The FED will have to slaughter the American economy. Expected salaries clearly show this

The wages of job vacancies received by jobseekers and the wage expectations of jobseekers increased in July, in another sign that inflation is leaving its mark on the labor market, and is not not retreating at all, indeed, and then the turmoil begins that much higher wages will lead to even higher inflation. Indeed, "Core" inflation, excluding energy and agricultural products, is indeed destined to remain high in the USA

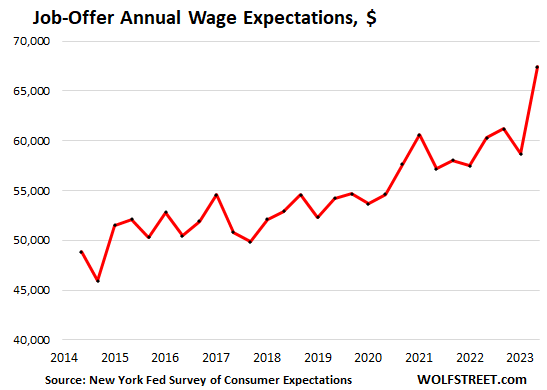

The wages that job seekers – not just the unemployed, but also the employed looking for another job – expect to earn in their job postings increased by $7,105, or 11.8%, compared to a year ago, averaging $67,400, according to this morning's New York Fed Consumer Expectations (SCE) survey. This part of the SCE is conducted three times a year, in July, November and March, as also reported by Wolfstreet .

This was the largest increase in wage expectations in terms of labor supply in SCE data, dating back to 2014. It is clear that job seekers are feeling encouraged and that their wage expectations are at an all-time high:

Employers, still struggling to find qualified personnel, seem to play along to hire. The median full-time job vacancies wages that job seekers actually received increased $8,711 from a year earlier, or 14 percent, to a record $69,500 in July, according to the SCE.

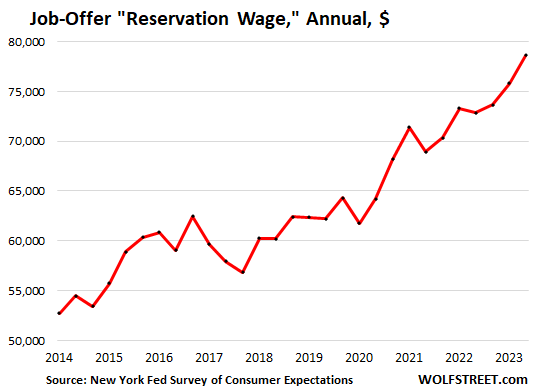

The lowest wage jobseekers would be willing to accept to take a new job — the median reservation wage — increased 7.9 percent from a year earlier to $78,600.

These are massive increases in what job seekers expect and what they are offered. And this occurs in a scenario in which the unions push for much higher wages and do not give up on industrial action to underline their demands. Minimum wages in eligible states, counties and cities have also been raised, in some cases substantially.

In July, the effective average hourly wages of “production and non-supervisory employees” – the majority of total employment – accelerated sharply, rising by 0.45% from June, the largest monthly increase since November, equal to a 5.5% year-on-year increase. This figure is based on the Bureau of Labor Statistics' surveys of employers, which we covered earlier in August.

The effect of these pushes will be an increase in inflation, as we have said, especially Core inflation. The FED will respond correctly from a financial point of view and very painful from a social and personal point of view: it will raise rates until it causes a crisis such as to lower workers' income expectations. A very painful cure and which politically will have harsh consequences in the year of the elections.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The FED will have to slaughter the American economy. Expected salaries clearly show that it comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-fed-dovra-massacrare-leconomia-amerciana-gli-stipendi-attesi-lo-mostrano-chiaramente/ on Tue, 22 Aug 2023 06:00:16 +0000.