How Italian exports recover. Report Ref

The analysis by the economist Fedele De Novellis, editor of the report Congiuntura Ref

The Italian economy in 2021 was characterized by a significant recovery of exports and imports. The national accounts data show that both variables, expressed at constant prices, have returned to the levels of the end of 2019, while for the other major economies of the euro area there is still a gap to be bridged by a few percentage points.

In terms of the contribution of net exports to growth, there are no substantial differences compared to other European countries, but the signal drawn from the performance of our exports is positive.

The ability of our production system to cope with a particularly difficult phase confirms the exports signals of strengthening the competitive position of the Italian industry that have been accumulating for some years now (see Economic Update ref ., No.22 of 2021). This result appears significant also in the light of the specialization of the Italian economy. While benefiting from our smaller presence in the automotive sector, which affected exports above all from Germany, Italy boasts a greater presence in the textile and clothing sector , which has been heavily affected in this crisis; in addition, we have been affected by the difficulties that the pandemic has caused for exports of services, given our presence in the tourism industry. Focusing only on trade in goods, the data available up to November show a phase of stabilization in exports in volume, while imports showed a slight decline. In the fourth quarter of 2021, the contribution of net exports to the change in GDP should therefore have been positive.

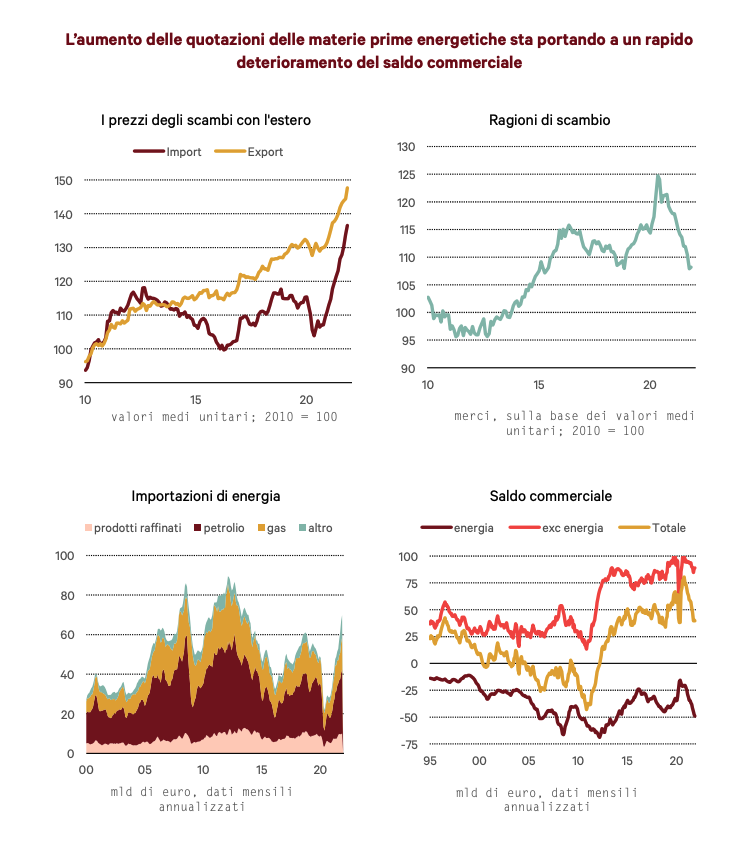

However, these trends are conditioned, as in other countries, by the difficulties that some sectors are encountering in increasing production. In fact, the economic surveys of manufacturing companies show very positive evaluations regarding the consistency of the foreign order portfolio. These indicators would therefore be compatible with a growing export trend at the beginning of 2022. On the other hand, imports should also have suffered from non-deliveries of semi-finished products and raw materials from abroad, and could recover during the first months of the new year. . During the second half of 2021, trade with foreign countries also showed large fluctuations in prices. Especially the prices of energy commodities, of which Italy is a net importer, have increased significantly. Imports of raw materials and energy products in 2019, before the pandemic, amounted to just over 50 billion euros. Within the most important items were oil (26 billion), gas (14 billion) and refined fuels (9 billion). Exports instead amounted to almost 15 billion, so Italy's energy balance before the Covid crisis was in deficit of about 40 billion a year.

In 2020, the effects of the crisis on imported volumes and the simultaneous collapse in the prices of energy commodities had led Italy's energy bill to almost halve, but the price increases will lead to the end of 2021 with a figure in line with the pre- pandemic. However, the energy trade deficit is destined to worsen in the course of 2022. There is a lot of uncertainty on this point given the effects of the gas price increases, whose prices at the moment continue to be very volatile, and on which it is not easy to hazard forecasts. An aspect to underline is that the value of gas imported from Italy in the second half of 2021 almost quadrupled compared to the same pre-crisis period. If a similar increase were proposed for the whole of 2022, the increase in the cost of gas alone would weigh on our imports for almost 45 billion.

If prices at the end of 2021 were to persist for the whole of 2022, Italy's energy bill would reach 90 billion and would in fact almost completely offset the balance of goods no energy (which in 2021 should close with a surplus of over 90 billion). billion euros). Our trade surplus would almost vanish. It is however likely that, given the trends observed in recent days, the situation at the end of 2021 represents the extreme point of the energy crisis, and that the tensions are destined to diminish in the course of this year. The loss of terms of trade linked to the increase in the prices of energy raw materials could also have consequences on the competitive position of Italy and other European countries. In fact, the gas crisis is specific to the European landscape and, if the prices did not return quickly, exports would be affected.

In fact, European demand would weaken, penalizing all intra-area trade. Furthermore, the competitiveness of Italian industry (and of other European countries) would also deteriorate compared to non-European partners. The extent of this loss would then be mitigated by the likely weakening of the euro exchange rate.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/recupera-export-ref/ on Sun, 30 Jan 2022 06:52:58 +0000.