Eni, Leonardo and beyond. How the accounts and profits of state subsidiaries are doing

The profit and turnover of companies participated by the Ministry of Economy grows in the first quarter of 2024. Numbers, comparisons and analyzes by the Comar study center

Successful accounts for Treasury subsidiaries in the first quarter of the year.

Here is what emerges from the analysis of the Comar study center.

GOOD START IN 2024 FOR ENI, LEONARDO AND MORE

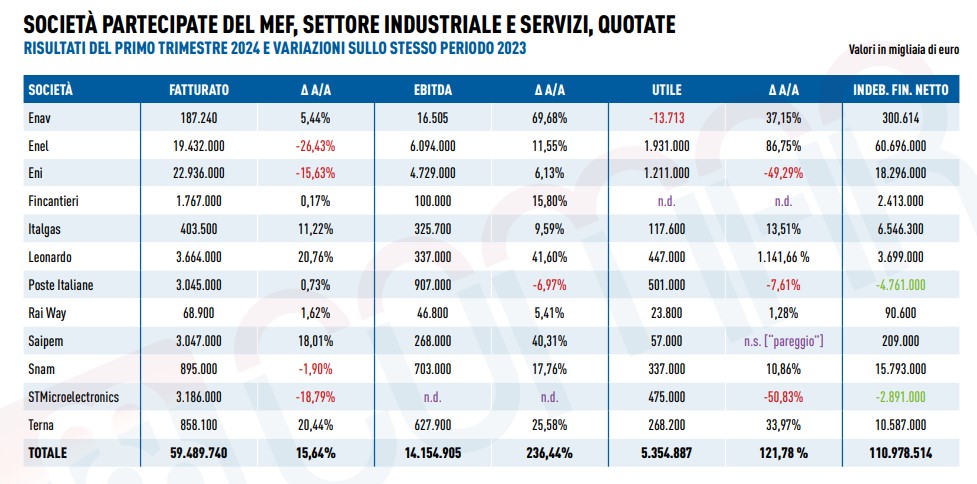

2024 is starting well for the main companies owned by the Ministry of Economy: turnover at 59.4 billion euros (+16.6%) and profits above 5.3 billion euros (+121.7%). These are the results achieved at the end of the first quarter of the year, compared with the same period of 2023, aggregated and reworked by the Comar research center on the basis of the companies' financial communications.

TREASURE'S INVESTED COMPANIES UNDER THE SPOTLIGHT

The CoMar investigation concerned listed companies in the industry and services sector: Enav, Enel, Eni, Fincantieri, Italgas, Leonardo, Poste Italiane, Rai Way, Saipem, Snam, STMicroelectronics , Terna.

THE NUMBERS FOR THE FIRST QUARTER OF 2024

Ebitda was also very positive, growing year on year by 236.4%, reaching over 14.1 billion euros. Net financial debt, again as of March 31, stood at 110.9 billion euros.

PARAMETERS AND FACTORS

Without forgetting the diversity of the markets in which the individual subsidiaries operate, for each of the parameters, over the twelve months, the following is highlighted:

- Turnover: increases mainly for Leonardo (+20.7%), Terna (+20.4%), Saipem (+18%); decreasing for Enel, STMicroelectronics, Eni;

- Ebitda: higher growth for Enav (+69.6%), Leonardo (+41.6%), Saipem (+40.3%);

- Profit: Leonardo (+1,141.6%), Enel (+86.7%), Enav (+37.1%) stand out; decreasing for STMicroelectronics and Eni.

CoMar analysts point out that these results are due to a variety of factors that influenced the specific markets:

- for energy , by the significant drop in prices and quantities sold, offset by the positive development of the energy transition areas, by the significant investments to improve the efficiency of the networks, by the entry into operation of new assets, by the reduction of net financial debt;

- for the mechanical and technological industry , by the level of order portfolio acquired, such as to further strengthen the commercial objectives envisaged in the strategic plans; from digitalization processes that encourage new revenues; but also from capital gains generated by extraordinary consolidation operations; negative effects from the decline in demand for automotive semiconductors;

- for services, performances above the average market trend; from the expansion of the customer base, also on foreign markets; by reducing costs such as to reduce the inflationary impact; from investments capable of broadening the offer.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/partecipate-statali-risultati-primo-trimestre-2024/ on Tue, 04 Jun 2024 11:21:00 +0000.