Why does Edison suffer?

Edison's results in the first half of 2023 were affected by the drop in Italian energy demand and the delays in deliveries of LNG from the United States, while the stock does not particularly shine on the stock market. Facts, numbers and insights

Edison, an Italian energy company controlled by the French group Électricité de France (EDF), has communicated modest results in the first half of 2023, amid some suffering.

The company, led by Nicola Monti, reported a 33.3 percent year-on-year growth in gross operating margin, from 622 million euros to 829 million, thanks to decent gas and electricity sales, increased production from sources renewables and energy-environmental services of Edison Next. Net debt fell from 477 to 191 million.

ALL THE DIFFICULTIES OF EDISON

Net profit, however, also decreased significantly: from 201 million in the first half of 2022 it fell to 187 million. Edison justified the result by citing charges of 140 million "dependent on territorial regeneration activities in the areas of the former Montedison factories", a large industrial group focused on chemistry. The "strong negative impact deriving from the delay in the deliveries of LNG [liquefied natural gas, ed. ] from the United States", which led Edison to initiate an arbitration dispute, also contributed to the drop in profit.

Due to the reduction in national consumption of electricity and gas, Edison's sales revenues were lower in the first six months of 2023 than in 2022: 9.9 billion against 13.2 billion. Gas-related businesses lost 34.3 percent year-on-year, to $6.7 billion; assets related to the electricity supply chain fell less sharply, -2.5 per cent, to 4.3 billion.

Despite the difficulties, Edison estimates a growth in EBITDA from 1.1 billion euros in 2022 to at least 1.6 billion in 2023.

ITALIAN ENERGY CONSUMPTION

In the first half of 2023, Italian demand for electricity in Italy was 5.3 percent lower than in the same period of 2022, writes Edison, settling at 150.5 terawatt hours.

As regards natural gas, on the other hand, the reduction was 15.2 per cent to 33.2 billion cubic meters and involved both residential consumption (-14.7 per cent) and thermoelectric (-22. 7 percent) and both industrial ones (-10.7 percent). The higher-than-average seasonal temperatures but also, on the industrial side, the consumption containment plan contributed to the decline.

THE PROBLEM WITH AMERICAN LNG

The drop in operating income from 410 to 307 million was influenced – explains Edison – by the delay in deliveries of liquefied gas from the United States, which are the largest producers and exporters in the world.

On May 15, Edison initiated arbitration proceedings at the London Court of International Arbitration against an American company, Venture Global , "for the failure to start supplying LNG". The loads should have departed from the Calcasieu Pass terminal, in Louisiana, with an innovative modular structure .

As the Energia Oltre news agency wrote, in recent months Venture Global informed the US authorities of the postponement to the first quarter of 2024 of the deliveries of some cargoes foreseen in the contracts due to delays in the commissioning of the liquefaction units of the terminal ; according to Edison, however, it would be an "unjustified and intolerable" delay.

In 2017, the company signed a 20-year contract with Venture Global to supply 1 million tonnes of LNG from Calcasieu Pass. “The deadline for delivery to Edison was the end of September 2022”, reads Energia Oltre , “but according to sources close to the matter, Venture Global had declared force majeure due to its inability to meet its commitments”.

About ten days ago Reuters revealed that the oil companies Shell and BP also filed motions for arbitration in the London court against Venture Global for non-compliance with contractual obligations by Calcasieu Pass.

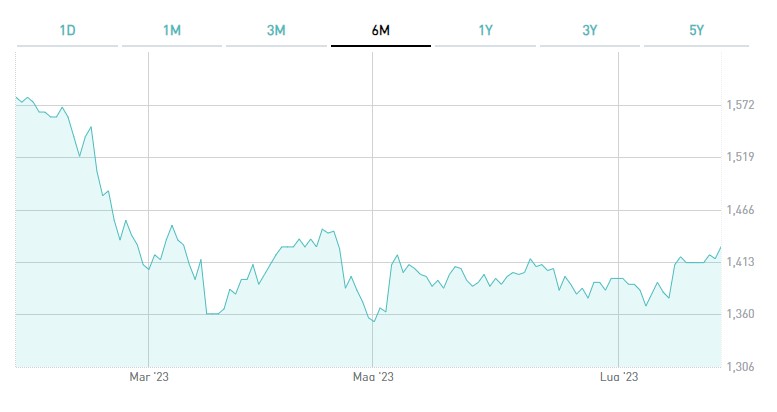

EDISON'S PERFORMANCE IN A GRAPH

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/edison-risultati-primo-semestre-2023/ on Thu, 27 Jul 2023 10:20:19 +0000.