SoftBank disappears from the Chinese giant Alibaba?

Softbank has sold a third of the stake in Alibaba and makes 22 billion from it. The turning point of the Japanese conglomerate, Jack Ma's historic lender, comes when the Chinese e-commerce giant is facing complications

Softbank is preparing to sell its stake in Alibaba.

The Japanese conglomerate Softbank has entered into derivative contracts on the sale with a redemption option for about a third of its historical stake in the Chinese e-commerce giant Alibaba, from which it has raised about 22 billion dollars. This was reported by the Financial Times on the basis of the accounting documents produced by the Japanese group, which now finds itself with more than half of its stake in the Chinese company engaged in similar sales contracts.

This all comes as the US Securities and Exchange Commission (SEC) added Alibaba to a list of more than 250 Chinese companies that could be delisted on Wall Street due to non-compliance with financial audit requirements.

Alibaba will "strive" to maintain the New York listing despite the addition to the SEC watchlist, the company said Monday in a statement to the Hong Kong Stock Exchange. The new accounting rules is the front on which a new dispute has opened between Washington and Beijing. The group has applied for primary listing on the Hong Kong market.

However, Alibaba stock gained 1.5% yesterday, thanks to a better-than-expected quarterly report. Although Alibaba has beaten the estimates, it is the first time that the company has experienced flat growth. The Chinese e-commerce group experienced a slight decline in quarterly revenue for the first time in its history.

All the details.

SOFTBANK DISCLAIMS SHARES OF ALIBABA

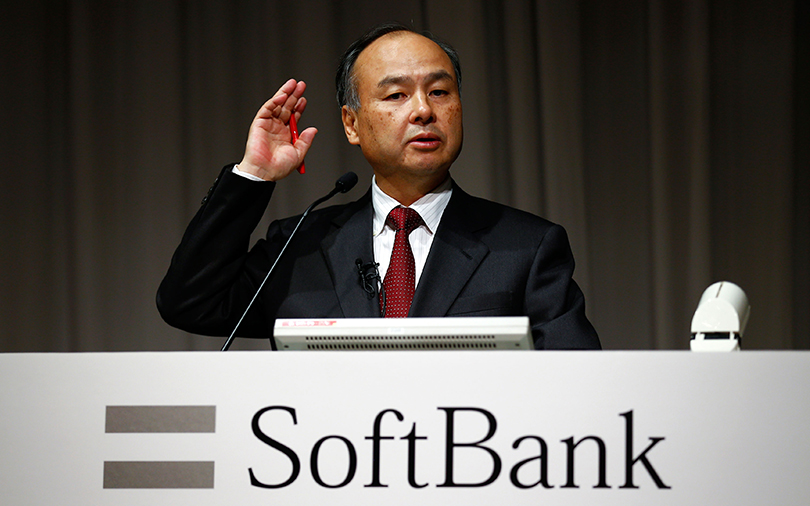

Softbank, the group led by founding billionaire Masayoshi Son, sold about a third of its stake in Alibaba this year.

Barring future second thoughts, and related massive expenses, Softbank's stake in the will be drastically reduced. A historic turning point, according to the London financial newspaper, given that the group had been among the main financiers of Jack Ma's company when it was a startup, with a loan of about 20 million dollars 20 years ago, which went on to rise and that the Japanese group has never liquidated.

These sales provide for a redemption agreement with which the company could repossess the shares. But according to the FT , it is unlikely to be exercised.

SoftBank's bet on Alibaba during its inception had made its CEO Masayoshi Son the richest man in Japan over the past decade. However, it lost this stock as Alibaba's shares fell due to regulatory pressures.

THE BEIJING CLAW ON THE CHINESE COLOSSUS

Meanwhile, the tech giant Jack Ma founded in China faced an antitrust investigation and a $ 2.8 billion fine last year.

In recent times, founder Jack Ma has almost disappeared from public view. And now it is now planning to relinquish control of Alibaba's subsidiary Ant Group, according to the Journal . For over a year, Ant Group has been in the sights of Beijing's market regulators. In 2020, the Chinese authorities blocked in extremis the initial public offer (IPO) of more than 34 billion dollars that should have taken the company on the Shenzhen and Hong Kong stock exchanges.

THE GEOPOLITICAL SCENARIO

Nor can it be excluded that among the considerations that led Softbank to these transactions there are also elements of a geopolitical nature on the growing tensions that are being created between the US and its allies on the one hand, including Japan, and Russia and China and several countries. emerging on the other hand on a multiplicity of episodes, including the war in Ukraine and the Chinese aims on Taiwan.

THE FIRST DECREASE IN TURNOVER IN THE HISTORY OF ALIBABA

Finally, Chinese e-commerce group Alibaba reported a slight decline in quarterly revenue for the first time in its history. For the first quarter of fiscal year 2022-2023, turnover was 205.55 billion yuan, up from 205.7 billion yuan in the same period of 2021. Net profit stood at 22.73 billion yuan against the 18.72 billion yuan expected from the analyst consensus.

In the quarter, Alibaba faced a series of headwinds, including a resurgence of Covid in China that led to the blockade of major cities and a sluggish Chinese economy in the second quarter.

In a statement, the group spoke of a 'decline' in commercial activities offset by those in the cloud. “After relatively weak April and May, in June we see signs of recovery in our business,” said group CEO Daniel Zhang.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/softbank-si-dilegua-dal-colosso-cinese-alibaba/ on Fri, 05 Aug 2022 06:27:39 +0000.