What are the US and the EU doing against the economic crisis? Report Ref

In the United States, fiscal policy has been more expansive: the “fiscal impulses” show a stimulus to the economy of 5-6% of GDP in the United States and around 3 points in the euro area. The analysis of the economist Fedele De Novellis, head of Congiuntura Ref

The possibility of a reduction in the spread of the epidemic opens up the prospect of a gradual removal of restrictions on behavior, with positive effects on the performance of American economic activity. In fact, all the current forecast scenarios discount a phase of recovery at a relatively brisk pace once the restrictions are relaxed.

It is likely that in the US the second quarter will already be characterized by a strong acceleration of GDP, while in the euro area the reversal is postponed to the third quarter provided that the expected acceleration in the vaccination campaign occurs. This means that the eurozone economic cycle could remain out of phase with the American one. In this regard, the most recent economic indicators confirm the recovery of manufacturing in the US as well as in the eurozone.

This is a trend that is characterizing the entire world economy as a result of the progressive removal of restrictions on the purchase of goods after the first lockdown , which is followed by a phase of replenishment of the warehouses, heavily downsized in that period.

In some cases the trend is accentuated by the reorientation of global demand from services to goods, as in the case of consumer electronics or furniture.

On the other hand, it is with the data for the spring months that the economic scenario should differentiate following a more pronounced recovery in the United States. In fact, as the distancing measures are reduced, growth will be more lively, especially in the service sectors.

Among the factors that lead us to believe that a further gap will be observed in US growth compared to the euro area, there is also the different approach to budget policies.

In 2020, the crisis affected the public budgets of all countries through the direct impact on balances mainly due to the fall in revenues, and following the measures adopted by governments to support the economy.

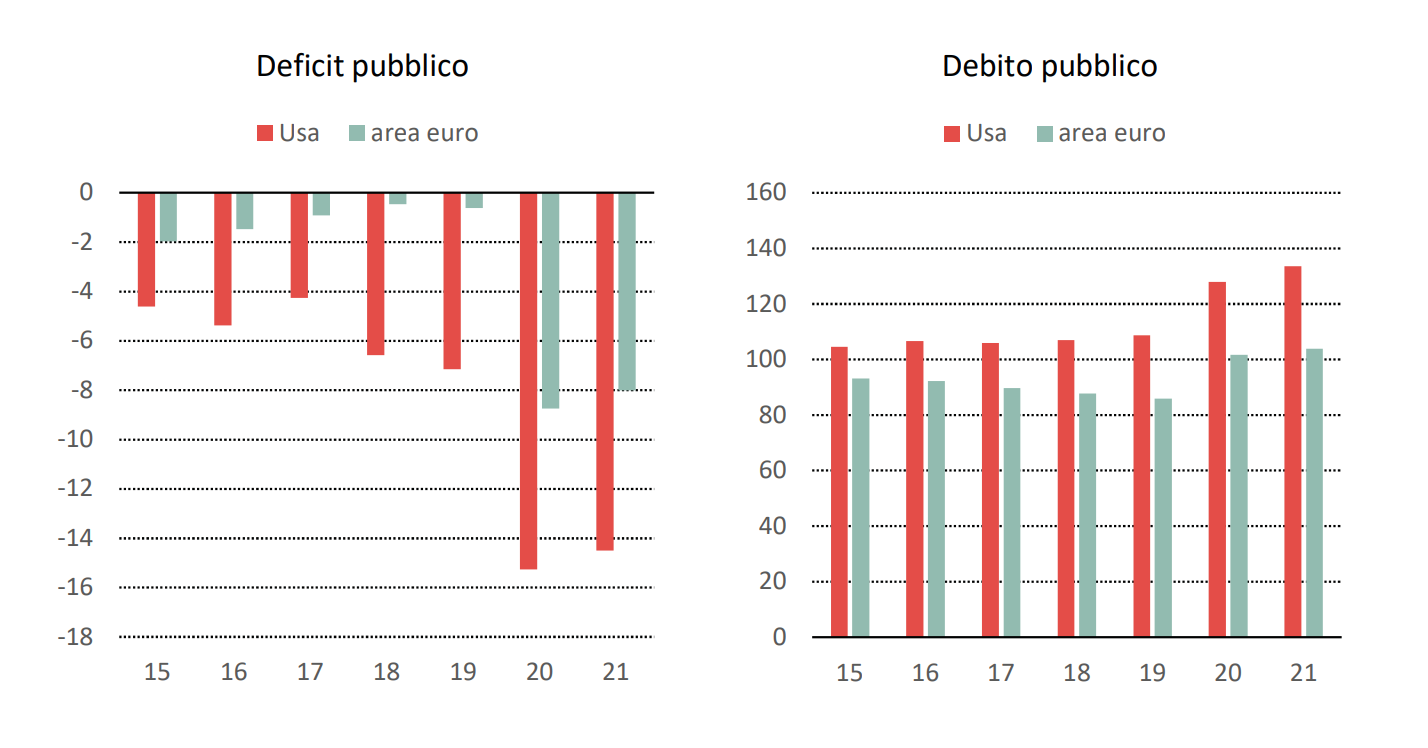

However, the ex-post quantification of the fiscal measures adopted in the various countries shows that in the United States fiscal policy has been more expansionary: the "fiscal impulses", calculated on the basis of changes in the structural primary balance, show a stimulus to the economy of 5 -6 per cent of GDP in the US and around 3 points in the euro area.

Before the crisis came, the United States already had a much higher deficit than the euro area (in 2019 the American public deficit was 6.7 per cent of GDP, compared to an almost balanced balance in the euro area).

The 2020 increase has therefore brought the US deficit to 15 percent of GDP, compared to close to 8.5 percent in the eurozone.

Many of the measures adopted by governments last year are of a transitory nature; that is, they tend to have a temporally limited duration. For this reason, it is likely that in the course of 2021 governments will have to take measures to refinance this type of intervention (as happened for example in Italy with the Sostegni Decree ). In fact, the prevailing approach in the euro area is to “follow the economic cycle”, or to refinance this kind of measures until the pandemic is overcome. Therefore, with vaccination campaigns at an advanced stage, public budgets should improve a lot, benefiting both from the effects of the recovery and from the failure to renew support measures.

It is understandable that in a framework of this kind, the public finance balances of 2022 will be the better the stronger the recovery we will observe in the coming quarters. However, in recent months, a different approach between the US and the euro area has also emerged on the point of fiscal policies. In the US, budgetary policy intended to provide an expansive impulse this year despite significant progress on the side of vaccination campaigns, which have improved economic prospects.

In particular, if already at the end of 2020 in the USA a set of measures for a total amount of 900 billion dollars (Response & Relief Act), equal to over 4 per cent of GDP, had been launched by the previous administration, the stimulus adopted by Biden (American Rescue Plan), is equal to 1900 billion or 9 per cent of US GDP, of which over 6 to apply to 2021.

The result is that the US deficit will again be around 15 percent of GDP this year. In the euro area, as we have seen, it is likely that new tax packages will be launched in the coming months by various countries, but in any case we will hardly exceed the levels of 2020.

For this reason, the distance between the US and the euro area in the levels of the public deficit will remain significant. Starting from these levels of public deficits, it would also result that the ratio between public debt and GDP for the euro area as a whole would continue to increase this year, reaching 104 per cent of GDP, while that of the United States would come close to 135 percent of GDP.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-fanno-usa-e-ue-contro-la-crisi-economica-report-ref/ on Mon, 05 Apr 2021 05:30:55 +0000.