The Japanese stock market at a 30-year high, in spite of the Public Debt

You don't hear about it in the European media, but Japan's stock is at a 30-year high. A good result for a country which, according to standard Western analysts, should have gone bankrupt.

Let's look at the Nikkei 225 index over 25 years:

We are still not at the levels reached in the mid-1980s, when it looked like Tokyo was on its way to becoming the capital of the world, but still, other indices like the NASDAQ are down after their 2020-21 highs. Also the general stock index Topix shows a similar trend and Nikkei 225.

Several investment banks, from SocGen to Goldman Sachs, have long positions on the Japanese stock exchange. In a May 12 report, Goldman Sachs said the investment bank sees a "number of reasons" to support its bullish stance on Japanese equities.

“In particular, we note the strength of fundamentals relative to overseas market stocks and believe expectations of structural changes/reforms could push Japanese equities further higher,” wrote equity strategist for Japan Kazunori Tatebe.

Noting the possibility of structural reforms in the future, he added: “We believe the main risks to our bullish view on Japanese equities come from external factors such as the US debt ceiling issue, recession risk and geopolitical risk.” .

"Reforms" are expected, yet Japan, from the point of view of monetary policy, is perhaps the most stable and conservative country in the world on expansionary policies. Mind you, they have improved the real economy, but Kuroda's successor has continued its expansionary monetary policy, just as Abe's successor, Kishida, continues its fiscal policy.

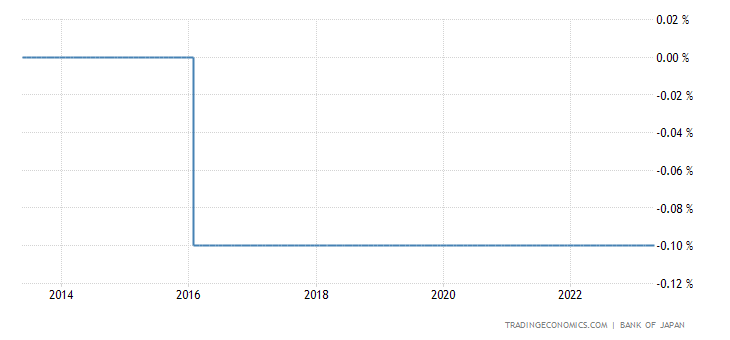

Japan, for example, continues its policy of controlling interest rates and expansive monetary policy. The new governor Kazuo Ueda has not detached from what Kuroda did previously and has not touched interest rates

all this takes place with inflation under control and with a yen that has stabilised, indeed strengthened, against the dollar and the euro. Yet the BoJ has not followed either the FED or the ECB. He has not made a fetish of inflation, thus managing to control it, even with the help of economic policy

Obviously the country has its problems: a negative demography, like that of all Western countries, with a rapidly aging population, but manages to manage, independently, economic problems very well, and, above all, with an empiricism that 'Europe ideologicalized by the green left has completely forgotten.

Obviously the country has its problems: a negative demography, like that of all Western countries, with a rapidly aging population, but manages to manage, independently, economic problems very well, and, above all, with an empiricism that 'Europe ideologicalized by the green left has completely forgotten.

Japan is an example that we in Europe fail to understand. In this we are really far.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The Japanese Stock Exchange at its 30-year high, in spite of the Public Debt comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-borsa-giapponese-ai-massimi-da-30-anni-alla-faccia-del-debito-pubblico/ on Thu, 18 May 2023 08:00:28 +0000.