What the Fed said (and what it will do)

The Fed remains confident that the recovery in the labor market will gain momentum and that the inflation spike is temporary, although it could last longer than expected. The analysis by Paolo Zanghieri, senior economist of Generali Investments

In a rather quiet meeting, the Fed again presented its vision of a recovering economy, with only temporary pressures on inflation. The press release released by the central bank has promptly noted that the recovery of the economy is still incomplete, but also signaled that the appropriate time is approaching to withdraw support.

As in previous meetings, President Powell noted that the "substantial further progress" in the labor market that the Fed must make before reducing the stimulus has not yet been achieved. The large disconnect between high unemployment and the boom in job vacancies is due to the fact that a high proportion of unemployed are taking on new jobs rather than returning to the old one, and this creates limits on the speed of hiring. Furthermore, the brakes linked to the residual fear of Covid, school closures and generous employment subsidies are fading. The FOMC expects a strong recovery in the labor market in the coming months, but there is still work to be done. Our indicator, which considers aggregate labor market behavior and performance differentials between groups, still shows a substantial gap compared to the pre-pandemic situation.

The Fed is not afraid of the rapid rise in wages. Unit labor costs are under control, reducing the risk of a wage-price spiral.

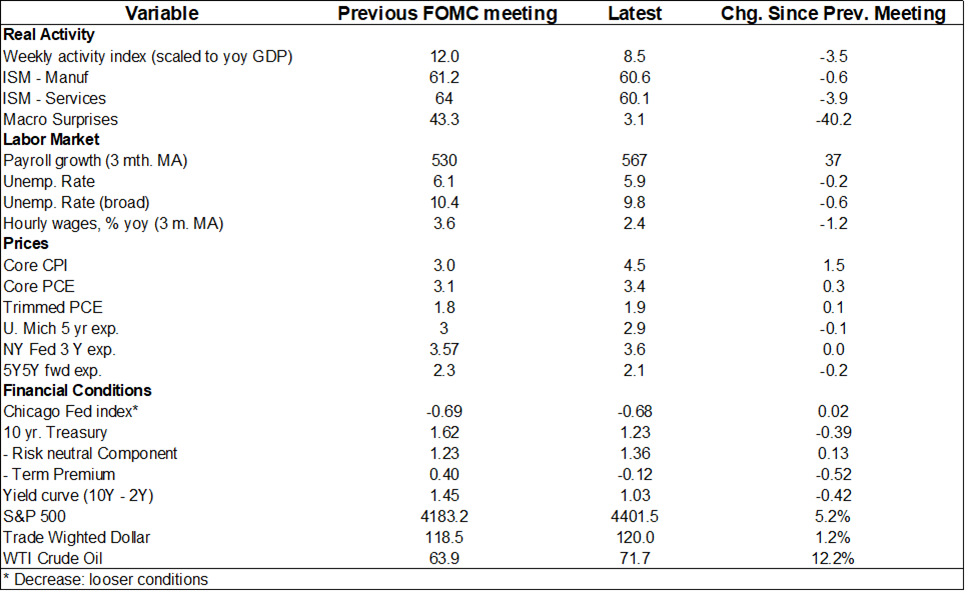

Progress made by the entire economy was highlighted, as well as temporary bottlenecks limiting supply in the automotive industry and other sectors. The Fed does not seem worried by the signs of a slowdown in activity reported by some indicators (see table) or by the risks associated with the spread of the Delta variant . President Powell noted that each wave of infection has been progressively less damaging to the economy and he expects the same to happen with the Delta variant.

The view on inflation remains unchanged. The current peak is due to transitory factors limited to a few sectors, heavily affected by the reopening of the economy, and to base effects that are already attenuating. Inflation is mainly caused by supply temporarily failing to meet demand, which even the Fed will not respond to. However, President Powell admitted that it is difficult to predict when inflation will normalize. Risks remain bullish, at least in the short term. Any discussion of whether average inflation has hit the target is up to the FOMC, President Powell pointed out. But this is only relevant for the first rate hike, which is not on the Fed's radar.

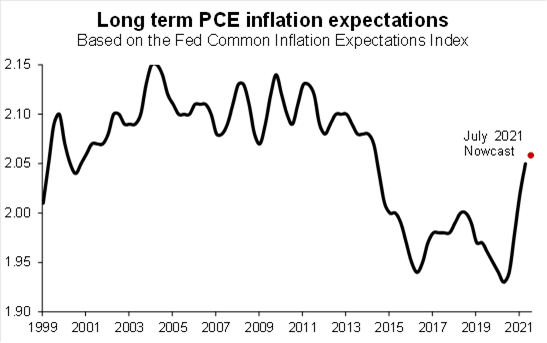

Indeed, both financial markets and households are becoming more confident in the temporary nature of high inflation, revising long-term expectations downward. The indicator of inflation expectations introduced by the Fed returned in the second quarter to the levels of 2014 (just under 2.1%). Our forecast for the third quarter of 2021 points to a further, but much smaller, increase.

As the economy evolves as expected, the right time for tapering approaches. Powell admitted that discussion on how to reduce purchases is ongoing and that FOMC members will strive to be as transparent as possible, providing advance warning of any move. The option of reducing Mortgage-Backed Securities (MBS) faster than the Treasury, to contain the rise in prices, finds little support within the committee, but is up for debate. We confirm our vision of a tapering starting in January, with some preliminary announcements at the next Jackson Hole conference (26-28 August).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-ha-detto-e-che-cosa-fara-la-fed/ on Thu, 29 Jul 2021 08:28:46 +0000.