What happens to Intesa Sanpaolo, Unicredit and not only on Russia and Ukraine

All the news on the stock exchange and not only for Italian banks such as Intesa Sanpaolo and Unicredit with the Russia-Ukraine war. Facts, numbers and analysis

Italian banks such as Unicredit are still in tension with the Russia-Ukraine war.

On the morning of Tuesday 8 March, the main European stock exchanges turned upwards after the indiscretion released by the Bloomberg agency on the launch of bonds by the EU to win the largest expenses against the energy crisis and for defense following the war in Ukraine. Milan (Ftse Mib + 3.15%) is the best, followed by Madrid (+ 2.76%), Paris (+ 2.32%), Frankfurt (+ 1.56%) and London (+ 0.56%) ), which being outside the EU is not involved in the initiative. At the same time, US futures are also up, while among the sectors preferred by the news are banks with Unicredit (+ 6.46%), Bnp (+ 5.42%) and SocGen (+ 4.72%).

WHAT HAPPENED TO UNICREDIT ON THE STOCK EXCHANGE

However, still a difficult day, Monday 7 March, for the securities of the two main Italian banks. Which, among other things, are the most exposed in the two European countries at war, Russia and Ukraine. Yesterday Piazza Affari closed with a decrease of 1.36% and UniCredit recorded the worst performance of the list, -5.59%. As Il Sole 24 Ore notes, Intesa and UniCredit – leaving approximately 44% and 35% of their value respectively on the ground – saw the capitalization of 14 and 19 billion dry up. With the memory we go back to two years ago, that is February-March 2020, when the beginning of the pandemic led to a collapse of the Italian banking index by 47% in a month.

THE PRESENCE OF UNICREDIT AND INTESA SANPAOLO IN RUSSIA

Looking at the presence in Moscow of the group led by Andrea Orcel, whose beginning dates back to 2005 after the merger with Hvb, we note that it is present with the subsidiary AO UniCredit, the 12th in the country, with a market share of 1 % and a book value of 2.5 billion, less than 4% of the group's assets. The risk-weighted assets towards Russia, the Confindustria newspaper recalled, amounted to approximately 9 billion. It is also necessary to add 5 billion of cross-border loans – especially on oil, gas and commodities – and 1.1 billion of Russian securities.

Moving on to Intesa Sanpaolo, the credit group headed by the CEO, Carlo Messina, has been operating in Russia for almost 50 years through a relatively small subsidiary – which has 160 million assets – and around 70 million Russian government bonds. More significant is the presence through the Cib business thanks to which Intesa Sanpaolo disburses more or less 5 billion in loans, 1% of the total.

#Fideuram – #IntesaSanpaolo private banking 3rd holder of 1.3 billion #Gazprom bond due yesterday and repaid in dollars. And this was not included in 5.57 billion exposure to Russia (loans to Russian clients) https://t.co/LQxuh6njju

– Carlotta Scozzari (@scarlots) March 8, 2022

According to reports from Il Sole , in the hypothesis of zeroing the value of local subsidiaries and progressive write-down of receivables from the country, Morgan Stanley calculated that Ca 'de Sass would record a decrease in Cet 1 between 0.1 and 1.1% while for Unicredit the decrease would range between 40 and 150 basis points, translated into money between 1.2 and 4.7 billion euros.

THE EXPOSURE OF UNICREDIT (AND NOT ONLY) ACCORDING TO S&P AND CREDIT SUISSE

In percentage terms, according to a Credit Suisse study – which processed data from the Bank for International Settlements, dating back to June 2021 – the institute in Piazza Gae Aulenti is the Italian one most exposed to Moscow and is third in Europe (after Raiffeisen Bank International and Société Générale). For the Italian and French groups, the exposure amounts to over 30 billion dollars, about 26.5 billion euros, for the Austrian ones, it is around 22-23 billion dollars. Turning to the individual credit institutions, the Credit Suisse analysis shows that the highest exposure is that of the Austrian Raiffeisen Bank International with a 20% revenue share made in Russia and with an amount of loans of 10.5 billions, if Ukraine is also considered.

In second place, it was said, the French Société Générale, which has a 4% share of revenues in the country led by Vladimir Putin with 8.7 billion in loans. Then we come to Unicredit, which currently has around 2 million retail customers and a network of 72 branches that provide around 8 billion euros in loans.

A report was also presented by Standard & Poor's: it underlines the existence of four EU banking groups that have significant exposure in Russia and Ukraine, while for the others direct exposure to the conflict area is limited. Among the four, of course, Unicredit is also mentioned after Raiffeisen Banking Group, Otp Bank and Société Générale. Raiffeisen and Otp also have a direct presence in Ukraine: by combining the two exposures, for the Austrian one comes to 5% of total assets, for Otp Bank to 7%. The rating agency notes that, as regards SocGen and Unicredit, the exposures are significant in absolute terms but represent a negligible share of the total assets and profits of these institutions. These four banks, says S&P, "will be able to demonstrate their resilience."

UNICREDIT ANALYSIS

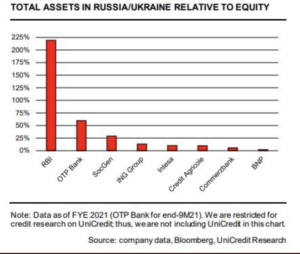

UniCredit also thought about it with a research that examines the data relating to 2021 (for Otp relating to the first nine months of last year) on the ratio between total assets and equity. As a result, the banks most exposed to Russia and Ukraine are – in order – the Austrian Raiffeisen Bank (close to 225%), Otp Bank (about 60%), the French SocGen (just over 25%), the the Dutch Ing Group, Intesa Sanpaolo and the French Crédit Agricole (about 10%), the German Commerzbank (between 5 and 10%) and the French Bnp Paribas (about 2-3%).

It will be noted, as journalist Carlotta Scozzari also did on Twitter, that the Ad Orcel group does not mention itself, which – as we have seen – is the Italian institution most exposed to Russia.

#Unicredit Research today tells clients that Austria's #Raiffeisen Bank International ( #RBI ) is the most exposed to Russia / Ukraine. You can see it in this chart (total assets / equity) but in the same chart you can't find #Unicredit (the Italian bank most exposed to Russia) pic.twitter.com/PcK89ykf7q

– Carlotta Scozzari (@scarlots) March 7, 2022

In a note, analysts warn: “We are restricted for credit research on Unicredit; thus, we are not including Unicredit in this chart ". In short, given the limitations, let's pretend nothing has happened.

THE CITI REPORT

Citi is not surprised that banks with the most direct exposure to Russia saw the largest sell-off, namely Unicredit and Societe Generale. For the rest, Mf / Milano Finanza points out , the banks in the regions with the greatest dependence on Russian gas have lost the most, namely the German and Italian banks, followed by the Austrian, Benelux and French banks. While Nordic and British banks have outperformed relatively, they still lag behind the European market in general and their US counterparts.

Citi has calculated that the cost of equity in the European sector has risen to around 15%, above the average of the last 15 years of 11%, although still below the previous highs of 17-18% during the global financial crisis (2008), the European sovereign crisis (2011) and the Covid pandemic (2020). “Reflecting the decline in share prices, UniCredit, Societe Generale, Commerzbank, Deutsche Bank and Intesa are the large-cap banks with the largest implicit rise in the cost of capital since the beginning of the Russia / Ukraine conflict. Conversely, SHB, DNB, Lloyds and Seb saw more modest changes. The large-cap banks with the highest implicit cost of capital, based on our forecasts, are currently Credit Suisse, Santander, Societe Generale, Deutsche Bank and UniCredit. In contrast, Abn Amro and Nordic banks typically have the lowest implicit CoEs, ”Citi points out.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/unicredit-russia-esposizione/ on Tue, 08 Mar 2022 10:31:26 +0000.