Sotrovimab, that’s why the only monoclonal (Italian) effective against Omicron is not found in Italy?

The strange case of sotrovimab, the only monoclonal effective against Omicron produced in Italy but exported to the United States. All the details

Of all the available monoclonals, only sotrovimab, called Xevudy, was effective against the Omicron variant. Italy, however, as Start has pointed out several times, does not make great use of this type of treatment.

It is true that monoclonal antibodies require early diagnosis, the administration is only recommended to patients who risk developing a severe form of Covid and need the intervention of a doctor in the hospital because it is received intravenously, but they also give excellent results.

WHO PRODUCES SOTROVIMAB

Sotrovimab was developed by GlaxoSmithKline (Gsk) in collaboration with Vir Biotechnology, but is produced in Italy in the Gsk plant in Parma for the whole world.

As explained in an interview by Maria Chiara Amadei, plant manager and CEO of Gsk Manufacturing Spa, "the Parma site deals with the production of the antibody, the filling in bottles, the analytical part to support the release and final distribution. ".

WHAT DO YOU SAY ABOUT ITS EFFECTIVENESS

A study, reported in a release from the European Medicines Agency (EMA), involving 1,057 patients with Covid, showed that sotrovimab significantly reduces hospitalization and death in patients with at least one underlying condition. exposes you to the risk of a severe form of the disease.

After antibody treatment, the percentage of patients hospitalized for more than 24 hours within 29 days of treatment was 1% (6 of 528 patients) compared with 6% of patients who received placebo (30 out of 529), 2 of whom died.

A study published in The New England Journal of Medicine also shows that, if administered early, it reduces the risk of hospitalization.

Furthermore, according to another recent study by the Institut Pasteur, sotrovimab is the only monoclonal to have performed well against Omicron.

HOW MUCH IS USED IN ITALY

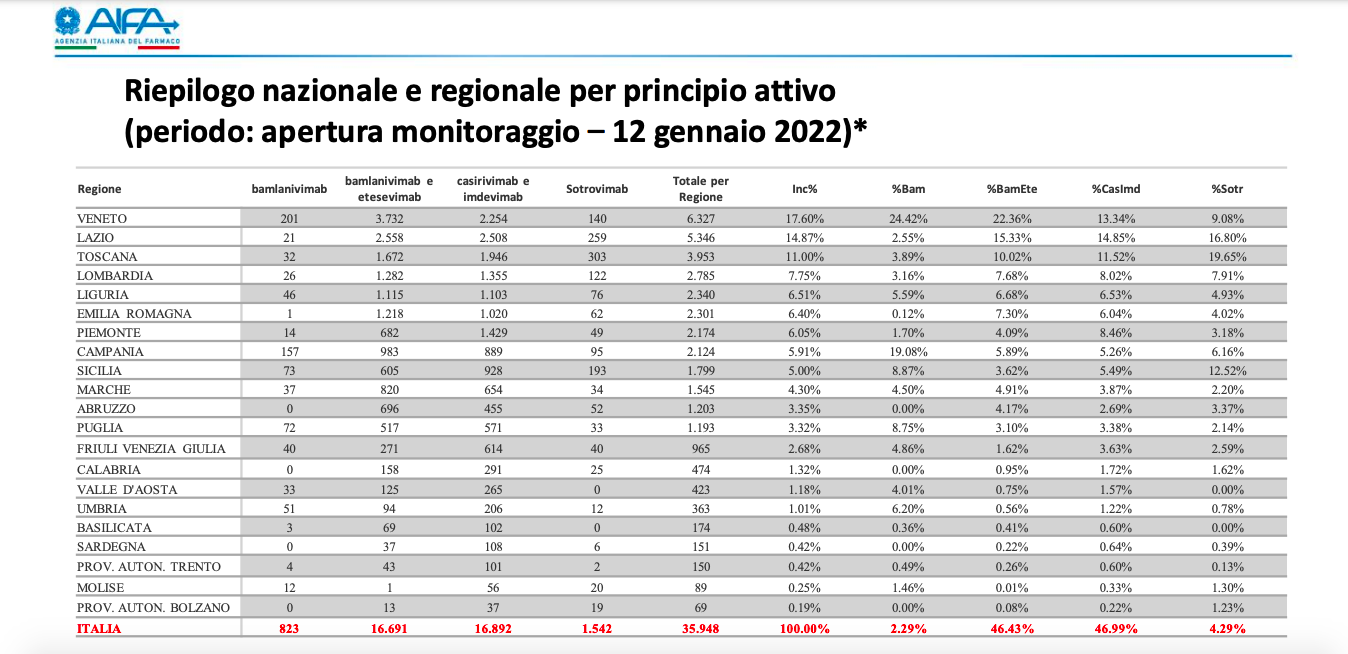

Although sotrovimab is produced in Italy, according to the latest report from the Italian Medicines Agency (Aifa), updated to January 13, only 1,542 doses have been administered, compared to 16,691 for bamlanivimab / etesevimab and 16,892 for casirivimab / imdevimab.

WHERE HAVE YOU BEEN

According to what Il Fatto Quotidiano writes, Italy has bought "a few and late doses" of sotrovimab, "to the point that many regions have run out of stocks". “We are at the national shortage”, the managers of the regional pharmaceutical services would have said, taking part in the national table with Aifa on 14 January.

Speaking of numbers, the newspaper writes that "our country bought just 2,000 doses in December and used 1,542: today there are therefore less than 500 in all of Italy, so much so that a region like Liguria has only 20 treatments. while others, especially in the south, not even one ".

Also in the Florentine edition of the Corriere we read that the administration of monoclonal antibodies stops because the only effective one is not available. "There are no stocks of sotrovimab, it is exhausted", denounce health workers. Ditto from the Asl Centro, where some family doctors who requested monoclonals for their older patients, were told that "there are none available".

WILL COME BACK?

Yesterday, according to the sources of the Fact , 5 thousand doses should have been delivered, "a number that already seems to the insiders to be underpowered by the needs dictated by the trend of the curve, by the number of infected and resuscitating people, by the expected peak of infections by Omicron ".

HOW THE DEFICIENCY EXPLAINED

The article argues that, having not moved in time, someone else would have been more forward-looking. This someone is the United States, so much so that they would have “ordered 500,000 doses from the GSK plant, thus conditioning the stock of the drug on a global scale, starting with Italy, which in theory would have it at home”.

The Washington Post also revealed that in recent weeks, with the increase in cases due to Omicron, US health officials had suspended monoclonal treatments, ordering them to stock up so that they had enough availability for when the variant became prevalent.

"It is a joke that repeats itself", concludes Il Fatto , "even the first monoclonals, those against Covid in the first waves, were bought late and amid much resistance".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/sanita/sotrovimab-perche-unico-monoclonale-italiano-efficace-contro-omicron-non-si-trova-in-italia/ on Tue, 18 Jan 2022 14:08:51 +0000.