The accounts in the pocket of Intesa Sanpaolo, Unicredit, Banco Bpm, Mps and Bper. Reports

Record accounts for the top five Italian banking groups (Intesa Sanpaolo, Unicredit , Banco Bpm , Mps and Bper). Here because. Facts, numbers, comparisons and comments

Why are the financial statements of Intesa Sanpaolo , Unicredit , Banco Bpm , Mps and Bper shining?

Here are facts, numbers and insights.

WHAT RESEARCH SAYS ABOUT THE FINANCIAL STATEMENTS OF INTESA SANPAOLO, UNICREDIT, BANCO BPM, MPS AND BPER

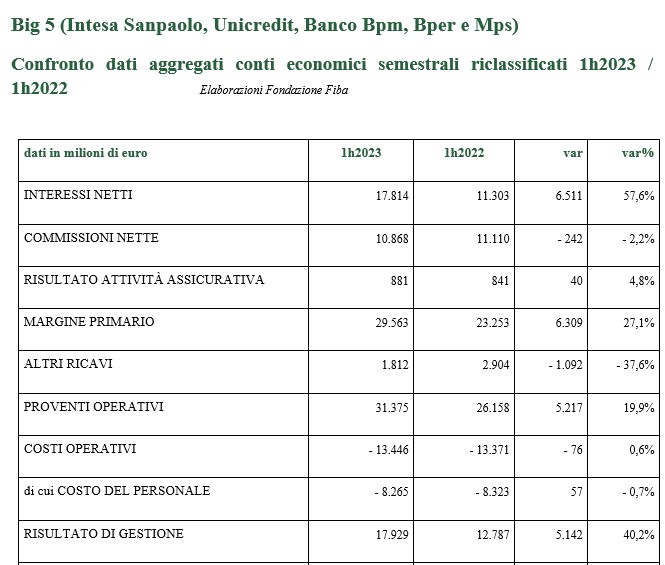

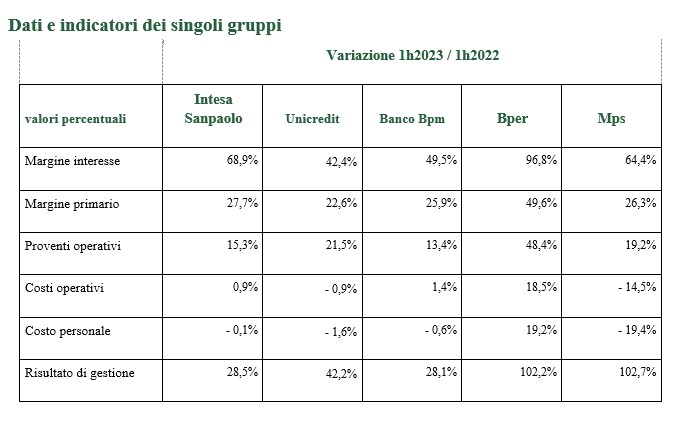

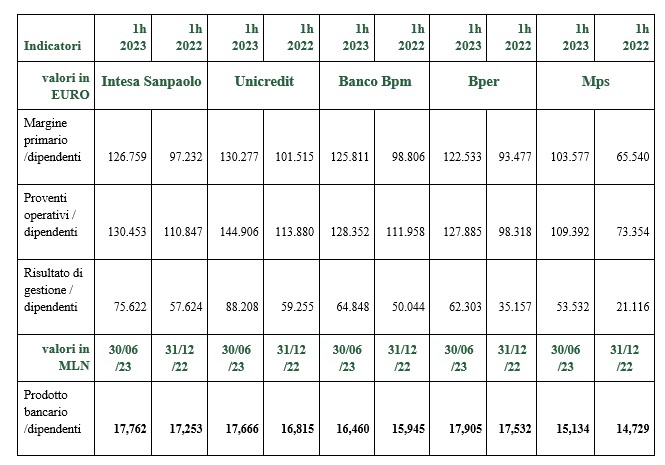

The accounts are booming for Italian banks in the first half of the year. The top five groups ( Intesa Sanpaolo , Unicredit , Banco Bpm , Mps and Bper) recorded more than 50% growth in profits, a consequence of the race in net interest triggered by the increase in interest rates. This is what emerges from the analysis of the Fiba Foundation .

THE COST OF CREDIT FOR INTESA SANPAOLO, UNICREDIT, BANCO BPM, MPS AND BPER

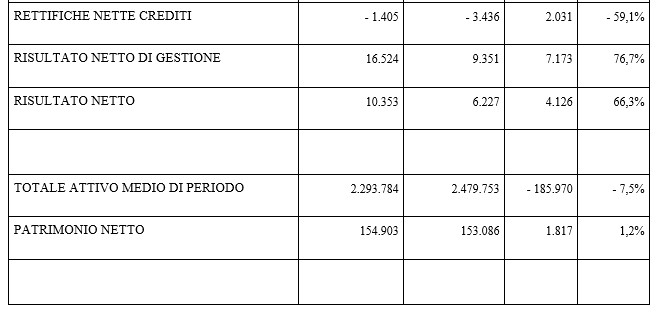

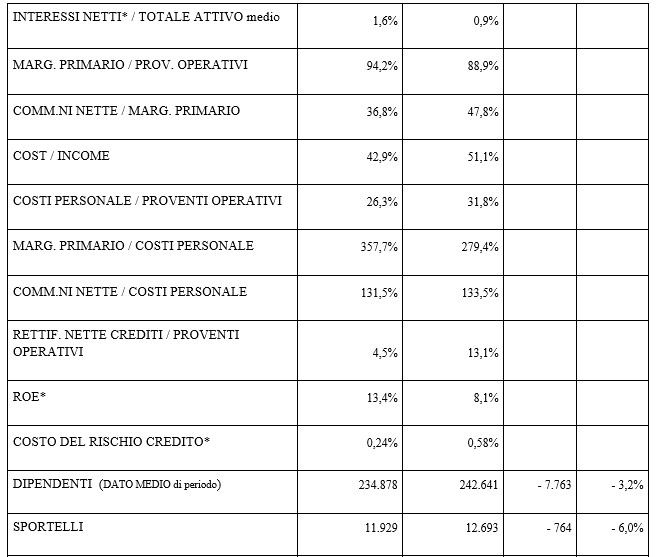

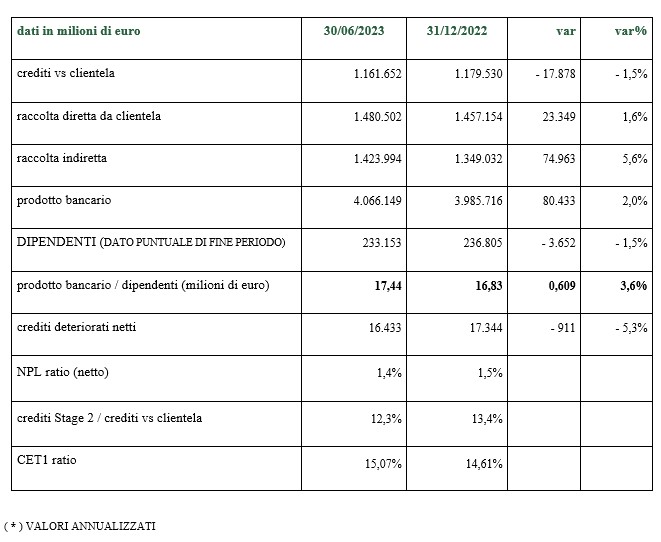

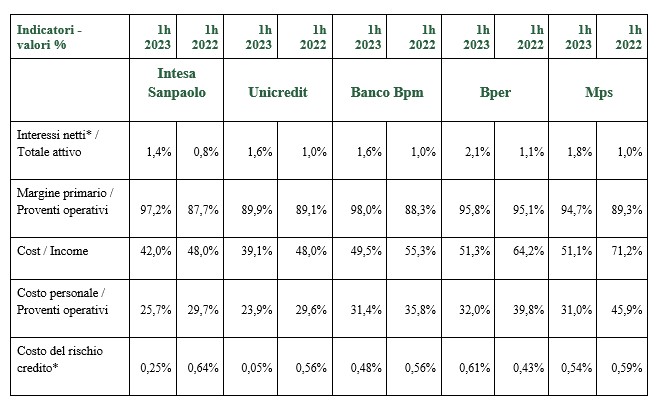

Profitability is also supported by the improvement in the cost of credit risk (net adjustments/net loans) which passes from 0.58% to 0.24% on annualized values, despite a systemic context rendered critical by the increase in interest rates and the slowdown in economy, which is reflected in the negative trend in the volume of loans to customers (-4.3% compared to 6/30/2022).

It should be noted that the data on the cost of risk processed by the ECB, for the first quarter of this year, for the set of "significant" banks records an average value for institutions in the Euro Area of 0.46%, while for Italian banks stands at 0.34%, also lower than the data of Germany, France and Spain.

IMPAIRED CREDITS FILE

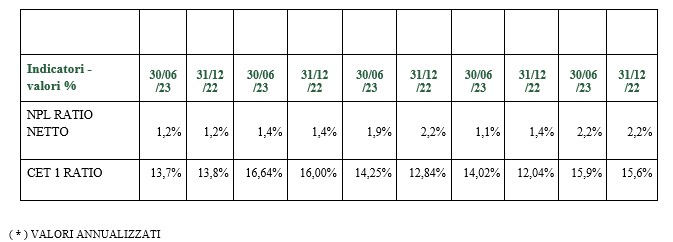

The incidence of non-performing loans (1.4%) remains substantially stable and at minimum levels for the five largest groups, but improvements have been recorded in indicators having prospective importance for credit quality:

- Stage 2: compared to the data as at 31.12.2022 there is a decrease in their weight from 13.4% to 12.3% of the total performing loans.

- Default rate: there is an overall containment of the impact of the flow of transfers from performing to non-performing loans, with values of the individual groups below 1%, specifying that we have not found the MPS figure.

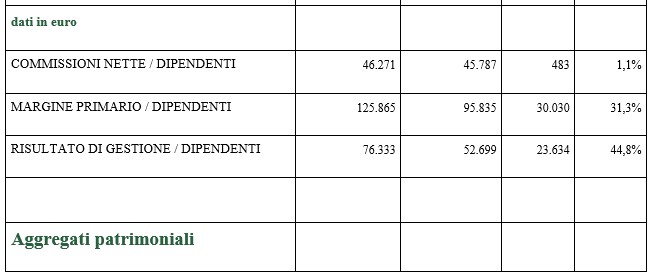

LOWER THE COST OF LABOR

The cost/income ratio fell again to 42.9%, about ten points below the average level observed among the major European banking groups. The incidence of personnel costs on operating income decreased from 31.8% to 26.3%. Compared to a year ago, the number of branches fell by 6% (-764) and employment by 3.2% (about 7,700 fewer, the average figure for the period).

HOW IS THE COLLECTION?

To complete an optimal picture, it should be noted the increase in direct deposits (+1.6%), despite the containment of the remuneration of demand deposits, the more than adequate monitoring of liquidity risk and capital solidity measured by the CET1 Ratio, which grows from 14.61% as at 12/31/2022 to 15.07% as at 6/30/23.

THE COMMENT

“The high credit quality of the top five Italian banking groups represents a strong point of the system. However, attention to risk management must not result in a restriction of the credit offer which would penalize investments and growth”, comments the general secretary of First Cisl Riccardo Colombani.

“To avoid a spiral of this type, it is necessary to invest in the training of male and female workers, also with the strengthening of the workforce, so as to guarantee correct and profitable credit management within the banks. In fact, it is necessary that a corporate culture be established aimed at supporting the country in a phase characterized by the ecological and digital transition. Negotiations for the renewal of the national contract will reopen in September: higher wages are needed, the value produced cannot go only to the shareholders. Lastly, MPS's results, positive beyond all expectations, should be underlined. We have always maintained that with the recapitalization the relaunch of the bank was possible and the facts are proving us right".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-qualita-credito-first-cisl/ on Sun, 06 Aug 2023 19:52:37 +0000.