How are the accounts and sectors of Fincantieri really going

What emerges from Fincantieri's 2020 report on the individual sectors in which the shipbuilding group is active

The Covid crisis has impacted Fincantieri's 2020 accounts : revenues drop but no orders have been canceled.

In 2020, orders acquired by Fincantieri amounted to 4.526 billion euros (8.692 billion in 2019), for 18 new ships and with a book-to-bill ratio (ratio between orders acquired and revenues developed in the period) of 0.8 ( 1.5 in 2019).

In 2019 the Trieste shipbuilding group had recorded a record level of orders acquired with 13 cruise ships.

Of the total orders, gross of consolidations between sectors, the Shipbuilding sector accounts for 82% (93% in 2019), the Offshore and Special Vessels sector accounts for 11% (2% in 2019) and the Systems sector , Components and Services accounts for 14% (10% in 2019); 7% of orders are intra-group.

All the details on the performance of the Fincantieri sectors that emerge from the 2020 financial statements .

SHIPBUILDING

The shipbuilding sector of Fincantieri includes the design and construction of ships for the business areas of cruise ships, ferries, military ships and mega-yachts.

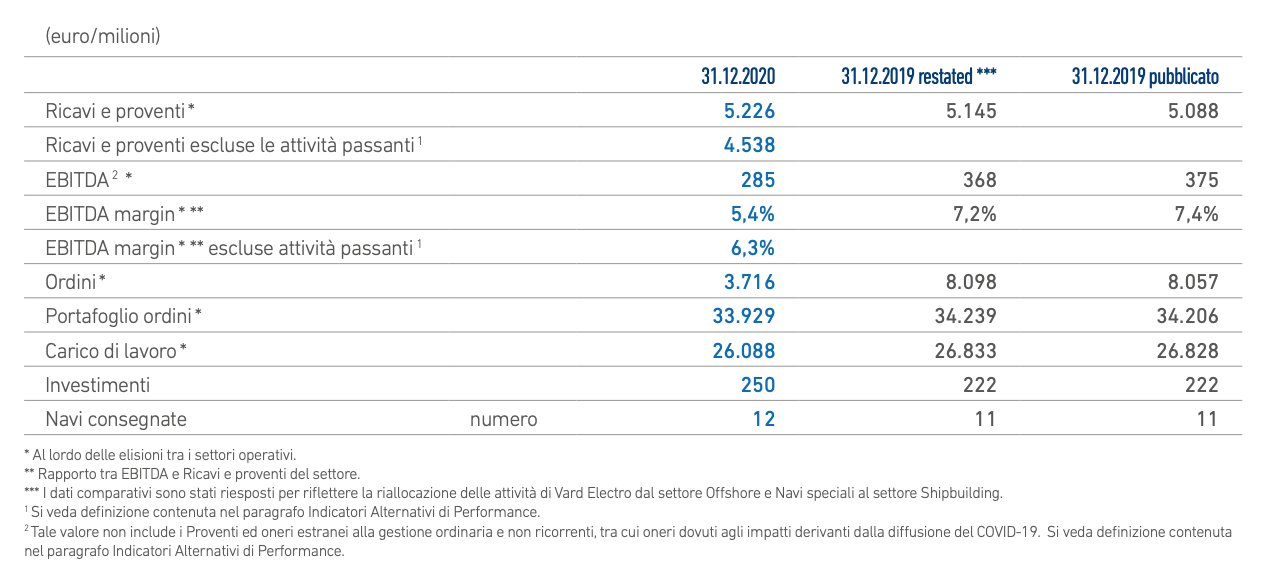

REVENUES

Revenues from the Shipbuilding sector as at 31 December 2020 amounted to € 5,226 million and, excluding revenues from pass-through activities of approximately € 690 million, amounted to € 4,538 million, a decrease of 11.8% compared to 31 December 2019.

This trend is conditioned by the postponement of production programs, following the shutdown of the group's Italian yards.

In the cruise ship business area, revenues amounted to 3,281 million euros (compared to 3,631 million euros at 31 December 2019), with a decrease of 9.6%.

As regards the military ships business area, revenues, excluding pass-through activities, amounted to € 1,250 million (compared to € 1,503 million at 31 December 2019), with a decrease of 16.8%.

EBITDA

The sector's Ebitda at 31 December 2020 was € 285 million (€ 368 million at 31 December 2019). The fourth quarter closed with an Ebitda of euro 94 million, confirming the positive trend of the sector already highlighted in the previous quarter. On an annual basis, the Ebitda is affected by the lower progress in the construction of cruise ships and military programs in Italy following the postponement of production programs which led to a non-recognition of Ebitda for approximately € 58 million.

IN A DRAW VARD

In the 2020 budget, the company led by Giuseppe Bono reports that Vard's Cruise is essentially in balance. Therefore, in line with the subsidiary's restructuring plan launched in 2019.

In fact, the shipbuilding company has recapitalized the Norwegian company for 90 million euros .

THE ORDERS

In 2020 Fincantieri acquired orders for 3,716 million euros in the Shipbuilding sector.

Among these, the group reports: the construction of the class leader unit of the new missile-launching frigates for the US Navy for the FFG (X) program; two U212 NFS submarines with Occar destined for the Italian Navy ; the development of the project and the engineering of the Large Unmanned Surface Vessel (LUSV) and the order for the shipping company Norwegian Cruise Line; the lengthening and further modifications agreed on 4 cruise units already in the portfolio for the shipping company Norwegian Cruise Line.

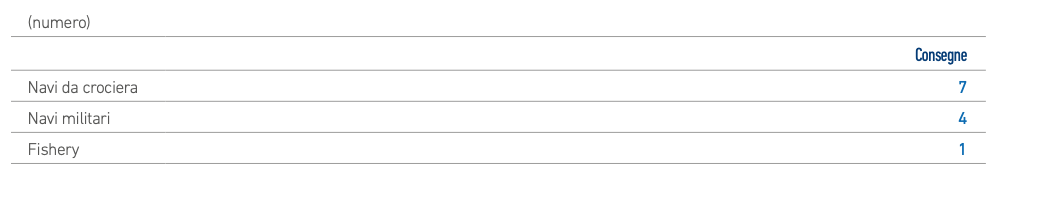

PRODUCTION

The number of ships delivered in 2020 is summarized below. Among the military ships delivered, the group mentions a multi-role frigate (Fremm), at the Muggiano (La Spezia) plant, or Spartaco Schergat, now renamed "Al-Galala ". In the draft financial statements prepared for the shareholders' meeting on 8 April, Fincantieri explicitly refers for the first time in months to the sale of two Fremm frigates abroad and, in the explanatory note, mentions the buyer: the Egyptian Navy.

OFFSHORE AND SPECIAL SHIPS

The Offshore and Special Vessels sector of Fincantieri includes the design and construction of high-end offshore support vessels, specialized vessels, vessels for offshore wind farms and offshore aquaculture as well as the offer of its own innovative products in the field. of ships and semi-submersible drilling platforms.

Fincantieri operates in this sector through the Vard group, Fincantieri SpA and Fincantieri Oil & Gas SpA. It should be noted that, following the reallocation of Vard Electro's activities from the Offshore and Special Vessels sector to the Shipbuilding sector, the comparative data as at 31 December 2019 below refer to the restated values.

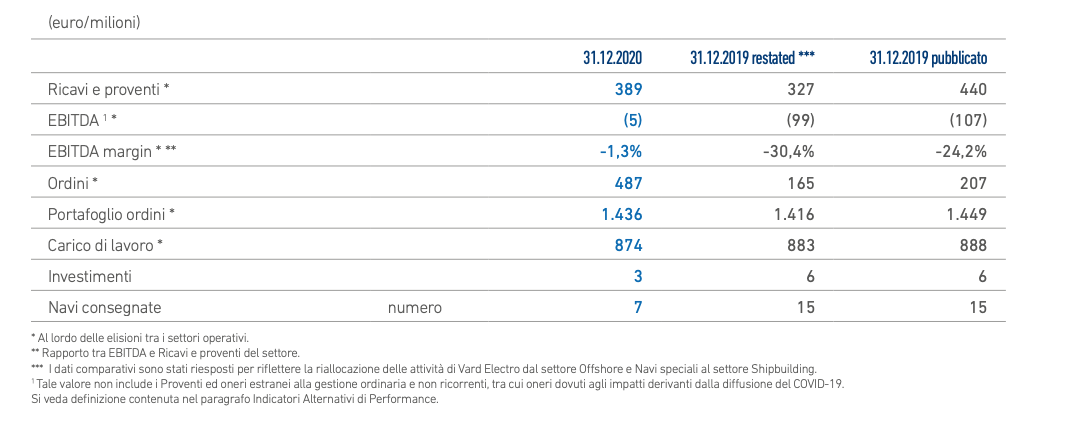

REVENUES

Revenues in the Offshore and Specialty Vessels sector as at 31 December 2020 amounted to € 389 million, an increase of 19.0% compared to those of the corresponding period of 2019 (€ 327 million), despite the negative impact deriving from the change in the exchange rate Euro / Norwegian Krone (Euro 26 million) for the conversion of the financial statements of the Norwegian subsidiaries. The measures adopted to compensate for the impacts and production slowdowns resulting from the spread of the pandemic have made it possible to maintain the expected objectives to date.

EBITDA

The substantial breakeven of Ebitdan in 2020 highlights the effects of the restructuring plan, launched by the Group's management in 2019, which also led to the revision of the final costs of the orders in the portfolio and the downsizing of production capacity which saw the closure of two Norwegian yards in Aukra and Brevik and exit from unprofitable businesses.

THE ORDERS

In 2020 the orders acquired by the Vard group amounted to euro 487 million and mainly concern: two innovative units for the fish farming sector; a Service Operation Vessel (SOV) for the maintenance of marine wind farms, confirming the diversification strategy defined by Fincantieri for the subsidiary; a state-of-the-art Fishery unit for Luntos Co. Ltd; a cable-laying vessel for the customer Van Oord; an order for the design and construction of eight robotic ships for Ocean Infinity, intended for the provision of maritime services in the United States and the United Kingdom.

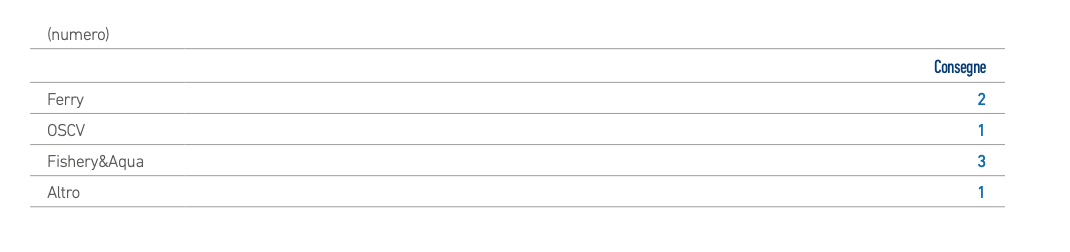

PRODUCTION

The number of vessels delivered by Fincantieri in the offshore and special vessels sector in 2020 is summarized below.

SYSTEMS, COMPONENTS AND SERVICES

The Systems, Components and Services sector of Fincantieri includes the following business areas: Service, Complete Accommodation, Electronics, Systems and Software, Energy, Infrastructure.

REVENUES

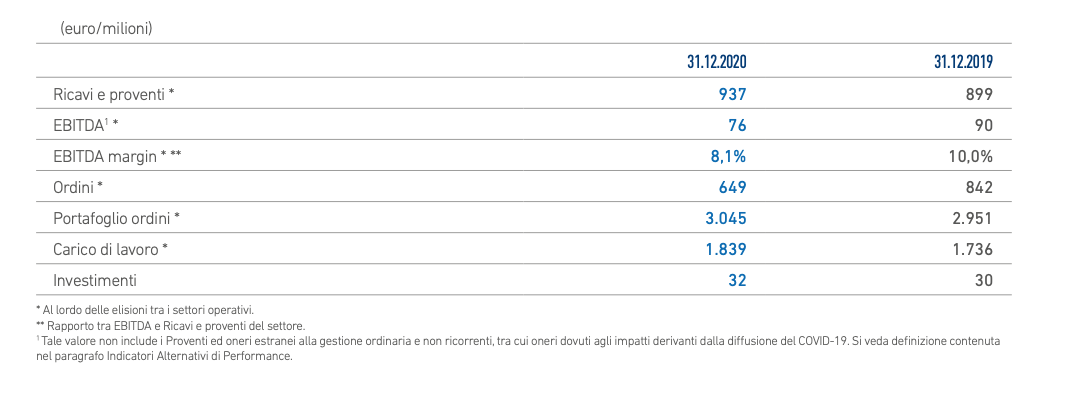

Revenues from the Systems, Components and Services sector amounted to € 937 million, despite the impact of approximately € 222 million of revenue slippage deriving from the production stoppage of some activities in Italy. They therefore confirm the trend of growth and consolidation of the sector. The trend reflects the Group's strategic choices for diversification of activities in the infrastructure sectors, in those with a high technological content (electronics and cyber security), in complete accommodation for the cruise ship sector, and in systems, components and post services. -sale.

EBITDA

The sector's Ebitda at 31 December 2020 was equal to euro 76 million (euro 90 million at 31 December 2019) with an Ebitda margin of 8.1%. The decrease in margins compared to 31 December 2019 is due to the postponement of production programs, with a non-contribution of Ebitda for € 22 million (of which € 17 million pertaining to the first half), as well as the different mix of products and services sold in the year compared to the previous year.

THE ORDERS

In the Systems, Components and Services sector, the value of orders in 2020 amounted to euro 649 million and by business area it mainly consists of:

- Service: among these we point out the after-sales assistance and spare parts supply services for the Italian Navy, the Navy and the US Coast Guard; for cruise orders and other minor customers; services and other mechanical workings for LCS orders; supply of In Service Support (LSS) to the Italian Navy on the “Classe Orizzonte” frigates and on the “Classe Dattilo” patrol vessels; feasibility study relating to the mid-life upgrade of the Orizzonte Class units, as part of the collaboration between Fincantieri and Naval Group, additional activities on the Through Life Sustainment Management program of the Fremm units of the Italian Navy.

- Complete Accommodation: supply and after-sales services relating to cabins, hygiene boxes, public rooms, kitchens and complete accommodation packages for the first cruise unit that Shanghai Waigaoqiao Shipbuilding Co. Ltd is building specifically for the Chinese market.

- Electronics, Systems and Software: agreement for the activation, marketing and joint maintenance of a new generation system for the monitoring and safety of motorway infrastructures with Autostrade Tech and IBM.

- Energy: over ten stabilization systems and five positioning systems for cruise orders, two propulsion reducers for the two new Fremm units for the Italian Navy

- • Infrastructures: reconstruction, reinforcement and adaptation of the international tourist port of Rapallo

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/come-vanno-davvero-conti-e-settori-di-fincantieri/ on Sun, 21 Mar 2021 17:58:21 +0000.