What will happen to the US, EU and UK economies

What are the prospects for growth and rates in the US, EU and UK. Analysis by Steven Bell, Chief Economist EMEA of Columbia Threadneedle Investments

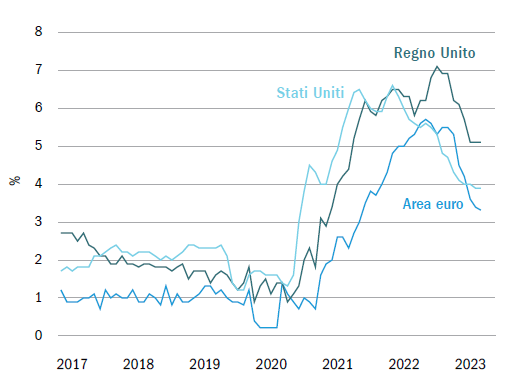

High employment and the absence of a significant contraction in the economy have removed pressure on central banks to cut interest rates as soon as possible following the decline in overall inflation. Monetary authorities will be able to wait for wage inflation to fall to 3-4%, a level in line with their long-term inflation targets of 2%. We believe that wage inflation has already reached these levels in the United States and therefore, when the next data arrives, the Federal Reserve will be the first to cut rates. The European Central Bank should also be able to expect better news on wages before its next meeting in June. The Bank of England, however, will have to wait longer, considering that wage inflation remains high despite the sharp decline in overall consumer price inflation. A few months' delay before the start of rate cuts may not matter much to markets and consumers if long-term interest rates begin to decline in anticipation of a prolonged cycle of cuts. We continue to expect a recovery in economic growth and view bonds positively; the combination of rate cuts and economic growth will also support stock market gains.

The United States is headed towards “immaculate disinflation”

The US economy is facing some headwinds, such as the rebound in bond yields, eroding previous mortgage rate cuts. This has dented consumer confidence and, despite the still positive Purchasing Managers' Index (PMI), there are few signs of a reacceleration. On the other hand, weakness in some areas of the US economy could help contain wage inflation. As a result, the Fed will probably be the first to cut rates, thus benefiting the economy, supported by the virtuous circle of falling inflation, which increases real income and is favored, in turn, by the moderation of wage demands , thus also providing greater margin for maneuver for rate cuts.

We expect a significant recovery in the UK economy

Even if we disagree about “technical recession”, it must be recognized that the UK economy has been through a very difficult period. However, PMIs indicate that growth has already picked up and, in our opinion, this recovery will be supported by improving consumer confidence. The data predicts a sharp decline in annual inflation in the coming months, thanks to falling energy prices, the appreciation of the pound driving down import prices and the elimination of the distortion caused by discounts associated with supermarket loyalty cards . The decline in headline inflation will strengthen the positive impact of real wage growth and encourage consumers to reverse the ongoing precautionary savings accumulation.

Given the favorable economic outlook, there is less pressure on the Bank of England to cut interest rates as soon as possible. Instead, the BoE will be able to wait for the currently high wage increases to decline, which is likely to happen in the second half of the year. Mortgage rates, which are tied to five-year interest rates, have already fallen, and with high employment and real wage growth supporting demand, property market activity has picked up. We expect housing prices to increase in the near future. This expected turnaround for the UK economy will not directly impact either the UK stock markets or the Conservative Party ahead of the next election. The international orientation of the FTSE 100 dilutes the positive effects of the recovery in the country and, given the sectoral composition of the index, it is unlikely to benefit from the gains in global equities. Falling inflation and improving growth will reduce the Conservatives' lead in the polls, but are unlikely to be enough to change the outcome of the election. The next government will generally be able to count on favorable economic dynamics.

European growth slowly recovering in 2024

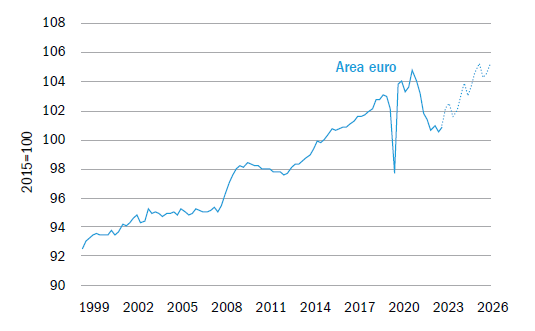

Looking at German manufacturing data it is easy to be overly pessimistic about the prospects of the European economy. The manufacturing sector is in great difficulty globally, especially in the case of Germany due to weak exports to China. Broader data shows that inflation is falling rapidly in Europe, that real wages have started to recover from the effects of the energy crisis and that consumer confidence is rising. This is enough to support modest growth. Rate cuts will also support the recovery, although the ECB is willing to wait for a clear downward trend in wage increases. In our opinion, the sharp increase in employment in Europe indicates a shift in the economic balance: growth, inflation and interest rates are destined to settle at higher levels than previous ones, which were very low, limiting the room for maneuver for rate cuts.

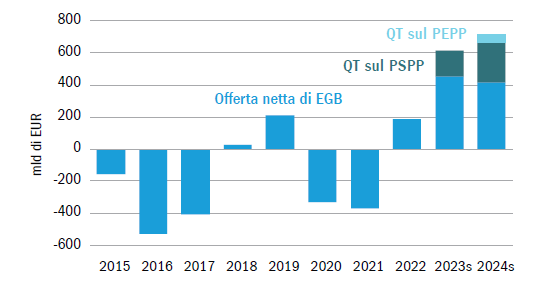

We remain optimistic about the financial markets, even in the face of probably modest returns

As for equities, we do not believe that high valuations, especially in the US market, will preclude gains amid a recovering economy and falling inflation and rates. However, they will definitely limit returns. On the other hand, however, bonds offer attractive and “risk-free” real returns. Nonetheless, the increased supply of government bonds, due to rising budget deficits and reduced central bank purchases, is likely to continue to attract investors. Finally, given high interest rates and declining inflation, attractive returns from cash will tempt some investors to stay out of the market; this will help support markets, especially when rates fall.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/economia-usa-ue-e-uk/ on Sun, 17 Mar 2024 06:02:42 +0000.