Because there will be more and more of the stench of recession

Rates resume the trend, more clouds and temporary flashes of sunshine for equity. The comment by Antonio Cesarano, Intermonte's chief global strategist

Time passes, words flow and add. Thus, from the monopoly of the word “ inflation ” we are gradually passing to the “duopoly” of “stagflation”, with the non-marginal addition of the meaning to be given to the word “stag”, that is, marked slowdown or recession.

The bond market, since the beginning of April, has been working on the US recessive scenario around mid-2023, paradoxically signaled by the reversals of the curve on April Fool's Day. The same bond market has for some time been suffering from a scenario of strong acceleration of the Fed hikes for this year and of an opposite trend in 2023, which is exactly what is beginning to emerge also from the ultra hawk Bullard, who asks to hasten the hikes to bring Fed Funds also target up to 3.5% this year, to prepare to do the opposite in 2023.

The bond world therefore senses the Fed's haste and has already discounted it, probably sensing that part of the haste is dictated by the November electoral deadline in the US, which sounds like a last resort for Democrats to prevent the perceived threat of Trump's return to the United States. presidential elections of 2024.

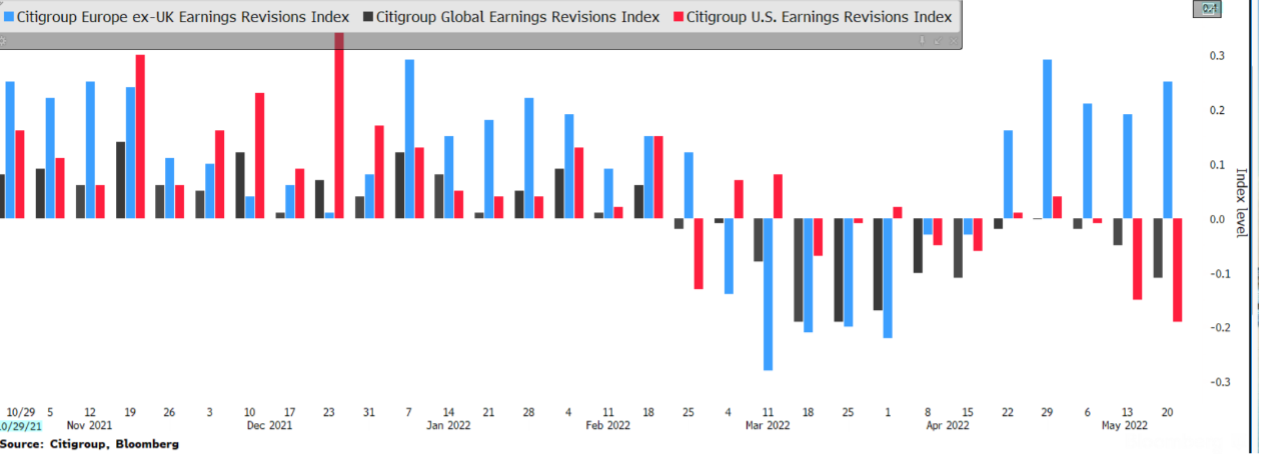

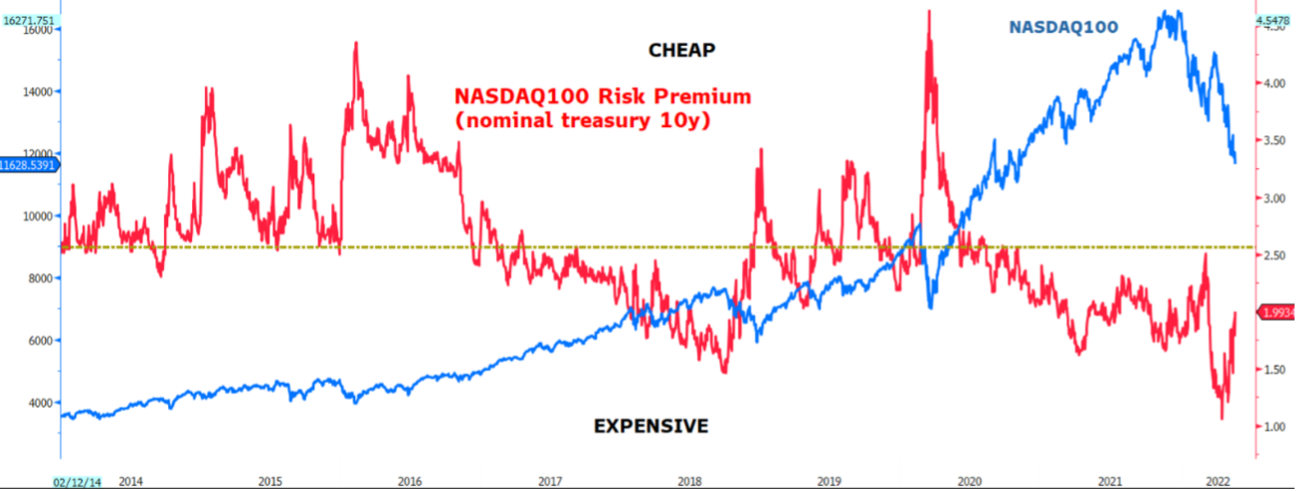

Equity markets, for their part, are still in a phase of potential further declines, as the pejorative US earnings review phase (shown in red in the graph) has just begun, as has just begun the reversal of US earnings. interest rates after the temporary rise in real rates at the beginning of 2022. In summary, both ingredients (pejorative revision of profits and reduction of rates) needed to bring the risk premium back to higher levels (i.e. closer to the levels of the average of long term), are in the early stages.

IN PERSPECTIVE

The more the year passes and the rolling 12-month scenario includes months of 2023, the more the perception of recession risk increases in 2023 and therefore of central banks forced to take the "shrimp path", the more paradoxically they push on the accelerator of rates and more generally the restrictive measures (including above all the QT which for the Fed starts on 1 June) in 2022.

This could lead in an increasingly evident way to the inversion of the trend of rates, which would therefore return to the primary downward trend over a decade, first the nominal rates and only subsequently also the real rates.

For equity markets, the adjustment of the risk premium to higher levels requires not only lower rates, but also a further cut to the estimated earnings, which proposes as a target for the S & P500 index still potential drops in the order of around one. 10%.

During this process, frequent and large temporary recoveries are possible, if anything more frequent the closer the index approaches the final objective.

In order to grasp them, it might be helpful to rely on the ultra extremes that can be deduced from the joint verification of very extreme financial conditions indicators ( Bloomberg , CNN Fear & Greed etc.) and a further very extreme control variable (for example Vix in area 35 or still VVIX / VIX ratio on historically extreme levels).

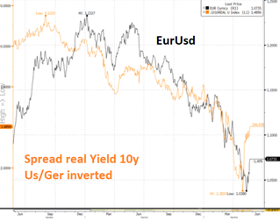

On the EUR / USD front, the US / Germany spread reduction phase is beginning as a result of the fear of recession in the US fueled by disappointing macro and micro data, after having worked hard on the penalties on the euro area caused by the war. This context could become prevalent and more evident in the coming months with an exchange rate that could reach the 1.10 / 1.12 area by July, with a possibly more ambitious target in the 1.15 area by the end of the year for which, however, it is preferable to wait developments on the war front.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-ci-sara-sempre-piu-puzza-di-recessione/ on Fri, 27 May 2022 06:28:49 +0000.