How are the accounts of Tim, Vodafone, WindTre, Fastweb and Iliad. Mediobanca report

Here are numbers, trends, comparisons and analyzes on Tim, Vodafone, WindTre, Fastweb and more from Mediobanca's annual report on the telecommunications sector.

The Italian telecommunications market is among the most fragmented and competitive in the Old Continent.

It is the photograph taken from the annual survey of the major global and Italian groups in the telco sector drawn up by the Mediobanca Research Area.

In particular, in the first half of 2023 the domestic revenues of the main Italian operators were stationary (-0.1%), with the mobile sector continuing its declining trend (-3.9%), while fixed telephony recorded a positive trend (+3%). The contraction in turnover remains concentrated in the mobile divisions of the top three operators: TIM (-6.4%), Wind Tre (-6.1%) and Vodafone (-5.7%), with a cumulative decrease of 286 million EUR.

The growth of Iliad Italia continues (+12.2% on the first half of 2022), with the subsidiary of the transalpine operator having expanded its offer to fixed telephony since January 2022. PosteMobile (+4.5%) and Fastweb (+4.3%) also increased.

All the details.

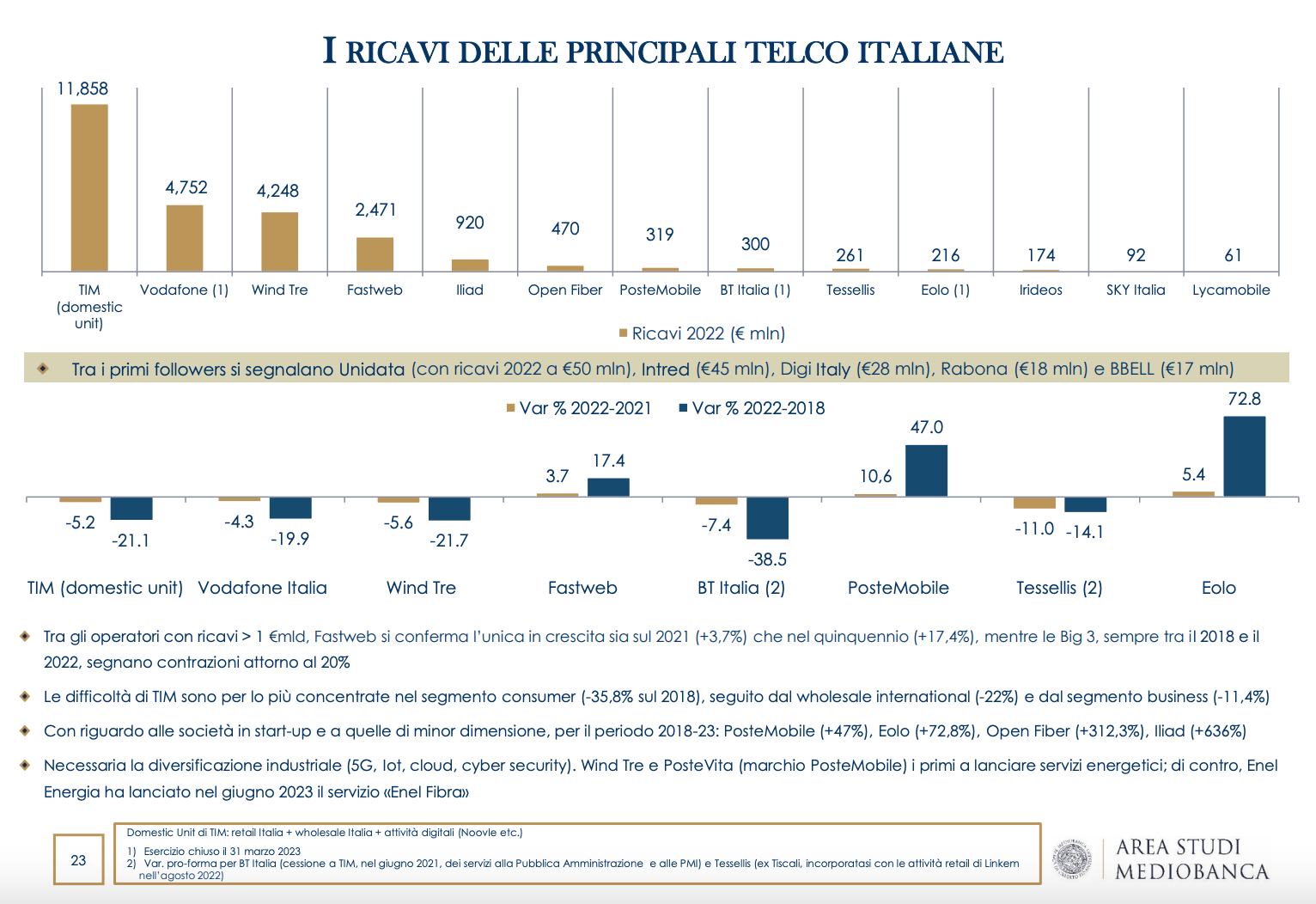

FROM THE MEDIOBANCA ANALYSIS, TIM IS THE FIRST IN REVENUES BUT FASTWEB IS THE ONLY ONE TO GROW

Moving on to the analysis of revenues, in 2022 Tim (Italian activities) is first in terms of turnover (11.9 billion euros; -5.2% on 2021) ahead of Vodafone (4.8 billion euros; -4.3% ), Wind Tre (4.2 billion euros; -5.6%) and Fastweb (2.5 billion euros; +3.7%), with Iliad in fifth position (0.9 billion; +15.9 %).

Excluding start-ups (Iliad and Open Fiber) and smaller companies, in the five-year period 2018-2022 Fastweb is the only one to grow (+17.4%), while the Big 3 show contractions of around 20%, with the greatest difficulties are concentrated in the consumer segment, underlines Mediobanca.

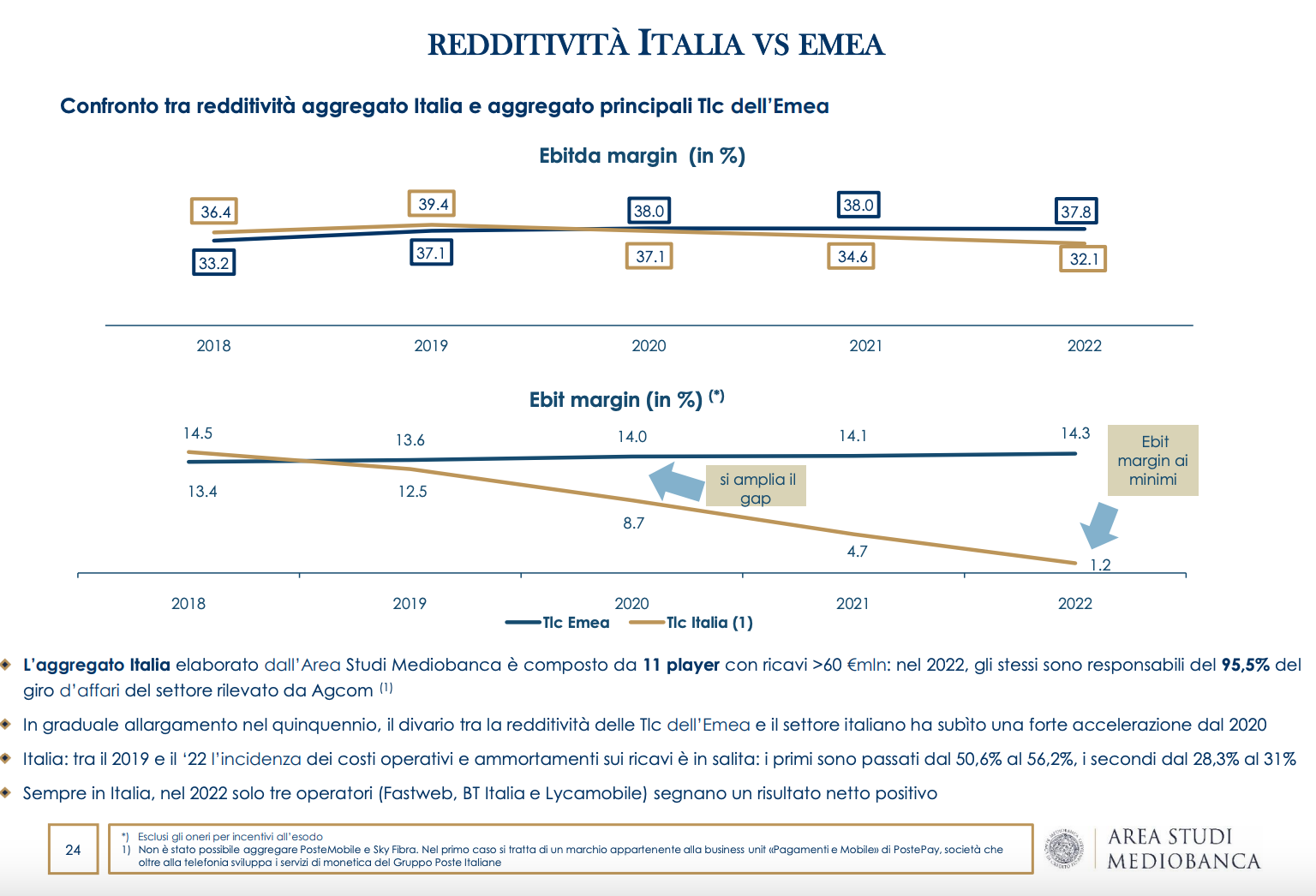

ITALIAN OPERATORS RECORD LOWER PROFITABILITY THAN EUROPEAN PLAYERS

From the comparison between the aggregate accounts of the 11 main Italian operators (players with a minimum turnover threshold of €60 million and representing 95.5% of the overall market detected by Agcom) and the big players based in EMEA, a lower profitability emerges of the former, with a gradual widening of the gap in the five-year period 2018-2022. For the main Italian groups, the decline in turnover and the rise in costs have led to an ebit margin of 1.2% in 2022 (from 14.5% in 2018), compared to the 14.3% marked by the big ones of EMEA (13.4% in 2018).

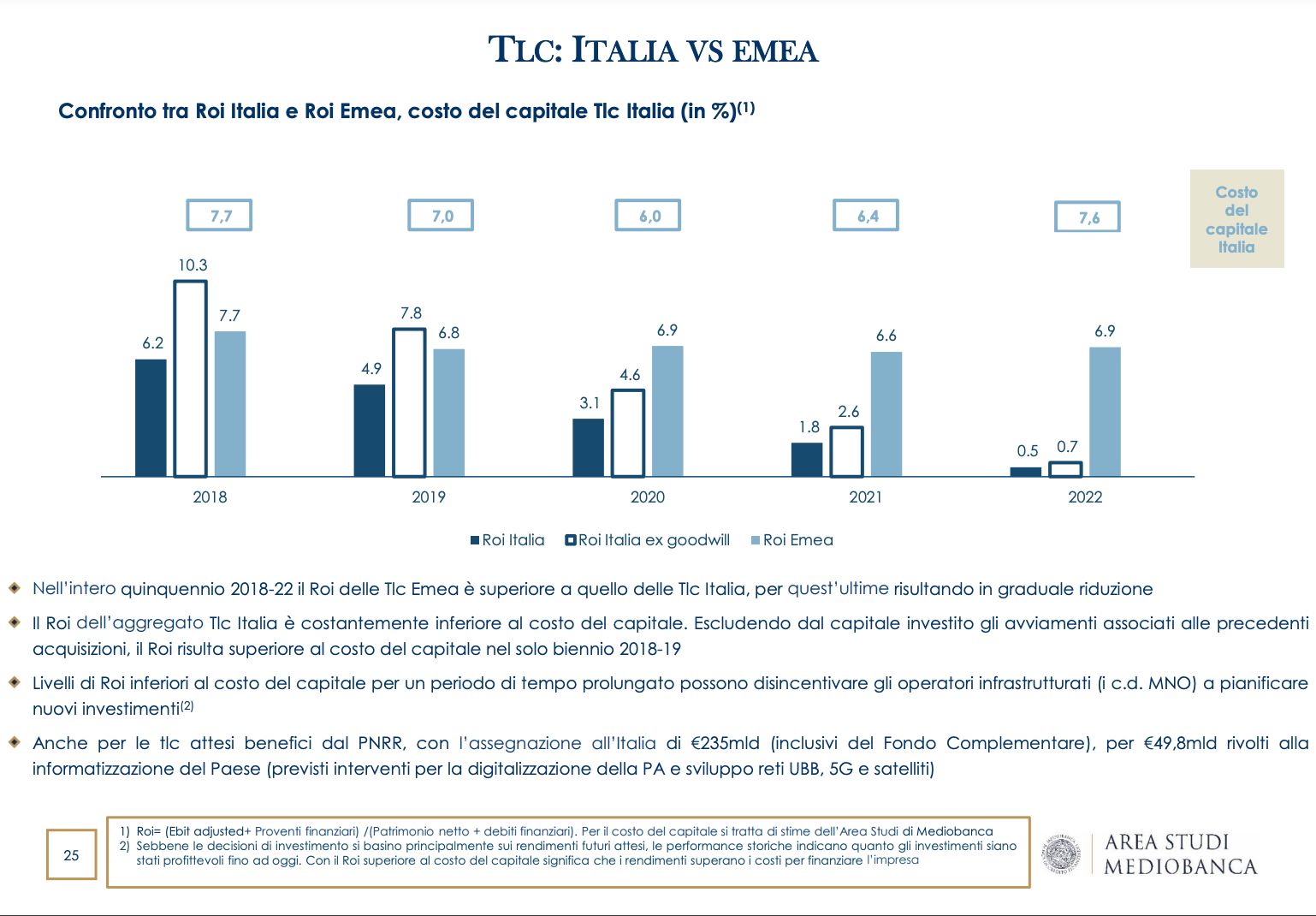

ALSO THE ROI OF THE ITALY TLC AGGREGATE IS LESS THAN THE COST OF CAPITAL

The return on invested capital also describes a similar path, with the aggregate ROI of Italian telcos decreasing from 6.2% in 2018 to 0.5% in 2022 (compared to 6.9% for EMEA in 2022), consistently appearing lower, in the last five years, than the cost of capital, estimated at 7.6% in 2022.

Considering that ROI levels lower than the cost of capital for a prolonged period of time can discourage infrastructure operators (the so-called MNOs) from planning new investments, it appears more necessary than ever to exploit the significant benefits offered by the full operation of the EU Recovery Fund which has allocated 49.8 billion euros to the Italian telecommunications sector aimed at the computerization of the country, the digitalisation of the Public Administration and the development of ultra broadband, 5G and satellite networks, highlights the Mediobanca report.

EMPLOYMENT FOCUS IN THE MEDIOBANCA REPORT: MOVEMENT OF TIM EMPLOYEES TO NETCO BY SUMMER 2024

With regard to employment in the telecommunications sector in Italy, Mediobanca recalls that, upon completion of the operation to spin off Tim's fixed network by summer 2024, 21.4 thousand employees will be transferred to NetCo.

Furthermore, Mediobanca recalls that last April Vodafone Italia started a collective dismissal procedure aimed at reducing the workforce by 1,003 units. The operation is part of a broader strategic plan that concerns the entire Vodafone Group and which will lead to the reduction of approximately 11 thousand employees over the next three years.

ABOUT INVESTMENTS…

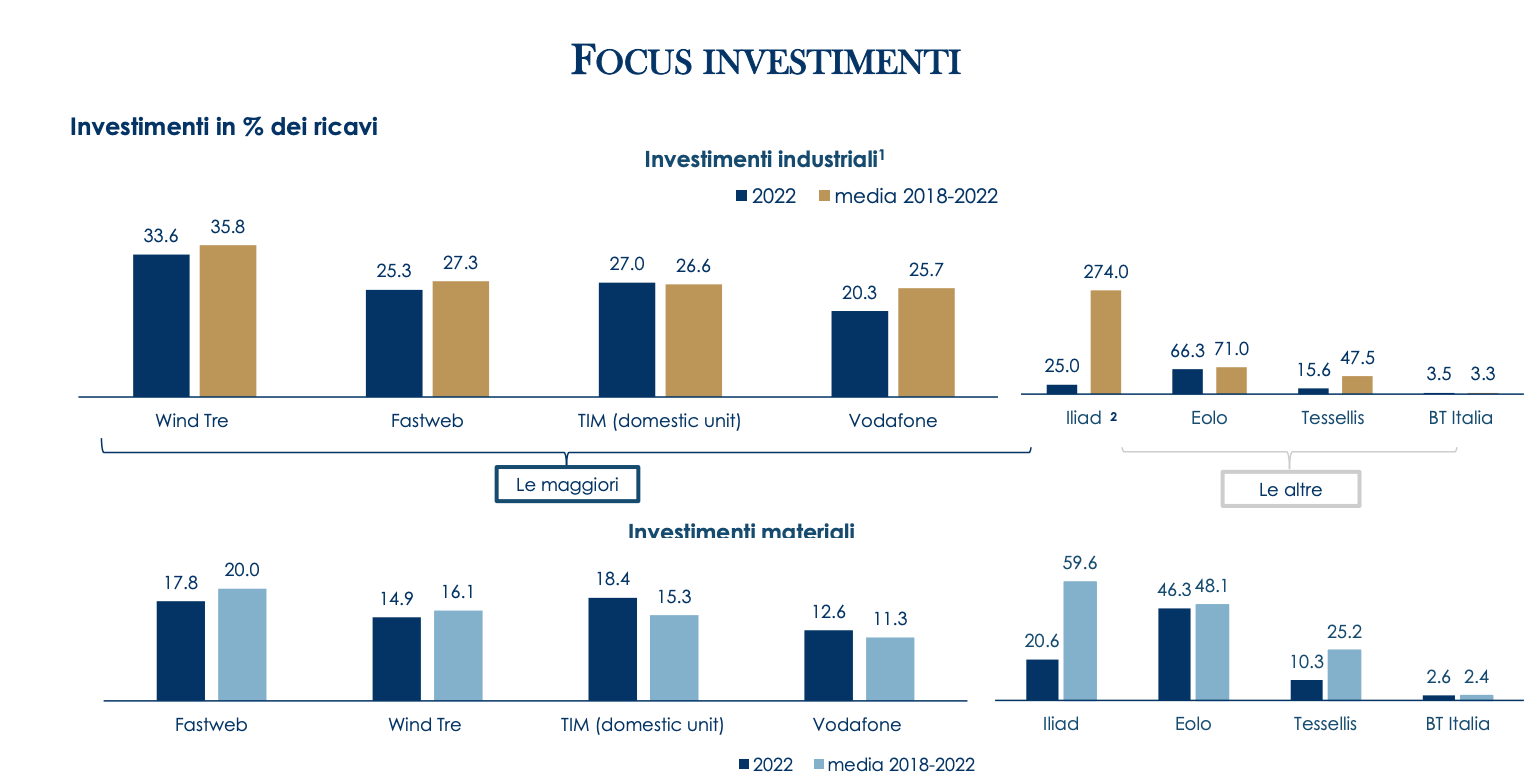

Finally, as regards investments over the five-year period, these are influenced by the assignment of 5G frequencies for 6.55 billion euros in 2018, by the coverage levels already achieved in the fixed and mobile networks (including the implementation of 5G) and by sale of the Wind Tre towers to CK Hutchison Networks Italia and of Vodafone and TIM to Inwit Fastweb achieves the highest average rate of material investments in the five-year period 2018-2022, while Wind Tre the highest industrial investments. With an already widespread presence in the North and Central Italy, since 2019 Eolo has launched an investment plan to widely extend the network to the South.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/come-vanno-i-conti-di-tim-vodafone-windtre-fastweb-e-iliad-report-mediobanca/ on Sun, 07 Jan 2024 06:28:11 +0000.