What will change in Digital360 (Digital Agenda and CorCom)

Why Digital360 will leave the Stock Exchange and what will be the news in the shareholding structure. The article by Emanuela Rossi

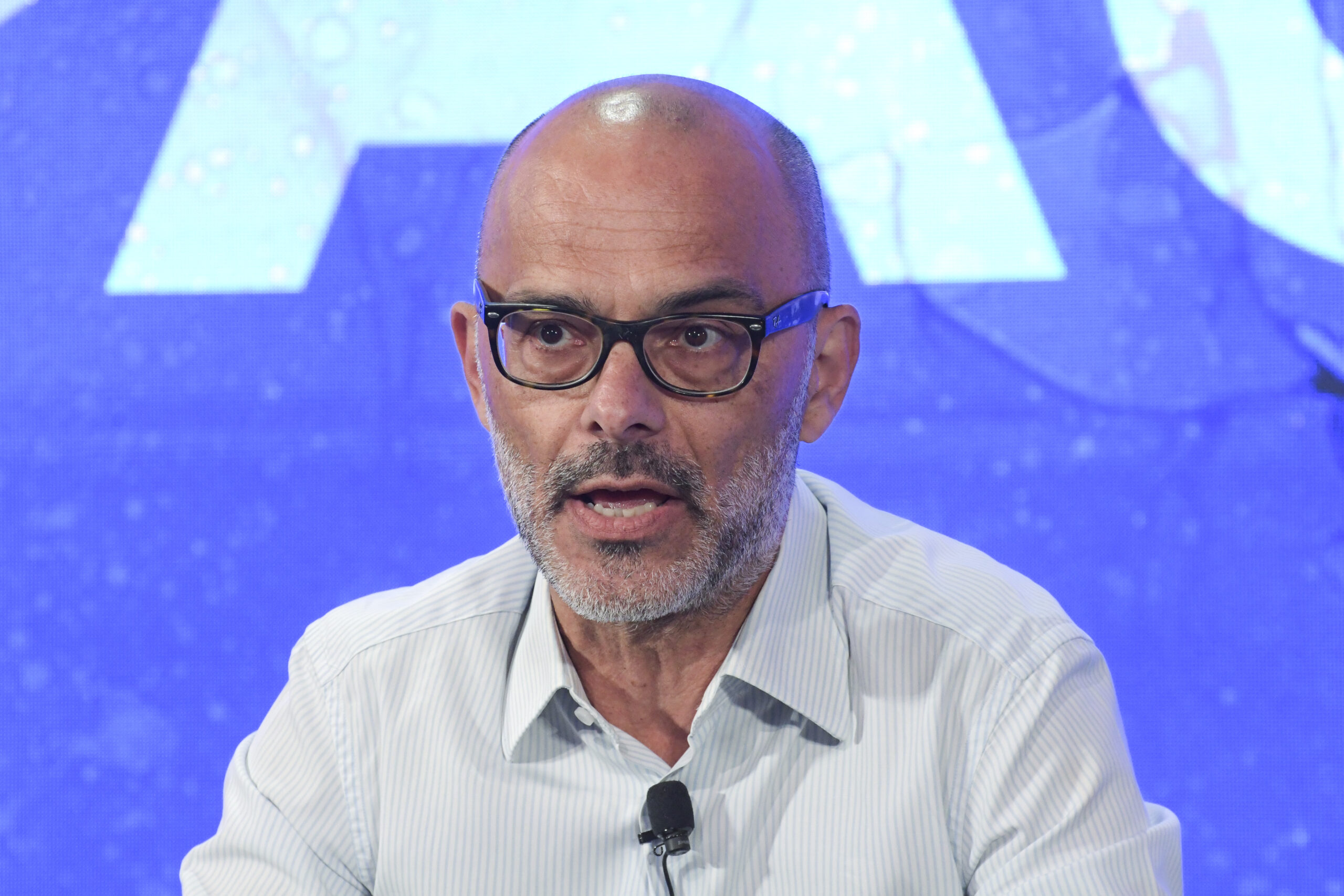

Digital360 chaired by Andrea Rangone (in the photo) is ready to leave the Stock Exchange, despite the group enjoying good health and the stock as well. Since 2017, the year of listing, the shares have risen by 365% and the capitalization has gone from 17.7 million to approximately 110 million euros.

WHO IS DIGITAL360 AND WHAT DOES IT DO

From the company's LinkedIn profile, we learn that the SME was born in 2012 and that five years later it was listed on the Euronext Growth Milan market of Borsa Italiana. It mainly operates in two innovative business areas – MarTech, i.e. the digital transformation of marketing and sales, and ConsulTech, i.e. the technological revolution of consultancy – but it also deals with content on digital innovation through publications such as Agenda Digitale, CorCom, EconomyUp , InsuranceUp and TechCompany360. Since 2012 Digital360 has grown at an average annual rate of 40%, thanks to an organic growth of 20% and has acquired 31 companies (and brought on board excellent co-entrepreneurs). In 2021 it became a benefit corporation. In Italy Digital360 has offices in Milan, Rome, Catania, Potenza, Ferrara and Prato and abroad in Madrid, Buenos Aires, Bogota, Mexico City and Santiago de Chile.

THE SHARE REORGANIZATION OPERATION

As reported by Il Sole 24 Ore , in order to proceed with the shareholding restructuring, a binding investment agreement was reached between the alternative capital fund Three Hills Capital Partners (Thcp) and the shareholders Andrea Rangone, Mariano Corso, Alessandro Perego, Gabriele Faggioli and Raffaello Balocco . Once the agreement has been completed, a mandatory tender offer on the company's ordinary shares (at a price of 5.35 euros) will be promoted in the second half of 2023 in order to achieve the delisting.

The investment agreement, explains the Confindustria newspaper, "provides for the contribution of shares held by the company's reference shareholders and by additional minority shareholders, for 12,724,116 Digital360 ordinary shares, corresponding to 61.7% of the share capital, in the newly established company D360 Holding, at a subscription price, including the premium, equal to 5.35 euro for each Digital360 share contributed". In turn, the newco will purchase from some reinvesting shareholders and other selling shareholders Digital360 ordinary shares, corresponding to 11.7% of the share capital, for 5.35 euro.

In this way, D360 Holding will become the owner of an overall percentage of approximately 73.5% of Digital360. The Thcp fund will invest up to 64.2 million in the operation, subscribing, in several tranches, a capital increase of 360 Holding for a maximum amount, including share premium, of around 25.7 million. Furthermore, he made himself available to make up to a further 40 million available to the group for future growth. D360 Holding, on the other hand, has undertaken to subscribe to a capital increase in Digital360 for an amount between 16 million and 30 million. Once the transaction is completed, Thcp will own a minority of the newco between 28 and 35%, while the remaining 72-65% will be held, pro rata, by the reference shareholders and by the other minority shareholders.

THE OPERATION EXPLAINED IN A FEW WORDS

According to an analyst interviewed by Startmag , the operation essentially envisages this: the current controlling shareholders of Digital 360 transfer their shares to a holding company (D360H) which then carries out a capital increase and obtains a loan, both from the Thcp fund, for about 64 million in total.

Thanks to these resources, the holding buys 11.7% of Digital 360 from some shareholders, for around 11 million, and puts around 50 million euro at its disposal to launch the takeover bid (costing 30 million) and to finance the company growth (about 20 million). Meanwhile, the Three Hills Capital Partners fund is also committed to paying another 40 million to support growth.

WHAT ARE THE GOALS OF DIGITAL360?

Probably – according to another analyst interviewed by Startmag – with the shareholding reorganization the founders of Digital360 aim to maintain an initial majority stake and to liquidate some minority shareholders but also to immediately have 20 million euros to invest and another 40 million potential. Without forgetting, however, that if the Three Hills Capital Partners fund were to convert its loans into equity, it would come to have an absolute majority of the capital.

So the founders may have been driven by the fact that at the moment the Stock Exchange does not allow for capital increases of 60 million (which would happen in Digital360) for companies listed on the Euronext Growth Market. Furthermore, it is not excluded that the shareholders will not subsequently sell to the fund, thus eliminating an even more expensive takeover bid by Three Hills Capital Partners.

WHAT'S HAPPENING IN THE STOCK EXCHANGE

Broadening our gaze, it should be noted that the takeover bid on Digital 360 is only one of eight delisting operations launched on the EGM since the beginning of 2023: NET Insurance, Finlogic, Sababa Security, Cover 50, NICE, Digital 360, Reevo and Labomar.

However, while for some of these the takeover bid is an obligation to transfer the majority of the company to a new controlling shareholder (Cover 50, Sababa, Finlogic, Nice Footwear, Reevo), for others – such as D360 (and apparently also Labomar) – the takeover bid, on the other hand, is a means of acquiring huge capital that the Stock Exchange is unable to put on the table.

And if on the one hand it is positive that many companies leave the Stock Exchange – so as to make investments truly liquid – on the other it would be necessary to have long-term funds to maintain and support listed companies capable of satisfying savers.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-cambiera-in-digital360-agenda-digitale-e-corcom/ on Sun, 04 Jun 2023 05:23:39 +0000.