What happens to US government bonds (13%?) and what will be the consequences

While the dollar is indicating a strong strengthening globally, the yields on 10- and 30-year government bonds are skyrocketing, so the values of the related securities are sinking.

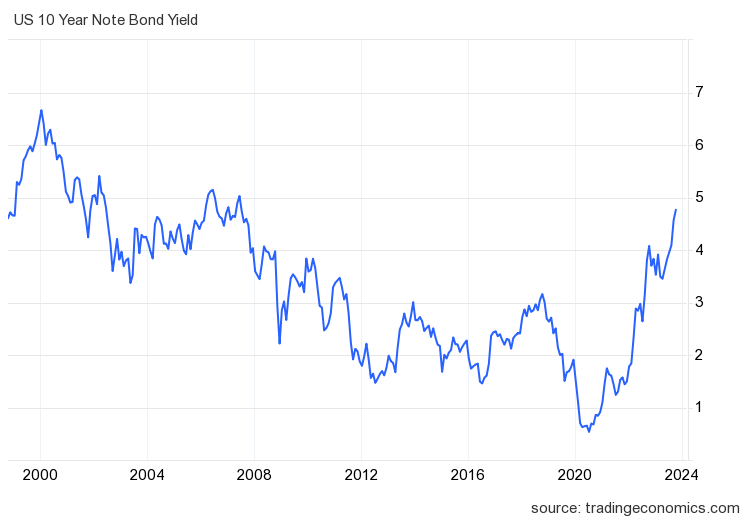

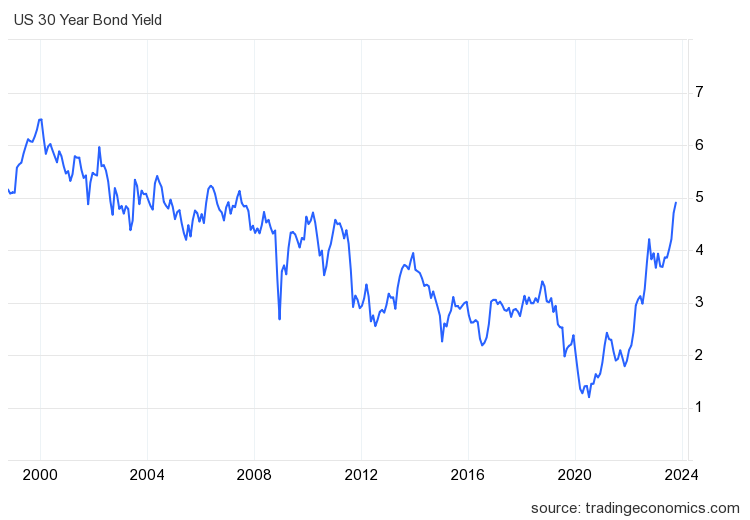

The data is clear and shows a strong surge. We show them to you over a twenty-five-year time horizon so that you can clearly grasp the extent of the growth and the level reached.

Here is the 10-year state bond:

We are almost at 4.75% and here is the thirty-year

Here we are above 4.90%, almost touching 5%.

This level of interest hasn't been seen since the Great Financial Crisis, and let's remember that it was the very high interest rate that caused that collapse, first in the real estate sector and then throughout the economy.

Why this boom today?

There are cyclical and structural factors:

Economically speaking , today the analyst Rick Santelli, on CNBC, clearly said that the yield on ten-year bonds could reach 13% if this week the ten-year bonds reached 4.75%, and this certainly did not reassure the markets, which there are data to reach this level.

Could 10-year Treasury rates hit 13%? @RickSantelli charts the path to much, much higher yields, and warns that the Fed is running out of tricks pic.twitter.com/51DfL2R6HF

— CNBC's Fast Money (@CNBCFastMoney) October 2, 2023

Structurally we have on one hand China which is selling US government bonds, to support the Yuan against the Dollar and not import inflation. On the other hand, the market is not evaluating the agreement for the 45-day postponement of the debt ceiling limit well.

What does this mean for all stocks, considering that the dollar index indicates a very strong American currency?

- the interest to be paid for securities, public and private, issued in dollars will increase;

- however, there will be a tension towards an increase in the yield of non-dollar government bonds, including those of other countries, with tensions on the balance sheets of private companies and states.

The future is not rosy at all and we will have to face very strong tensions. Hold fast.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article What happens to US government bonds (13%?) and what will be the consequences comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cosa-succede-ai-titoli-di-stato-usa-13-e-quali-ne-saranno-le-conseguenze/ on Tue, 03 Oct 2023 16:51:57 +0000.