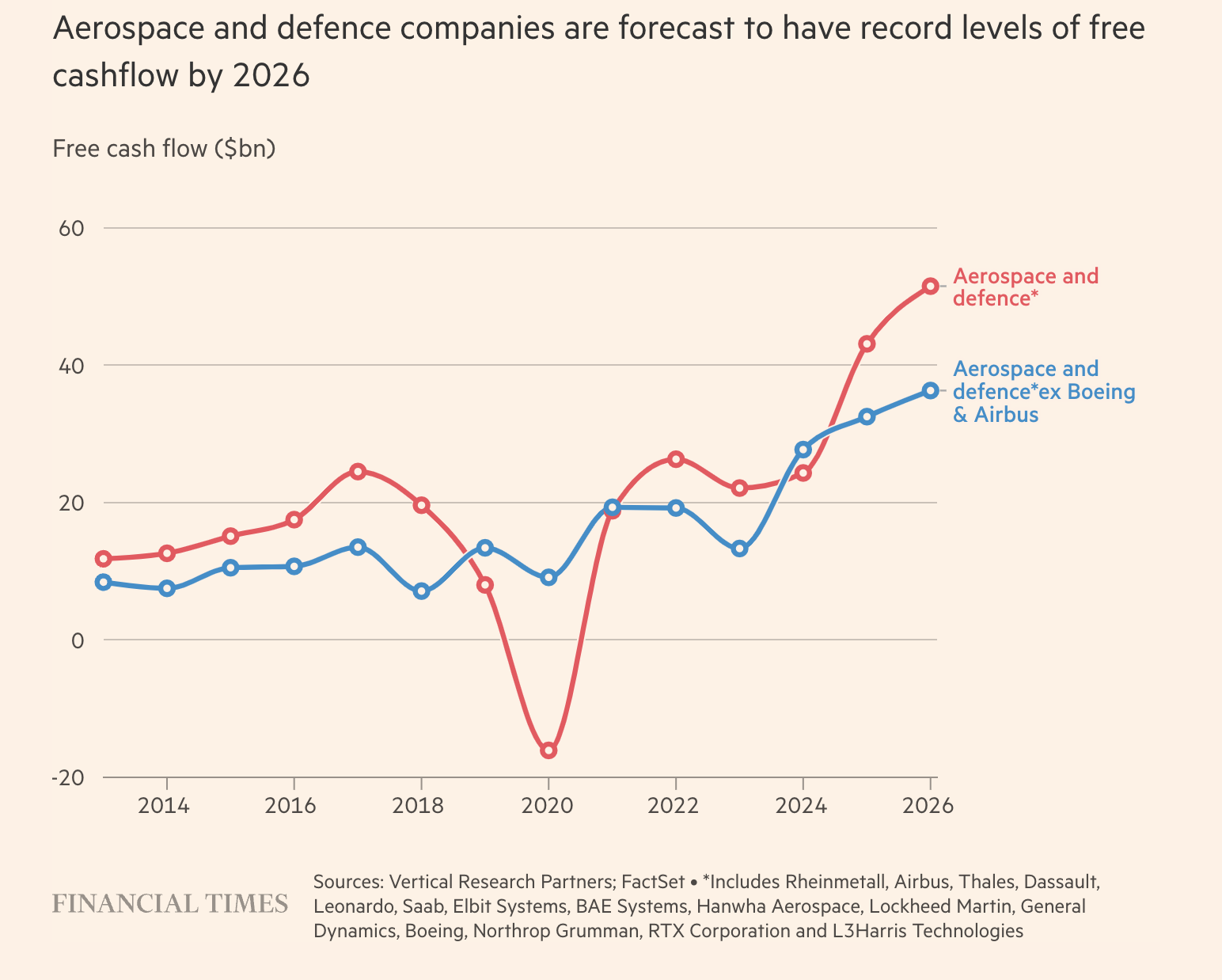

According to an analysis by the Financial Times, the world's top 15 defense contractors will generate free cash flow of $52 billion in 2026, almost double that of 2021. Enough liquidity for new acquisitions, but watch out for the competition

Swollen coffers for the defense bigs.

The world's largest aerospace and defense companies are poised to rake in record levels of cash over the next three years. This is what the Financial Times reported at the beginning of the week according to the analysis of Vertical Research Partners, an analysis company dedicated to studies of the corporate and industrial world.

Specifically, analysts expect the top 15 defense contractors to post free cash flow of $52 billion in 2026, nearly double their combined cash flow at the end of 2021.

The sector is benefiting from a sharp increase in military spending as governments increase their budgets in response to Russia's full-scale invasion of Ukraine and rising tensions in the Middle East and Asia. In response to these events, governments around the world are spending more on defense, which in turn increases industry earnings.

According to analysts, the industry may therefore increase share buybacks as large M&A opportunities are limited. Furthermore, defense spending is likely to remain strong in the coming years, but the recent increase in orders will likely moderate, especially once the war in Ukraine ends, notes the Ft .

“It's a cyclical business. As much as people talk about decade-long demand cycles, politics can change and security valuations can change and so can defense demand,” said Byron Callan of Capital Alpha Partners.

All the details.

THE INCREASE IN MILITARY SPENDING…

Russia's invasion of Ukraine has pushed NATO members to spend more on military efforts. In 2023, global defense spending increased 9% to a record $2.2 trillion and “will increase again in 2024 as the world enters a period of heightened danger” according to “The Military Balance,” the annual report on military capabilities and the defense sector on a global scale drawn up by the International Institute for Strategic Studies (IISS).

In the United States, for aid for Ukraine, Taiwan and Israel, the Pentagon has allocated almost 13 billion dollars for the production of weapons at the five largest American defense groups (Lockheed Martin, RTX, Northrop Grumman, Boeing and General Dynamics ) and their suppliers. In the UK, the Ministry of Defense has committed £7.6 billion in military aid to Ukraine over the past three years, including stockpile replenishment, the Financial Times finds.

…FILLS THE CORESSES OF DEFENSE COMPANIES

The surge in government spending has already pushed order books to near-record levels.

Analysts at Vertical Research Partners expect the top five U.S. defense contractors to generate $26 billion in cash flow by the end of 2026, more than double the 2021 amount. The figures exclude Boeing, given the its recent problems, underlines the Ft .

In Europe, national champions BAE Systems, Rheinmetall and Sweden's Saab, which have benefited from new contracts for munitions and missiles, are expected to see a combined cash flow increase of more than 40%, the British financial daily adds.

WHAT WILL THEY DO WITH THIS MONEY?

While the defense industry is accustomed to long military procurement times – it takes several years for new contracts to translate into increased sales – the growing cash flows are already sparking a debate over how the industry will spend this money.

“It's the billion-dollar question for the industry: Companies generally don't like to keep large amounts of cash on their balance sheets, so what do they do with all that money if acquisitions aren't that easy? Share buybacks and dividends are one way,” Robert Stallard, an analyst at Vertical Research, told the FT .

BUYBACK PLANS UNDER START

According to the Financial Times, companies had already channeled billions of dollars into share buybacks before the recent wave of new orders; some took on extra leverage to do so. Last year was the strongest for buybacks by aerospace and defense companies in both the United States and Europe in five years, according to Bank of America data, although levels remain far below those of other sectors.

Lockheed Martin and RTX bought back about $19 billion in stock between them last year. In Europe, Bae Systems concluded a three-year £1.5 billion buyback program this summer and immediately started a further £1.5 billion buyback, the financial newspaper summarizes.

WE ALSO LOOK AT ACQUISITIONS

At the same time, analysts say defense industry players will also target more M&A deals, while warning that large acquisitions will be limited by competition regulations.

“M&A is inevitably the next phase of the cycle,” said Nick Cunningham, an analyst at Agency Partners. “Given how long the industry cycle is, it takes a while for capacity to be created and money to flow, but the huge growth in the market will generate activity.”

And in this regard, something is already moving in the sector: the FT recalls that at the beginning of the month the German defense giant Rheinmetall announced a 950 million dollar agreement for the Michigan-based manufacturer of military vehicle components Loc Performance. After that Czechoslovak Group is submitting a bid for the ammunition business of the American Vista Outdoor. Bae Systems paid $5.6 billion for Ball Aerospace last summer. And in our country in May Fincantieri announced the acquisition of Wass (Whitehead Alenia systems subaquei) from Leonardo, the naval armaments subsidiary of the former Finmeccanica which is a leading company in the creation of torpedoes, sonars and underwater defense systems.

But the maneuvers in Italy do not end: last month Leonardo's number one declared that "we are working a lot with Thales and Airbus for new strategic visions in space". It confirms that maneuvers are taking place in Europe among the big names in the sector also in the space segment .

Consolidation of the European space industry in sight? Not so fast given that in addition to European antitrust approval, any alliance or merger talks would need the support of the French and Italian governments.

BUT CONSOLIDATION OF THE SECTOR IS NOT SO CLOSE

And the competition issue itself makes the prospect of large-scale consolidation unlikely.

“There is still room for mid-sized companies to buy more without regulators or defense ministries getting terribly angry,” Byron Callan of Capital Alpha Partners argued to the Ft , adding that some defense firms owned by private equity could also come to the market in the future.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-i-big-della-difesa-accumulano-soldi/ on Mon, 16 Sep 2024 06:21:49 +0000.