The price of oil is not growing, despite the political crisis in the Middle East

U.S. commercial crude oil inventories have been shrinking at a faster-than-usual pace this summer . However, the decline in inventories over the past four weeks has failed to trigger a rally in U.S. or Brent crude prices, amid lingering concerns about demand from the world's top crude importer, China.

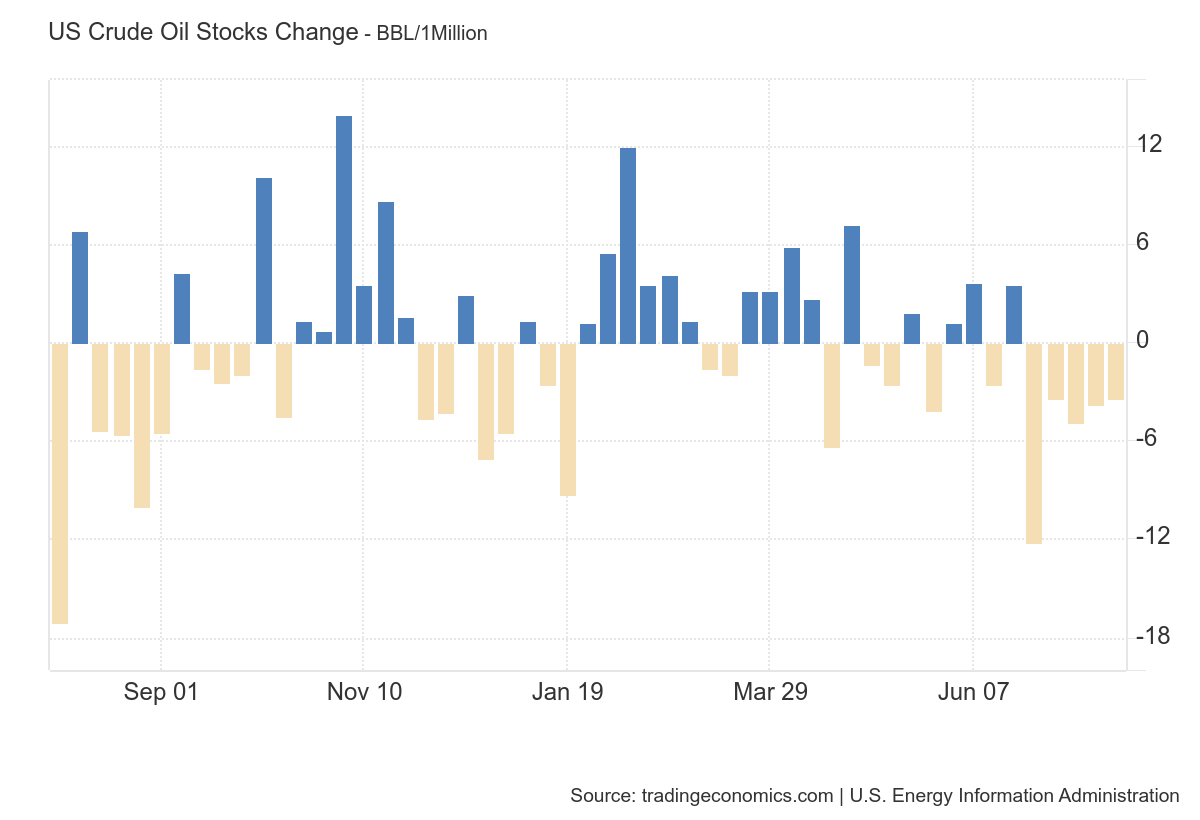

In the following graph we can see the changes in US oil inventories:

Even with rising geopolitical tensions in the Middle East, oil prices just recorded their third consecutive weekly decline, despite reductions in U.S. crude inventories reported by the Energy Information Administration (EIA) in recent weeks.

Between June 21 and July 19, commercial crude inventories in the United States fell by a total of 24 million barrels, according to EIA data compiled by Reuters market analyst John Kemp.

But money managers in the paper market have bought back most of their previous short positions in WTI crude , leaving the market little room to sustain a price rally, according to Kemp. In fact, prices have fallen, as can be seen from the following graph:

WTI crude oil prices fell below the $80 per barrel mark last week, despite yet another week of declines in U.S. crude inventories and rising implied U.S. gasoline demand.

While rising tensions in the Middle East have kept prices from collapsing, gains have been capped by concerns about weakening demand in China and signs that the physical market for crude is not as tight as many analysts had initially predicted of summer.

The risky atmosphere in the oil market also weighed on prices.

Last week, for example, the EIA reported a decline in inventories of 3.7 million barrels for the week to July 19.

Two contrasting and opposing forces

We have two contrasting forces that tend to cancel each other out. On the one hand we have international tensions in the Middle East area, linked to the conflict between Israel and Iran, combined with good domestic demand in the USA for processed products, especially due to the stoppage in early July linked to hurricanes.

On the other hand, persistent concerns about the state of the Chinese economy and oil demand in the second half of the year continue to be the main drag on oil prices. Drawdowns from US inventories could continue into September, but Chinese oil consumption could continue to disappoint and push prices lower. This could lead OPEC+ to delay the easing of production cuts, currently expected in the fourth quarter, depending on market conditions.

All this makes it difficult to make a prediction on the future trend of crude oil

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The price of oil is not growing, despite the political crisis in the Middle East comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-prezzo-del-petrolio-non-cresce-nonostante-la-crisi-politica-in-medio-oriente/ on Sat, 03 Aug 2024 14:57:27 +0000.