I’ll explain the flaws of the Superbonus

The biggest flaw of the Superbonus is the lack of conflict of interest between the client and the supplier, a decisive element for containing the cost of the works. Giuseppe Liturri's analysis

There is some news – compared to the drafts circulated – for the "Aiuti-quater" law decree published today in the Official Gazette . The most relevant is the possibility of dividing the credits into 10 annual installments and then offering the assignees to purchase these fractional installments, lightening the financial commitment and, hopefully, thus reviving the market for already accrued credits which sees all the players in the supply chain in liquidity crisis. Uncertainty reigns over the deadline for Cila which many would like to extend from November 25th to at least mid-December. The government's decision which reduced the superbonus in favor of interventions to improve the energy performance of buildings was justified by the excessive cost of the subsidy.

Here we try to understand if the superbonus really creates a hole in the accounts and if the tax credit market is definitively dead. These are two articulations of the same problem that must be examined in parallel, but then converge, because the hole (or presumed hole) is created precisely as a result of the circulation of superbonus credit.

The government's fears are well summed up by the words of Economy Minister Giancarlo Giorgetti, spoken on two different occasions. The first on 9 November in a joint hearing before the special commissions of the Chamber and the Senate, when he observed that " tax credits are a huge problem to be tackled and managed, which is observing some observations from external subjects with respect to the nature and the definition of tax credit that can be transferred several times. I'll stop here… (assuming an allusive expression, ed. note) Let's avoid saying that these tax credits must circulate freely. We really don't have to say that. It's better for everyone, for the Italian State in particular […] I've never seen a law that cost so much for so little" To then conclude that "I never spoke of elimination but of rationalization" .

Two days later, at a press conference to illustrate the “Aiuti-quater” Law Decree, he reiterated with particular emphasis: “ I want to reiterate one thing: the transfer of tax credits is a possibility, not a right. There will be the certainty of being able to deduct them from income over the years. But not the certainty of finding a bank that accepts the transfer, otherwise we would have created a currency. Which was not created. This I must say. ”

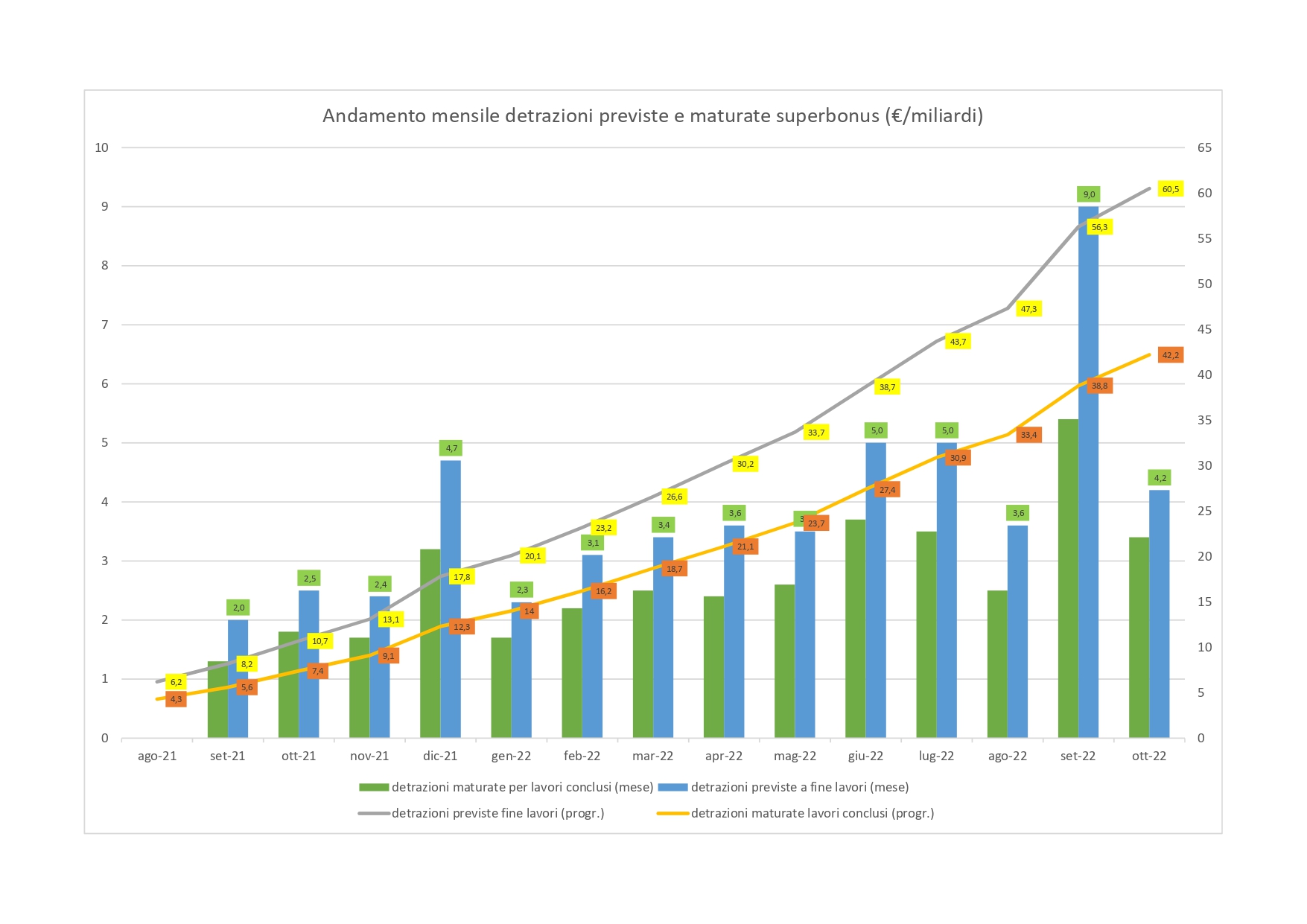

Giorgetti gets it right when he affirms the need to rationalize the measure. Suffice it to say that the technical report with which the Conte 1 government launched the measure in May 2020 spoke of a requirement of around 9 billion spread up to 2026. And now we find ourselves on 31 October with 42 billion in deductions already accrued and 60 billion in deductions foreseen at the end of the works, with an impressive progression in recent months. It is clear that the phenomenon has gotten out of hand.

A remedy – that of reducing the benefit from 110% to 90% of the expenditure – finally puts its hand to the biggest defect of the Superbonus, i.e. the lack of conflict of interest between the client and the supplier, a decisive element for containing the expenditure for works in project. The other statements overlook essential aspects of the story, as it evolved during 2021 and 2022 and are too flat on the shaky justifications provided by the Draghi government in its numerous interventions on the matter.

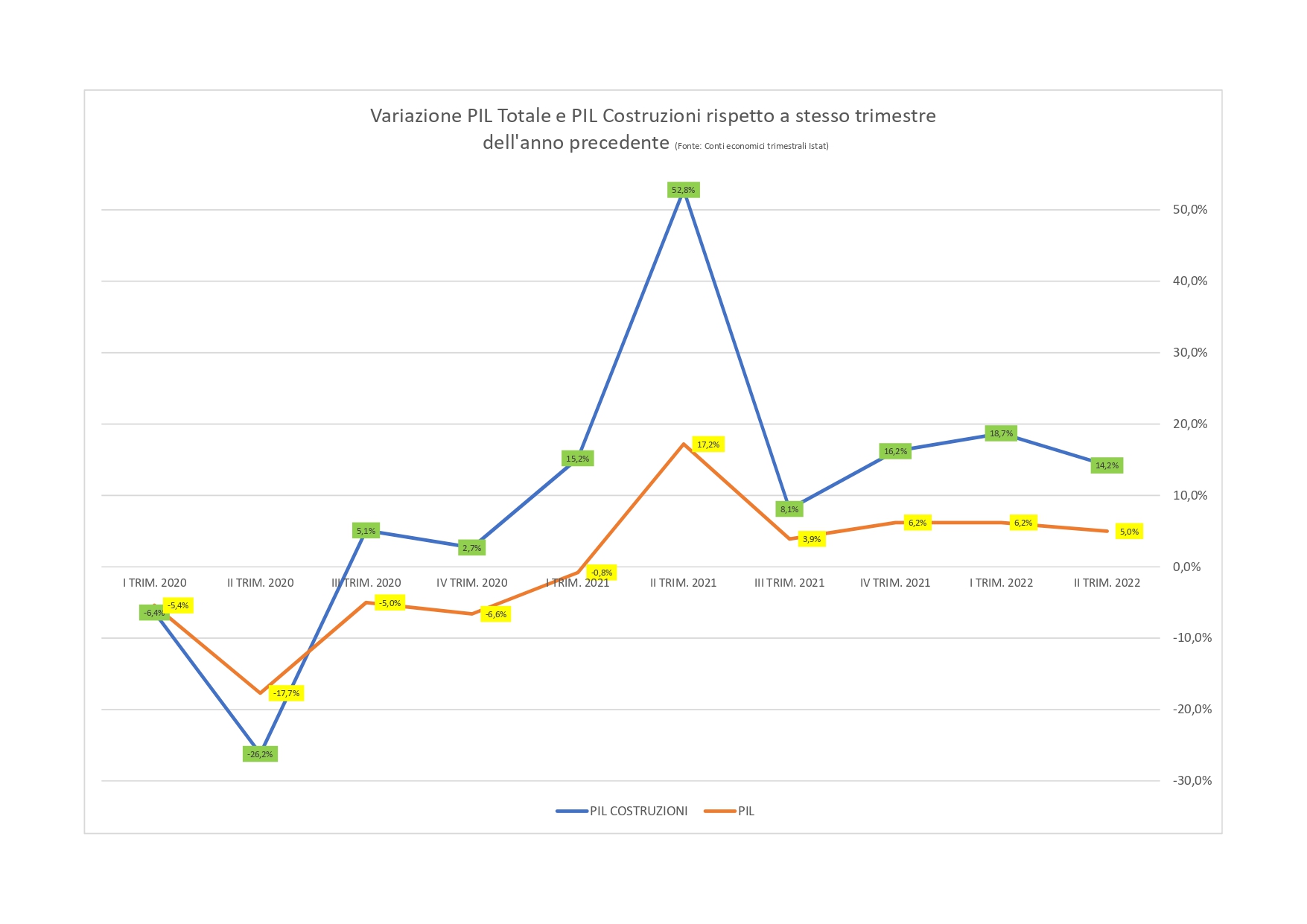

First of all, it makes no sense to talk about cost without taking into account the return on that expense. It is an undeniable fact that the construction sector – driven by incentive interventions, given the modest increase in new residential construction – has contributed decisively to GDP growth as early as autumn 2020, when those regulations began to take their first steps . In all subsequent quarters, the value added of the sector grew at double or triple rates of that of the entire economy. On average, at least 20% of GDP growth is attributable to the construction sector alone, even though the latter generated only around 5% of GDP in the second quarter of 2022. In other words, just under one point of the trend growth of 5 % recorded in the second quarter of 2022 is due to the construction sector. Same trend for hours worked and job positions. Then there would be the induced effect: the same 2020 technical report estimated that for every 100 € of deduction, there would be around 18% revenue, for VAT and IRPEF/IRES generated by the additional expense. Finally, it should be noted that 13.9 billion in funding comes from the PNRR and another 4.5 billion from the complementary fund.

If we consider that the residential construction sector was literally buried with the double knockout blow of the crises of 2009 and 2012, as can be observed from the trend in building permits, it can be concluded that the decision to focus on that sector for a The country's rapid restart has paid off.

But you can not ignore the transfers. No need to hide behind a finger. For the simple fact that for those who do not have financial resources and / or tax capacity in their future IRPEF, either there is the transfer / discount on the invoice or the superbonus does not exist. And it might as well declare the end of it. Especially for the less well-off, who even say they want to favor, a discount or transfer is the only way to benefit from the superbonus.

The vice of transfers is elsewhere and does not even coincide with the problem of creating a currency that does not have legal tender but is voluntarily accepted as a means of payment, which has always been smoke and mirrors for the ECB/Bank of Italy and it does not even lie in fraud, which has involved marginal way the superbonus.

Upstream of everything there is a problem of accounting rules, already explained in these columns in June 2021 and January 2022, drawing on documents from Eurostat, Istat and the State General Accounting Office.

An essential feature of the superbonus tax credit – but also of all the others with limited usability and reporting over time – is the "non-payability". The taxpayer or transferee can in fact deduct or offset it in five (then four) quotas within the limit of his fiscal capacity for the year. Beyond this last ceiling, the benefit is lost. This feature allows the impact on the deficit and debt for Maastricht purposes to be spread over the various years. However, Eurostat and the Rgs have observed that “the right to transfer the credit actually involves exceeding the fiscal capacity of the beneficiaries and therefore would make the credit “payable”. This is what Giorgetti is referring to when he enigmatically says that "it's better for the Italian state". Because if he lets credit circulate, the public accounts will blow up and the legacy of Giuseppe Conte and Mario Draghi will become toxic.

Today no one can say how much of the 60 billion deductions envisaged will actually be compensated in the coming years and therefore will translate into an effective burden for the state coffers. Not surprisingly, the solution envisaged by the government with splitting it over 10 years, dilutes the burden over time. The fact is that without the transfers, the match will be left in the hands of the current credit holders who – regardless of the pressing liquidity problems – may not have adequate fiscal capacity in the coming years and therefore suffer a sharp loss. Preventing or curbing the circulation of credits helps the State twice: it reduces the effective burden – increasing the probability that there are incompetent creditors – and prevents everything from being immediately accounted for as a deficit/debt. It is obvious that the greater the circulation of credits, the greater the probability that they end up in the hands of transferees with fiscal capacity and therefore the greater the effective burden for the State in each of the years due. But at this point Eurostat would immediately increase the deficit and debt by requesting the accounting of the entire amount. Here are the "external subjects" who make "observations" to which Giorgetti alludes and to whom he takes care to let it be known that he "does not intend to create a currency". Precisely because a coin circulates and is payable, with the serious consequences illustrated above. With a monetary mass M1 (banknotes and deposits) of around 1,800 billion, the problem is not that of a tens of billions more money. Those credits must not circulate in order not to constitute debt immediately, Europe is asking us for this.

(Integrated and updated version of an article published in La Verità)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/magagne-superbonus/ on Sat, 19 Nov 2022 06:56:07 +0000.