What happens to Amazon, Google and Microsoft. Mediobanca report

Revenues for post-pandemic web giants are holding back. Here are the numbers, comparisons and analyzes that emerge from the report edited by Mediobanca on Websoft (Software & Web Companies) in the three-year period 2019-2021 and in the first 9 months of 2022

After the pandemic boom, growth slows down for web giants in the first nine months of the year.

In fact, between January and September, the world's leading websoft operators grew only in terms of aggregate turnover but recorded a drop in profits (-42%).

This is what is reported by the Mediobanca Research Area's annual survey of the 25 major international WebSofts (Software & Web Companies with revenues exceeding €12 billion each) in the three-year period 2019-2021 and in the first nine months of 2022.

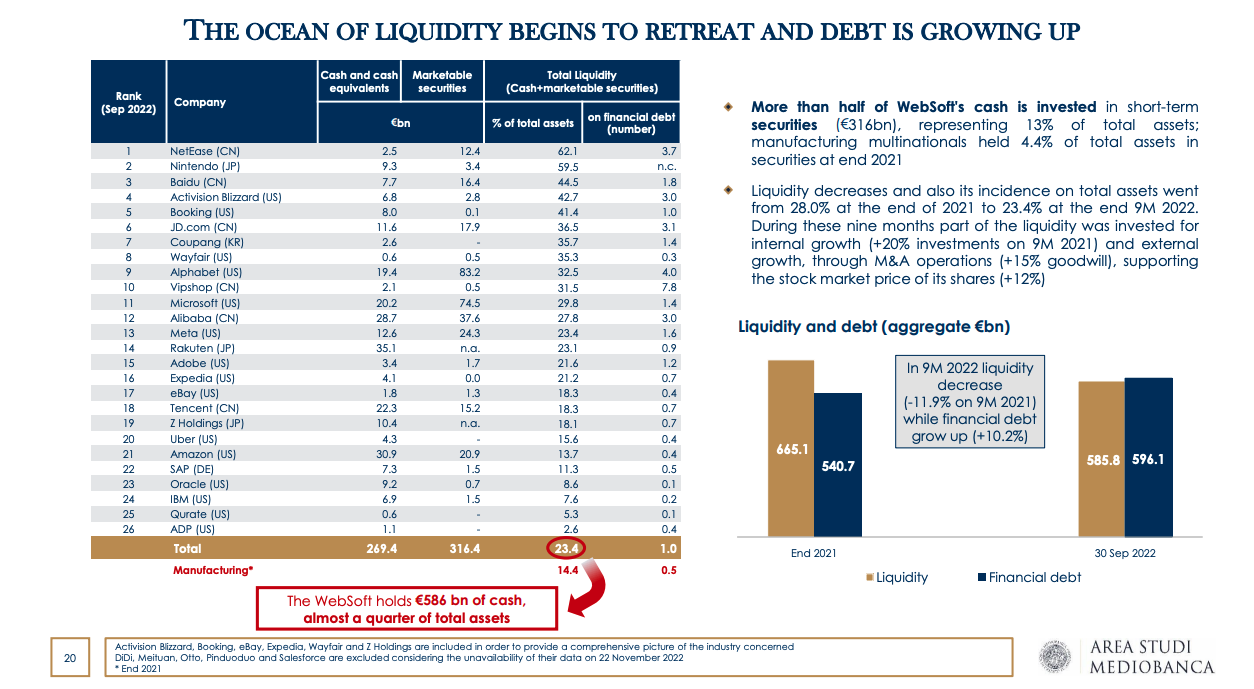

Furthermore, according to the Mediobanca Research Area, liquidity and stock market value are also decreasing.

All the details.

BRAKING OF WEB GIANTS IN THE FIRST NINE MONTHS OF 2022

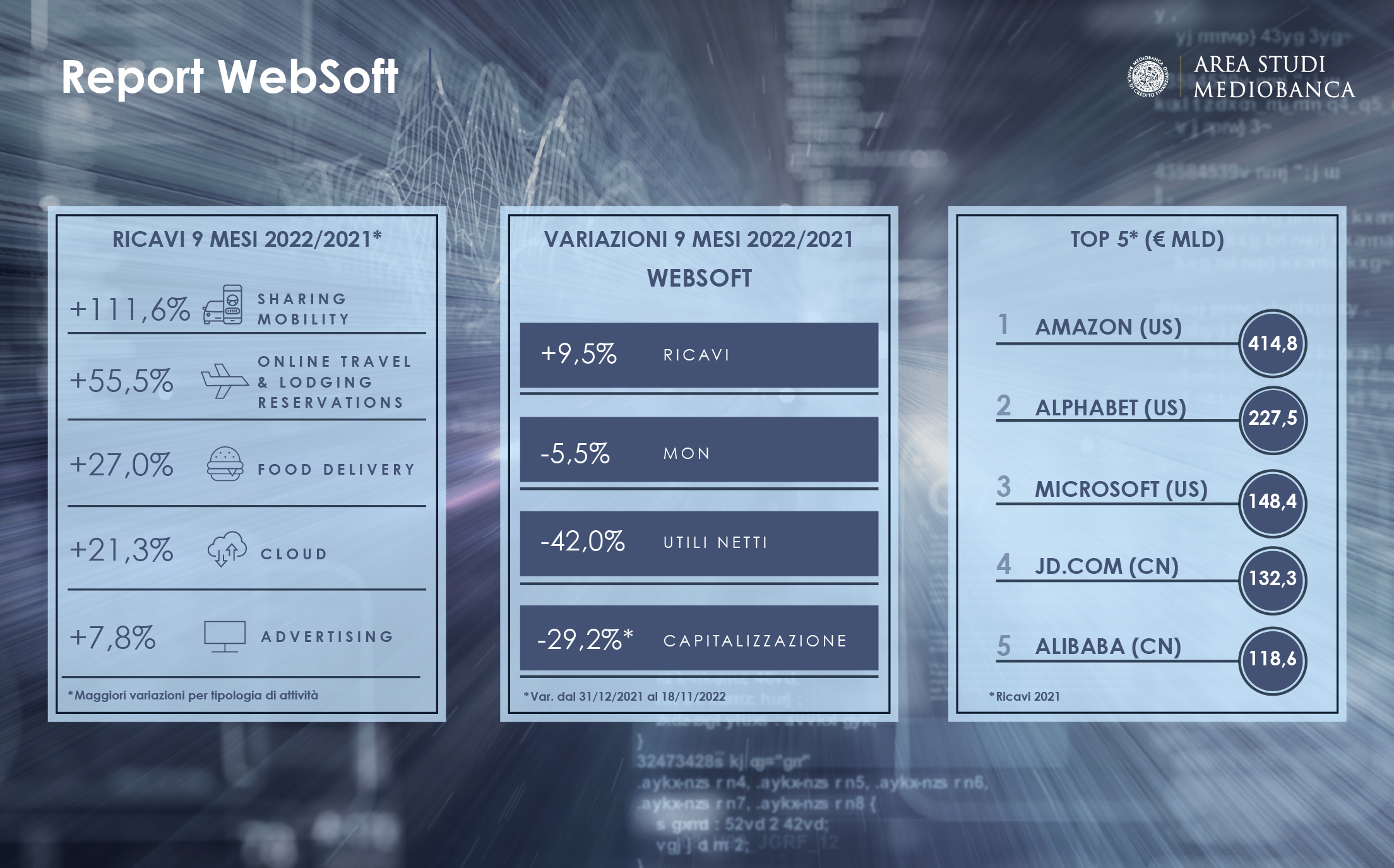

In the first nine months of 2022, the world's leading WebSoft operators grow only in terms of aggregate turnover (+9.5% on the first nine months of 2021), with geographical asymmetries: North America (+13.7%) holds more of Europe and Asia whose growth is limited to single digits (+8.2% and +6.6% respectively), with Latin America accelerating sharply (+24.9%), albeit with still low values ( 1.5% of total turnover). The return to normality is reflected in the rebound of the sectors most penalized by the pandemic: sharing mobility (+111.6% of revenues y/y) and online travel sales (+55.5%). The increase in turnover, on the other hand, appears more limited for those sectors that had benefited from the changes in consumer habits: food delivery (+27.0%), cloud (+21.3%) and e-commerce (+3 .8%). The sectors with the greatest impact on turnover are e-commerce (37%), advertising (25%) and the cloud (19%).

IT DECREASES THE OPERATING PROFITABILITY

In the same period, operating profitability decreased (-5.5% MON over the first nine months of 2021).

PROFITS COLLAPSE

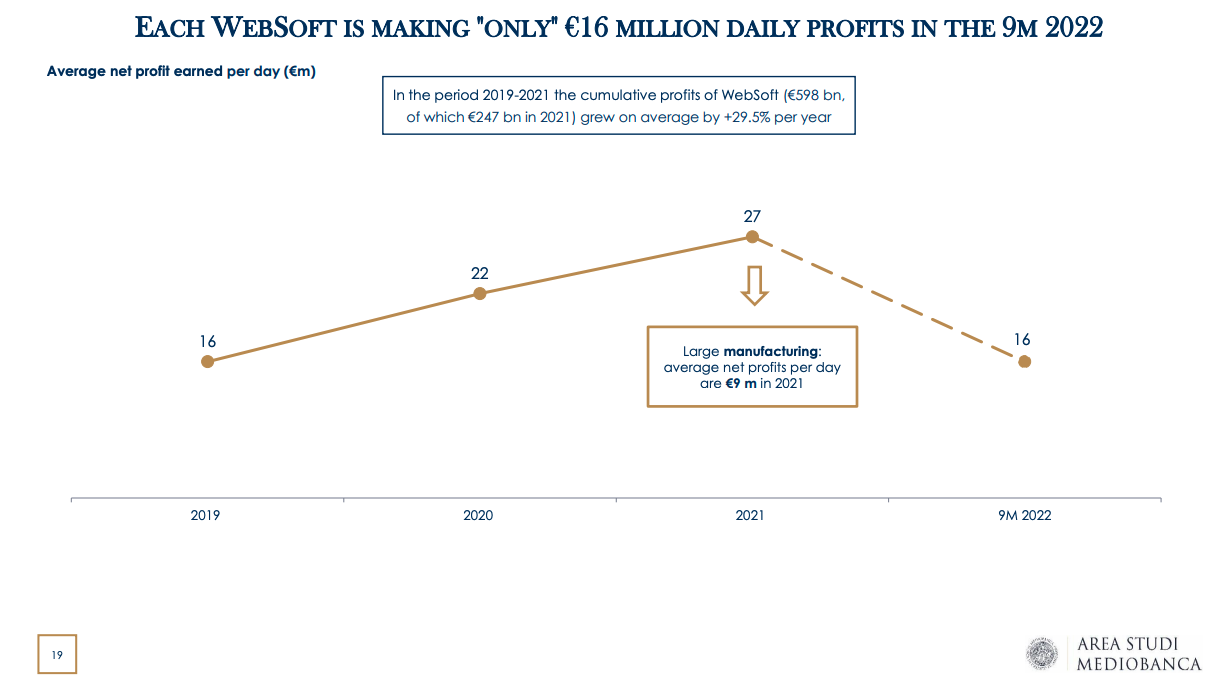

At the same time, net profits decreased (-42.0%), with each company producing an average daily net profit of 16 million euros compared to 27 million in 2021.

FLEXION ALSO FOR LIQUIDITY

Liquidity was also down (-11.9%) which in any case still remained strong, with an incidence on total assets of 23.4% at the end of September 2022 (from 28.0% at the end of December 2021, higher than the 14.4 % of large manufacturing). This downsizing reflects the higher investments for internal growth (+20% over the first nine months of 2021) and external growth, through M&A transactions (goodwill +15%), but also the action to support stock market prices (purchase of treasury shares + 12%).

DOUBLE-DIGIT REVENUE GROWTH FOR UBER, BOOKING AND EXPEDIA

At individual group level, in the first nine months of 2022 there was a surge in revenues from the US Uber (+99.3%), Booking (+63.5%) and Expedia (+43.2%), followed at a distance by the Korean Coupang (+14.4%) and by the Japanese Rakuten (+13.7%). Negative and double-digit sign for Activision Blizzard (-21.8%), Qurate (-14.1%), Vipshop (-13.9%) and Wayfair (-12.8%). As regards industrial profitability, in the first nine months of 2022, Microsoft leads the ranking for ebit margin (41.2%), ahead of Adobe (35.1%), Oracle (33.4%) and Nintendo (33.4%). 0%).

THE TURNOVER OF WEB GIANTS IN 2021 EQUAL TO 90% OF ITALIAN GDP FOR MEDIOBANCA

In 2021, the aggregate turnover of the 25 largest WebSofts in the world reached €1,584bn, equal to 90% of Italy's GDP. In a long-established framework of forces, the United States and China have shared almost all of the revenues: 67% of WebSoft's revenues were generated by the US giants, 28% by the Chinese ones and only 5% by groups of other villages.

Furthermore, the pandemic has further highlighted the growth speed gap between WebSoft and multinational manufacturing companies: while the former accelerated revenues (+50% for 2019-2021), the latter only recorded +7.6%. Turnover is increasingly concentrated: the top three players, Amazon, Alphabet and Microsoft, account for half of aggregate revenues, with Amazon (€414.8bn, of which 50.9% generated by retail), in first place position since 2014, which alone concentrates over a quarter.

THE WEB SECTOR HAS THE LEADING PROFITABILITY COMPARED TO ANY OTHER INDUSTRIAL SECTOR

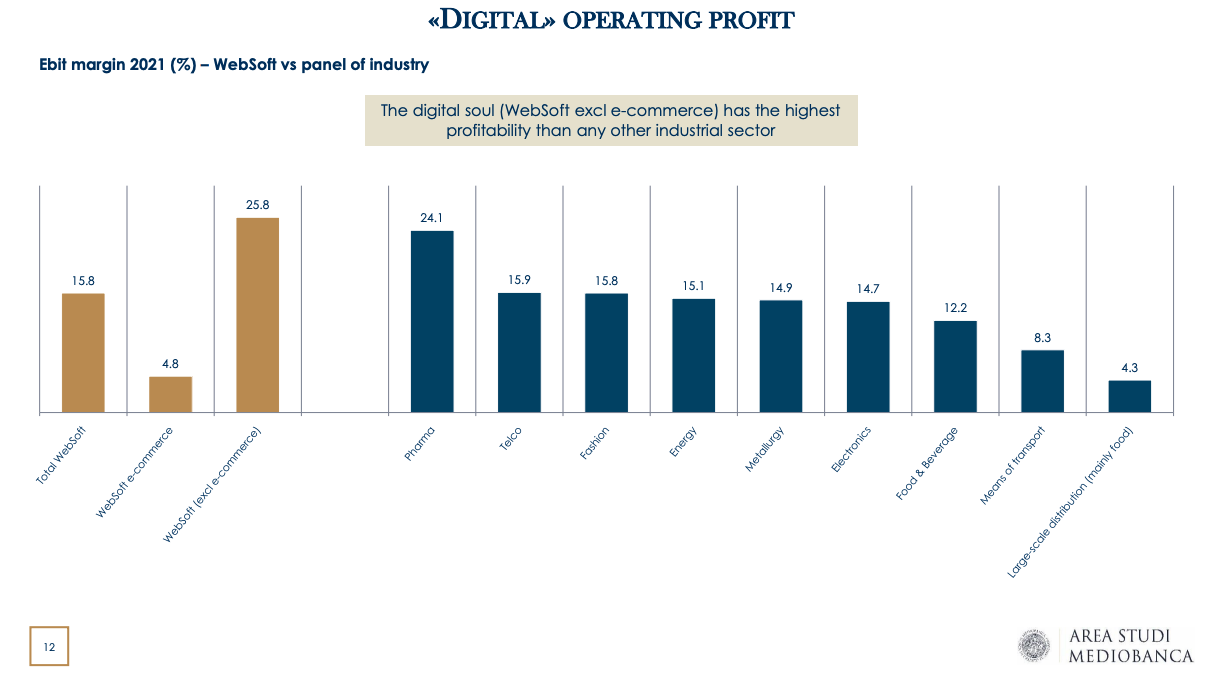

WebSoft multinationals continue to shine for industrial profitability. With an EBIT margin of 15.8% in 2021, they are in third place in the sector comparison after pharmaceuticals (24.1%) and telcos (15.9%). However, if we focus exclusively on the digital core and exclude e-commerce, their ebit margin soars to 25.8%, outperforming all other industrial sectors.

THE WORKFORCE IS INCREASING

At the end of 2021, the WebSoft workforce numbered almost four million people worldwide, an increase of over one million units on 2019, of which +810,000 from Amazon alone, the undisputed queen in terms of number of employees: 1,608,000 at the end of 2021 .

STOCK STOCK COLLAPSE IN 2022 OF WEB GIANTS PHOTOGRAPHED BY MEDIOBANCA

After years characterized by a particular feeling with stock exchange lists, with the capitalization peak reached in December 2021 (8,628 billion euros), 2022 records the first significant decline with a drop of -29.2% as at 18 November 2022. At the end of 2021, the capitalization of the 25 largest WebSofts was worth 8.3% of the total value of the world stock exchanges, while it currently stands at 6.6%. In comparison with Italy, however, WebSofts are confirmed as heavyweights: they are worth ten times the entire Italian Stock Exchange.

As at 18 November 2022, the podium on the Stock Exchange is occupied by Microsoft (€1.735bn), Alphabet (€1.219bn) and Amazon (€927bn); wooden medal for the Chinese Tencent (€340bn).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-succede-a-amazon-google-e-microsoft-report-mediobanca/ on Mon, 02 Jan 2023 06:31:00 +0000.